Increased investment sector merger and acquisition (M&A) transactions in August involved private banks, financial planners, wealth managers and asset managers. Key deals were led by trade buyers expanding their geographic footprint and pursuing scale economies, as well as consolidators in the wealth management sector acquiring smaller financial planning firms. Aside from four deals this month, most transactions were estimated to be valued below £5m, showing the continued resilience and rationale for the consolidation of the wealth management sector.

Investment sector M&A market update

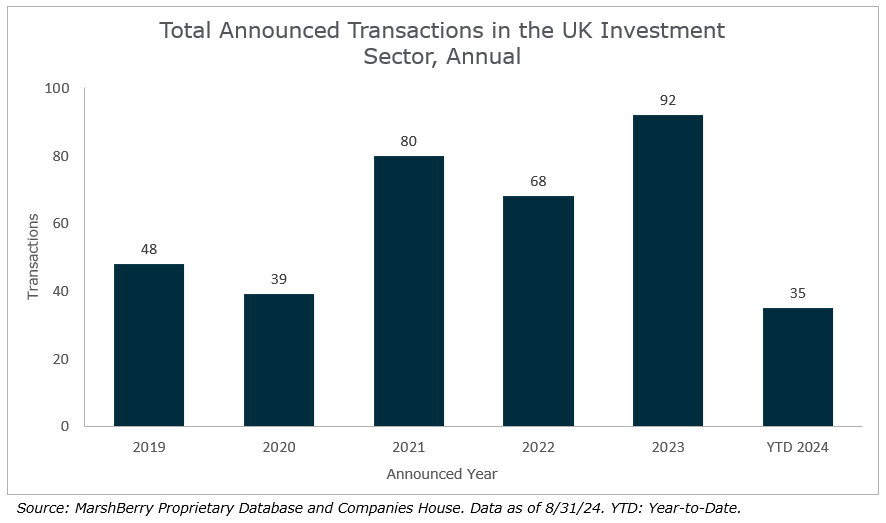

Year-to-date, a total of 35 deals (estimated to be above £5m of value) have been announced in the investment sector. While M&A activity usually slows in the summer holiday season, potential changes in UK capital gains tax legislation are expected to drive some business owners to accelerate the completion of their sales ahead of the Autumn Budget announcement at the end of October in the hope of avoiding any adverse tax implications. As a result, it is possible volumes of deals across the sector, particularly among privately held businesses, will increase in the next couple of months and reverse the subdued activity in August.

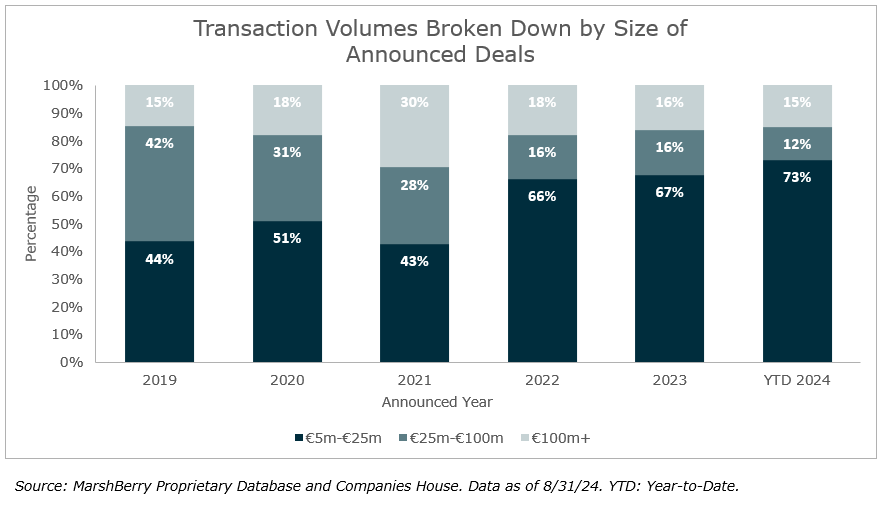

Year-to-date, transactions with values exceeding £100m have seen an increase compared to 2023. One example is the acquisition of Kleinwort Hambros this month, which also represents the first deal over £100m this year not involving a private equity fund, or an acquirer backed by one, but rather a family-owned Swiss Bank. In the meantime, transaction volumes of smaller scale have continued to account for the lion’s share of deal activity this year.

