Transaction volumes in December reverted closer to the monthly mean for the year after extraordinarily high levels of activity in the preceding two months, finishing the busiest quarter since Q4 2023.

Investment sector M&A market update

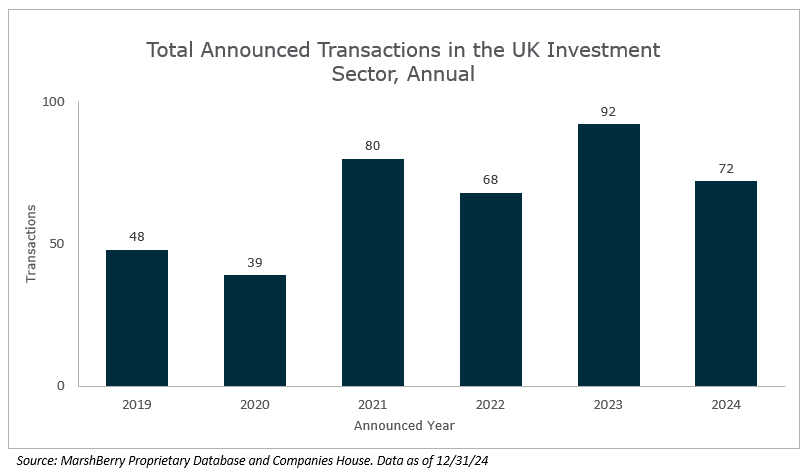

During 2024 there were 72 merger and acquisition (M&A) transactions in the investment sector with an estimated value over £5m each. Seven deals were announced in December, bringing the average to six transactions per month over the year. December’s M&A activity was lower than the other two months in the quarter, especially October which saw surging activity in the run-up to the Autumn Budget announcement. All of the transactions announced during the month involved wealth managers and financial planners bar one, which involved an advice tech firm.

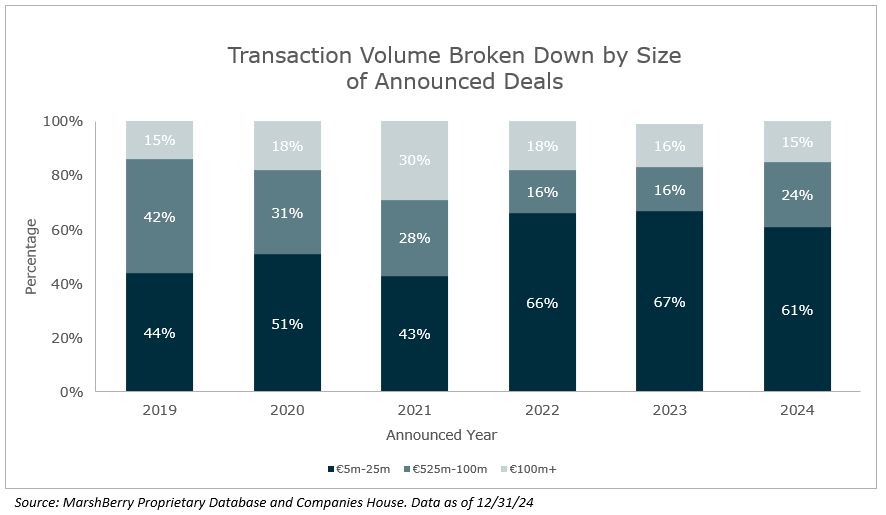

While most of the transactions this month were below an estimated value of £25m, Titan Wealth’s acquisition of Independent Wealth Planners (IWP) exceeded that and represents an example of a consolidation of another consolidator, something we may witness more in the future.

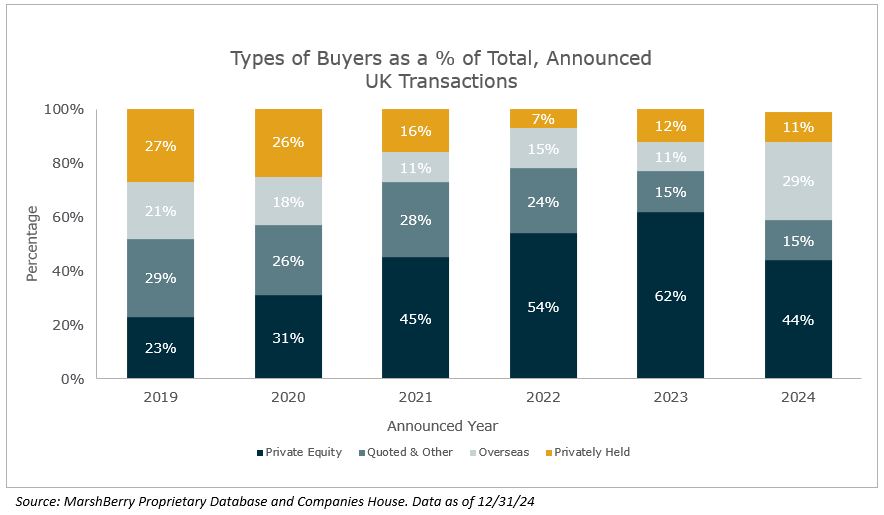

December also saw the private equity-backed groups Söderberg & Partners and Shackleton (formerly Skerritts) announcing multiple deals during the month, adding to the long list of acquisitions this year by private equity-backed wealth managers.

All but one of the deals announced during December involved a private equity-backed buyer. This did not negate the increased proportion of overseas buyers, who have nearly tripled their share of the total deal count compared to 2023 levels. It should be noted however that some of the overseas buyers are funded by international private equity firms.

Notable transactions (December 2024):

- Titan Wealth announced the acquisition of Independent Wealth Planners (IWP). The transaction includes IWP’s two trading entities (IWP Financial Planning Limited and IWP Investment Management Limited) and brings £6.6bn in client assets to Titan, raising Titan’s total assets under management and advice to £35bn. The acquisition also propels private equity-backed Titan to become one of the largest financial planning businesses in the UK.

- Söderberg & Partners announced it had acquired minority stakes in three advice businesses: Norfolk-based Hoyl Independent Advisers (£3bn of client assets), Midlands-based Intelligent I-FA (over £300m of client assets) and Yorkshire-based Mosaac (£230m of client assets). The Nordic wealth manager, backed by private equity firms KKR and TA Associates, has invested in over 20 UK firms this year as part of its strategy to grow advice firms and integrate its technology and investment solutions.

Other UK transactions (December 2024):

- Skerritts announced it had rebranded to Shackleton and acquired four advice firms: Save & Invest Group, Fleming Financial, Robson Lister and Shorts Financial Services, adding a combined total of £1.5bn in client assets and offices in Scotland, Bristol, Plymouth, Sutton Coldfield and Chesterfield.

- Foster Denovo announced the acquisition of Staffordshire-based advice firm Brian Mole Independent Financial Advisers, adding £300m of assets under advice. The deal brings seven advisers, nine support staff and 1,300 clients to the group.

- Moneyfarm announced it had agreed to acquire Borehamwood-based direct-to-consumer investment and cash solution services provider Willis Owen. The transaction expands Moneyfarm’s UK footprint and adds £680m in client assets, taking Moneyfarm’s total assets under management to over £5bn.

- Milecross Financial announced the acquisition of Buckinghamshire-based The Martin Cliffe Practice. The deal brings four advisers, three administrators, 650 clients and £80m of client assets to Milecross.

- Focus Business Solutions announced it had completed its management buyout from Abrdn marking a return to independence after nearly 14 years. The advice tech business’ buyout was led by Dave Upton who has been with the business since 2007 and became CEO on completion.