2024 has come to a close, and as MarshBerry analyses detailed deal data ahead of the publication of our annual 2024 Insurance Distribution Market Report – UK in a few weeks’ time, the full year figures show a busy year for mergers and acquisitions (M&A). 2024’s deal volumes are almost identical to 2023 and set a new record for announced deals. However, the number of deals alone tells only part of the story. To really understand the impact of M&A on market structure it is necessary to look at who is buying and selling, the mix of businesses being acquired, and the size of deals. Taken together, this info presents a picture of an increasingly mature domestic consolidation and a more international M&A landscape where cross-border activity has become more common, involving both overseas buyers acquiring in the UK and UK buyers becoming more active in overseas markets.

M&A Market Update

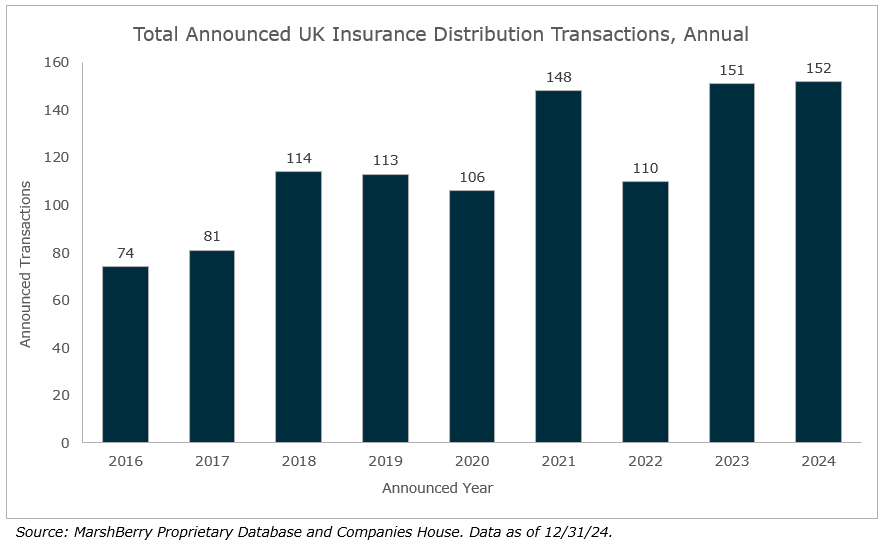

Overall transaction volumes in 2024 finished almost exactly in line with last year, with a deal count of 152, one higher than last year’s 151 deals. This makes 2024 the most active year ever in the sector and while broadly in line with 2023 and 2021, it is substantially higher than the long-term average. There were only ten new deals to report on in December*, but Q4 – which contained the October budget with its increase in the main rate of Capital Gains Tax that many vendors had raced to beat – ended with 41 announced transactions, the second-most active quarter on record.

* Note: Eagle eyed readers may notice that the total of 152 deals is more than 10 higher than the 135 deals we had at 30 November 2024 in last month’s Viewpoint. This is because at the year-end we have undertaken a deep dive process that has identified several previously unreported deals, all of which were very small and not widely reported on at the time.

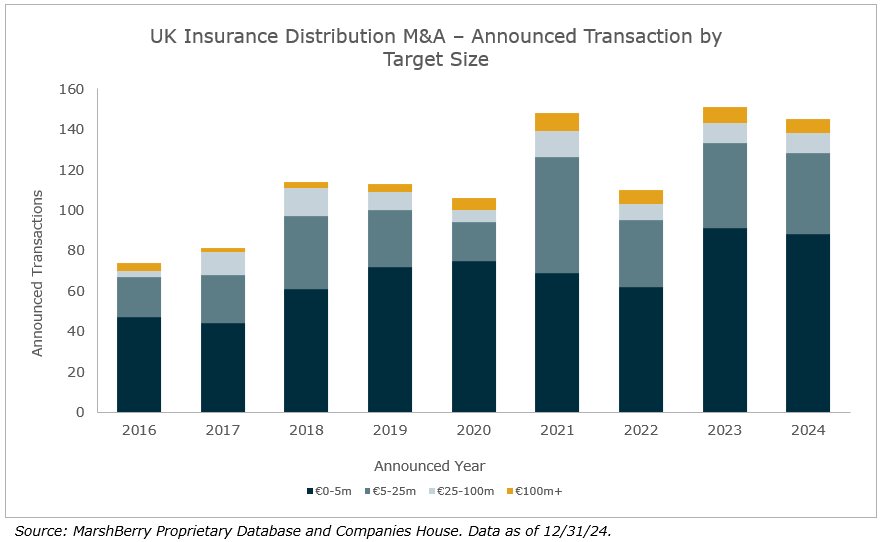

Of the ten newly announced deals in December, all were generally smaller in terms of both headcount and valuation, which has been a common feature in 2024, particularly in commercial broking. As MarshBerry has previously discussed, the average size of acquired targets in commercial broking has continued to trend downwards, as selected consolidators pursue a strategy of acquiring smaller targets (which are generally unadvised and less expensive) in higher volumes. There were more sub-£5m transactions in 2024 than in any other year. (Enterprise Value basis and based on MarshBerry estimates where consideration was not disclosed.)