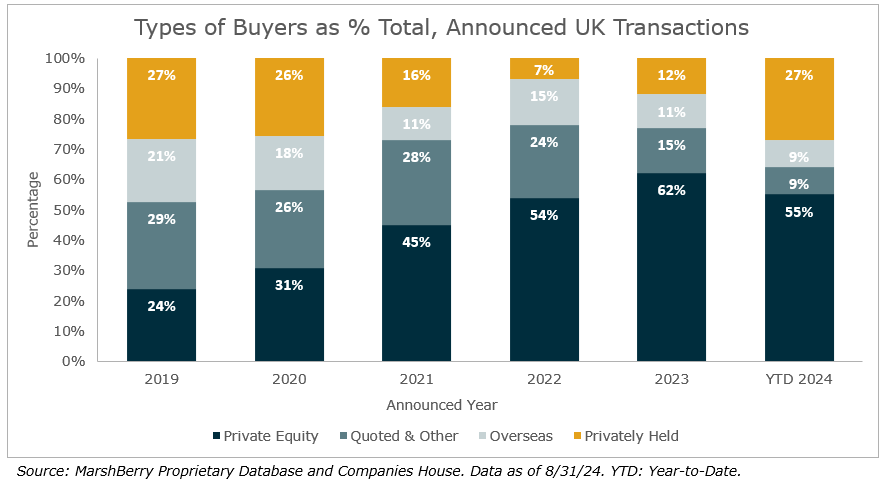

This is reflected in the more balanced distribution of buyers developing this year, with private equity becoming less dominant as an acquirer, albeit still being present as a buyer in just over half of all acquisitions. Meanwhile, privately held business has shown a sharp increase in relation to other buyer categories, being the acquirer in almost one in every third deal in the market.

Notable transactions (August 2024):

- Axa and BNP Paribas are in exclusive talks for a €5.4bn deal where BNP Paribas would acquire Axa Investment Managers (Axa IM) for €5.1bn in cash and €300m for Axa IM’s select business. The deal, valued at 15 times Axa IM’s 2023 earnings, will create Europe’s second largest asset manager with €1.5 trillion in assets under management. A long-term partnership will also have BNP Paribas providing investment management services for Axa, with completion expected by Q2 2025, pending regulatory approvals.

- Union Bancaire Privée (UBP) acquired Societe Generale’s UK private bank, Kleinwort Hambros, as part of a €900m (£771m) private banking deal that also includes Societe Generale Private Banking Suisse. The acquisition adds €25bn in client assets to UBP and expands its presence in the UK, with Kleinwort Hambros’s offices in Cambridge, Edinburgh, Leeds, Newbury, and London.

- FNZ sold its stake in Timeline, a comprehensive financial planning platform for UK IFAs, for £10.2m after Timeline partnered with rival platform Seccl. FNZ had been a minority investor since 2018, but the sale followed Timeline’s decision to work with Seccl instead. The shares held by FNZ were sold to existing shareholders, possibly funded by a loan from Seccl’s parent company, Octopus Investments.

- Howden acquired Help Me Compare Group Limited (ActiveQuote), a leading UK health and life insurance broker, boosting its presence in the market and expanding employee benefits capabilities. ActiveQuote, managing £60m in premiums with 132 employees, strengthens Howden’s position amid rising demand for private medical insurance.

Other transactions:

- Azets acquired Glasgow-based Milne Craig, a chartered accountancy and wealth management firm with over 2,000 clients and 90 employees throughout Scotland and the UK.

- Wren Sterling’s acquisition of Hampshire-based In Focus Group adds £450 million in assets and 2,500 clients, marks its third 2024 acquisition, and converts the Fareham office into its new Solent office, enhancing its presence on the south coast.

- Perspective Financial Group acquired Whittington Goddard Associates and Copthorne Financial Services, increasing its client assets by £185m and bringing its total to £8bn across 39 offices.

- Fairstone acquired Grayside Financial Services and Executive Wealth Management, adding £318m in funds held by 1,250 clients, while also launching its sixth UK hub in Farnborough.

- Tweed Wealth Management acquired Glasgow-based Capital Wealth Consultants, expanding its team, and enhancing its services, particularly for sports professionals.

- AAB Wealth acquired WealthFlow, boosting its assets under advice to over £1bn and strengthening its position in financial planning, especially in medical negligence and injury settlements.