The process of passing on or transferring the company’s ownership comes in many forms, with the most important decision being whether the succession should be internal or external. For insurance intermediaries and brokers, internal continuation is becoming increasingly rare as the merger and acquisition (M&A) landscape has become a rapid consolidation frenzy. Part of the reason for this shift in external vs. internal succession is the fact that company shares of the shareholder(s) are significantly more valuable to the primary shareholder(s) than they were just a few years ago. It is also because financing has become much more difficult for members of the family or suitable managers.

Based on MarshBerry’s experience in advising clients through organic growth strategies, perpetuation planning, and M&A transactions, it is estimated that 75% of insurance agencies and brokers will most likely not continue to exist internally.

Nevertheless, many owners of smaller companies continue to talk about the possible transfer to family members or loyal employees for completely understandable reasons. Agencies and brokers who are truly committed to an internal continuation plan will only succeed if they understand the options available and start implementing the plan sooner rather than later.

Reasons in favor of an internal succession plan

There are a number of reasons why owners may consider in-house continuity – including heritage preservation, the ability to remain independent, customer loyalty, and tax implications.

The most common reason for owners to seek internal succession is usually to preserve their heritage and ensure continuity for customers, employees, and the next generation in the family.

There may also be strategic reasons to transfer responsibility to internal stakeholders. If an owner is convinced that existing employees and/or family members have the necessary skills to continue on the same path, an internal continuation plan could be a viable solution for succession. The challenge is to create a plan that can be implemented successfully and well in advance of a targeted exit from the business.

Forward-looking planning is the key to successful succession planning

Succession planning should be seen as a continuous process. With the average age of insurance brokerage firm owners rising, it’s never been more important to have an equity transfer plan in place. Equity succession planning may seem daunting – but it can be achieved in a number of ways, such as identifying a good capital partner for debt or equity, or by expanding ownership to key stakeholders over time.

But without question, people are the most important component in the process of continuity planning. To retain the right employees, a company must commit to continuously investing in staff. This includes identifying potential stakeholders, developing their skills, and communicating the succession plan. In addition, there is always the possibility of considering external executives, possibly from competitors or risk carriers, who have already been observed as strong leaders.

Recruitment should also be done with a strategic goal and tailored to replace existing talent that may be moving up (or leaving) and maintaining important relationships long before a transfer of ownership takes place.

How internal succession can drive growth and value

While internal succession planning may serve to create the roadmap for an owner’s exit and subsequent handover of the company to the next generation, a resulting byproduct can be exceptional growth and more value to the company.

When existing employees are supported through professional development programs, given the opportunity to move up in a company, or given the opportunity to participate in them, they are more motivated. Motivated employees are more productive, more innovative and stay with the company longer.

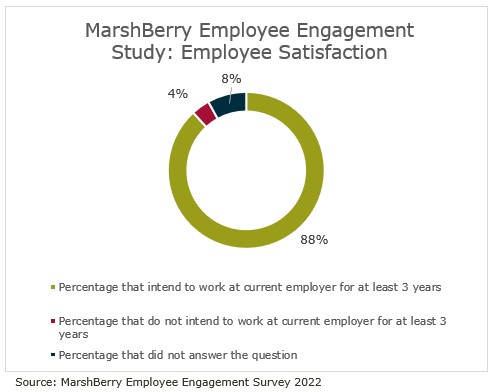

According to MarshBerry’s Employee Engagement Survey, 88% of respondents who agreed that their employer offers strong employee centricity and professional development programs also planned to work at their company for at least another three years.

From a recruiting perspective, an internal continuity plan can also be extremely attractive to potential candidates and reduce turnover in key leadership positions. This can help ensure the smooth operation of the business and lead to more growth and value.

In-house options for internal perpetuation

When the time finally comes to decide how to transfer equity, an internal succession plan has some options.

One possibility is a participation model, in which employees (selected over a longer period of time and in small steps) are offered company shares and thus motivated to think about a long-term commitment to the firm. The term “company shares” could mean various things, including bonus shares (i.e., the reinvestment of performance-based bonuses), the purchase of shares from the owner, the issuance of new shares, or more generally – other company shares by the company. One can also combine this with the issuance of so-called warrants (a financial instrument that grants holders preferential rights in the company) to give key employees the opportunity to benefit from the company’s overall performance.

External options: Private equity capital investment

There are more and more providers of private venture capital, mostly investment companies, which have recognized the growth opportunities of insurance brokers. In addition to a takeover of the entire company, there are increasingly more instances of minority investments being made in brokerages. In these cases, there is an exit plan after a few years and/or as soon as a significant increase in the value of the company’s assets has been reached. In doing so, the investors actively contribute with their industry and their market knowledge and input, for the benefit of “their” share and thus also of the entire company and the other shareholders.

What each of these strategies have in common is that the company’s substance can remain in existence in the long term and a complete sale to a much larger broker is not left as a mandatory option for financing one’s own retirement provision.

How can MarshBerry help you?

As an insurance brokerage or wealth firm management owner looking for the first step towards a long-term succession plan, consider the wealth of knowledge and experience that MarshBerry can bring to the conversation. MarshBerry’s approach goes beyond the standard quantitative financial analysis. It starts with an understanding of your culture, your goals and what you envision your future to look like.

MarshBerry believes successful perpetuation planning for an independent insurance broker or wealth management firm is a continual process without a beginning or an end. It is an ongoing discipline to continuously build and maintain an operating environment that can enable the seamless transition when that time comes.