August 2024 was another active month for UK insurance distribution merger and acquisition (M&A) activity, with 12 new deals to report on, involving ten separate buyers. With changes to the Capital Gains Tax rate now widely expected to be announced at the end of October, there will likely be a rise in deal volumes over the next few weeks, as sellers race to beat any changes and lock in the current (more favourable) tax rate.

M&A Market Update

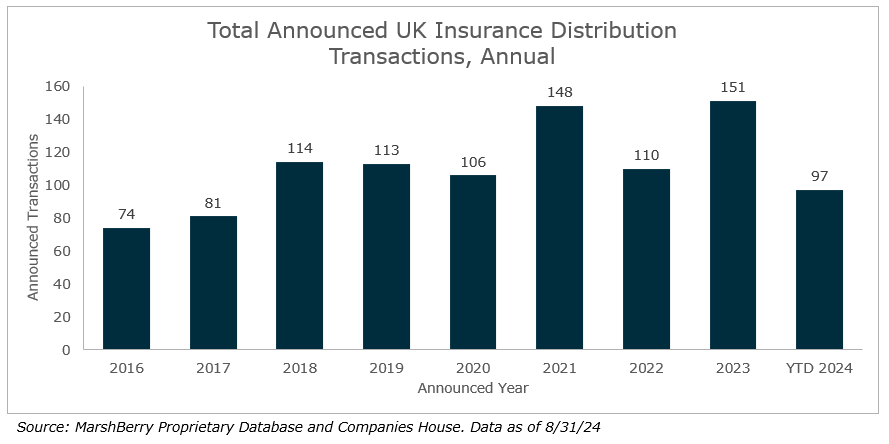

Overall transaction volumes in 2024 remain slightly behind the record M&A deal volumes in 2023 (see also Demand and Supply, here), despite a relatively busy August (12 new deals vs. eight in August 2023) with no signs of the usual summer lull. Year-to-date (YTD) deal count stands at 97, down 5% compared to the same point in 2023 (with 102 deals).

There is currently an unusual level of enthusiasm amongst sellers to finalise deals before October, and we expect to see a flurry of new deal announcements between now and the Autumn Budget. Whether such a spike results in final 2024 deal volumes exceeding 2023 will depend on how far M&A activity drops immediately following the Budget. Many transactions are currently being accelerated to beat the October deadline by businesses that may have sold later in the year (rather than unexpected new deal activity). This phenomenon could also mean that the first half of 2025 proves to be a bit quieter for sector M&A.

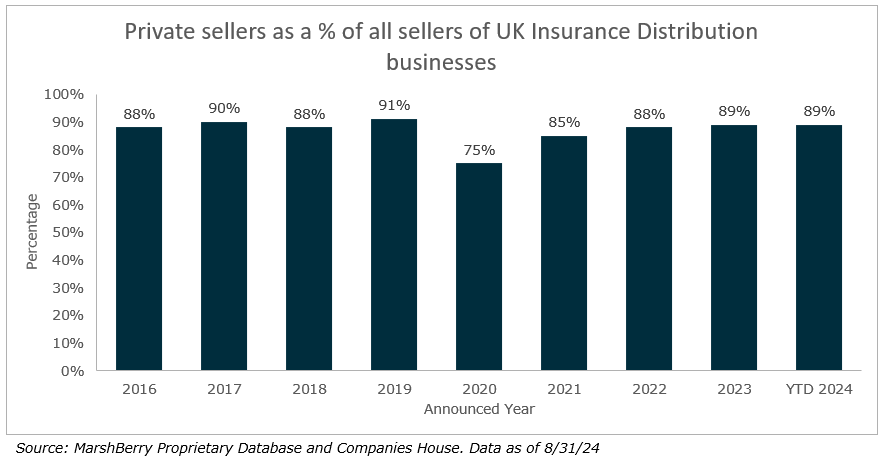

These monthly updates often focus on who the buyers are and the percentage of deals that involve private equity (PE) or PE-backed acquirers (44%, YTD), but perhaps focus less on who the sellers of these businesses are. That is because in any given month the majority tend to be private owners (89% YTD and 85% of all deals in the past five years). But an interesting highlight in 2024 has been the number of larger deals that have involved insurance carriers divesting distribution businesses. Allianz and Liberty Mutual have both recently sold sizeable UK broking businesses, and in August it was announced that Zurich has agreed to sell its Navigators & General marine MGA (managing general agent) business to Geo Underwriting (part of Ardonagh). There are far fewer distribution businesses sitting within UK carriers than there used to be. But such business units, which are often non-core and unloved or overlooked by their owners, remain a continuing source of acquisitions for broking consolidators who generally – and with some justification – believe they can manage them more effectively than a carrier.