The most significant deal in the month from a market structure point of view was actually a U.S. transaction, with implications for the UK – Arthur J Gallagher’s announced acquisition of AssuredPartners adds more than £100m in brokerage and c.850 staff in the UK. AssuredPartners is a top 50 UK broker and has been a reasonably active acquirer recently, having done more than a dozen deals over the past two years, including for several sizeable businesses. As with Aon’s acquisition of NFP earlier in 2024, it is an example of how consolidation out of the U.S., at the very top of the market, can reduce the number of in-market buyers (read: options for sellers) for the remaining medium to large targets in the UK.

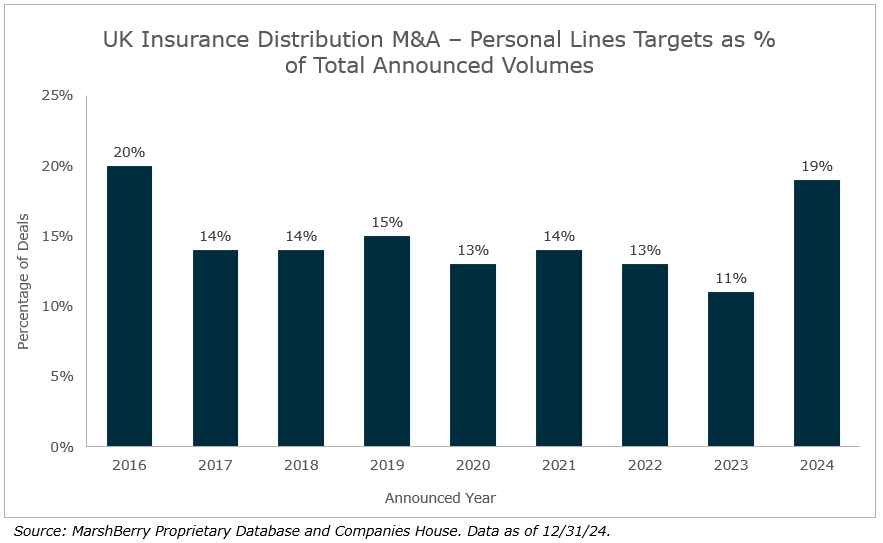

Two of the deals in December involved personal lines targets and an interesting feature of 2024 has been the jump in the proportion of deals in this segment. Over the year almost one in five deals was for a personal lines business. Furthermore, of the six new direct acquisitions of UK businesses by private equity in 2024, five involved personal lines targets (and the only one which didn’t, Specialist Risk Group, was a secondary buyout). Having spent years out of favour, both strategic and financial buyers are taking a greater interest in personal lines, where the typically lower levels of renewal retention and chokehold on distribution by price comparison websites in the major lines have historically made the segment less appealing than commercial business, but where the opportunities to establish a competitive advantage and grow quickly in digital are arguably stronger.

Newly announced transactions (December 2024):

- Abbey Insurance Brokers completed a book deal for the assets and liabilities of fellow Northern Ireland based commercial broker Wallace Insurance Brokers.

- Partners& continued to build out its presence in the Midlands and North of England with two new acquisitions, Elliot Westland Insurance Brokers and Midlands Insurance Services.

- Industry stalwart Derek Coles led a Management Buyout (MBO) of Uris Group, the business he has previously owned and sold, from Ardonagh, in another recent example of a large consolidator divesting a non-core business.

- Specialist Risk Group acquired specialist broker R3.

- Lycetts acquired Newcastle commercial lines broker Cheviot Insurance Services.

- J.M. Glendinning acquired North Wales holiday park specialist broker Anchor Insurance and Midlands-based commercial lines broker The Risk Hub.

- Financial Affairs acquired Lancashire based personal lines broker Owen & Ewing Insurance Brokers.

- Brown & Brown (Europe) acquired Hampshire-based commercial lines broker Addingstone Insurance Solutions.