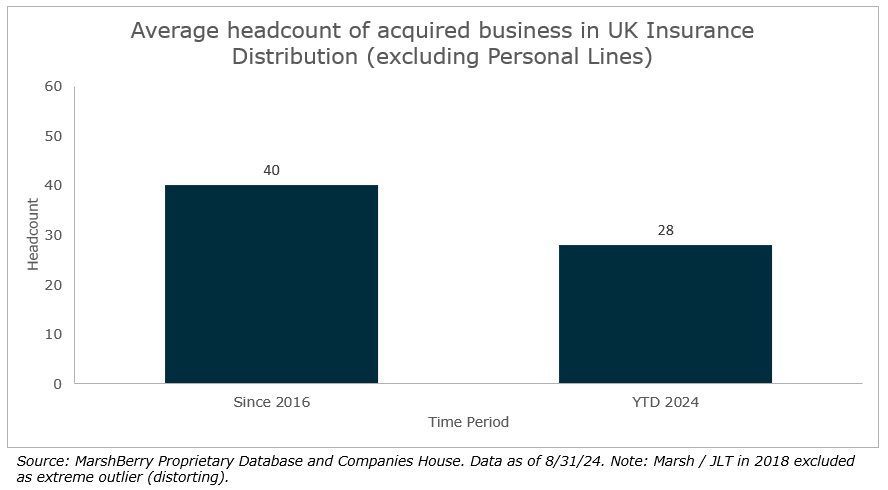

Whilst UK deal volumes continue to remain at or near historic highs, average deal sizes have continued to fall. More than 60% of all announced deals in 2024 have been for targets whose value is estimated to be below £5 million. This is reinforced by analysing the disclosed headcount of acquired targets. In 2024 (to 31 August) the average headcount of all acquired businesses was 43. But remove personal lines business and refinancing deals (i.e., where one financial investor is replacing another, so not real industry consolidation) and this falls to 28. This is broadly consistent with 2023 when the average headcount was 26, but considerably below the long-term average of 40.

The targets remaining available to consolidators are getting smaller. This continues to present challenges for the larger firms, where small deals don’t really ‘move the dial.’ The shift in focus of many UK buyers towards Europe, where the stock of available medium and large targets is more plentiful, reflects this.

Notable transactions (August 2024):

- Australian group AUB continued its expansion in the UK (following its acquisition of 40% of Momentum Broker Solutions in June) with the acquisition of a controlling stake in Movo Partnership, which comprises a fast-growing broking business, AR network and technology offering.

- As noted above, insurer Zurich announced the sale of its Navigators & General MGA business to Geo Underwriting (Ardonagh) during the month. This was one of two new UK acquisitions by Ardonagh in August, the other being chartered broker RK Henshall & Co, in Cheshire.

- Brown & Brown (Europe) completed the acquisition of The CI Group, a trade credit insurance solutions specialist that works with major UK lenders and that will become part of Xenia, the trade credit arm of Kentro, which Brown & Brown acquired in 2023.

Other transactions:

- Specialist Risk Group announced two new acquisitions adding commercial lines broker Anthony James Insurance Brokers and a book of business from Morton Insurance Brokers.

- J.M.G. Group acquired commercial and personal lines broker C P Bennet in Yorkshire.

- Jensten Group acquired Asprey Harris Insurance Consultants in Chesham.

- Alan Boswell Group acquired Priory Insurance Brokers in Norfolk.

- PSC Insurance, itself soon to become part of Ardonagh, announced a deal for acquired PI (professional indemnity) specialist Cox Mahon in London.

- Clear Group acquired commercial broker R.T. Waters in Leatherhead.

- The Broker Investment Group acquired a majority stake in regional broker JPM Insurance.