In recent years, insurance brokers have attracted substantial interest from private equity (PE) investors, driving significant growth in the sector. Brokers seeking expansion through acquisitions or those ready to sell could easily find eager investors. Consequently, valuations for insurance broker firms have surged. However, a notable divide has emerged. Firms with strong management, high margins, and proven track records of organic growth are commanding premium valuations, while those with considerable room for improvement are falling behind.

In this rapidly consolidating and dynamic European broker market, getting the fundamentals right is essential for maximizing opportunities. A growth-oriented mindset and robust leadership are more critical than ever. High-performing brokers who capitalize on key opportunities early and advance swiftly are positioned for success, whereas slower, underperforming firms often become acquisition targets, with valuations frequently falling below average mergers and acquisitions (M&A) price points.

The pressing question is: how can you position your firm as a top-performing, growth-oriented leader in this competitive field? The answer appears to hinge increasingly on the strategic use of artificial intelligence (AI). AI is emerging as a critical tool for driving organic growth and gaining a competitive edge in this rapidly shifting market.

AI could help firms outperform their competitors by improving new business growth. For example, machine learning algorithms can analyze large amounts of policy data in order to help find new business opportunities for brokers. AI and machine learning can help find better partner matches for clients, based on analysis of carrier’s appetites for various risks. By effectively harnessing AI, brokers can also better navigate market challenges, seize emerging opportunities, and gain a competitive advantage.

Is your firm an elite, high-performer?

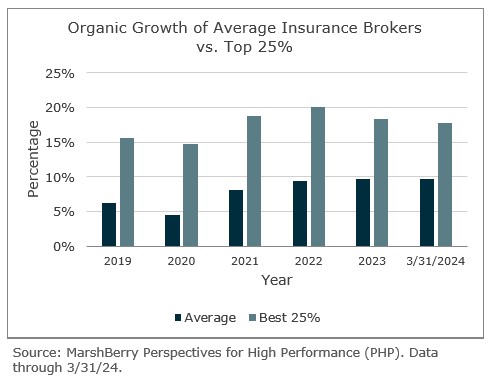

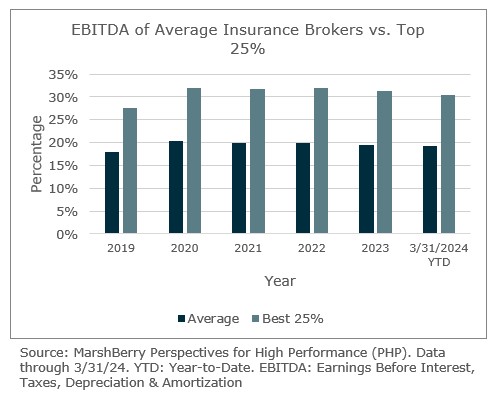

According to MarshBerry’s proprietary financial management system Perspectives for High Performance (PHP) an average insurance broker reaches yearly organic growth levels of 6-10% with a 20% EBITDA (earnings before interest, taxes, depreciation, and amortization) margin. By comparison, the top 25% of insurance brokers achieve organic growth levels above 20% and consistently operate with 25-30% EBITDA margins.

The best firms in the industry seek to understand how they compare with peers to drive performance. Staying ahead requires constant learning and feedback loops through data, KPIs and benchmarking. Strong organic growth always begins with the core, and top performers understand the importance of optimizing core activities and markets. They turbocharge their core through sophisticated data analytics to target higher growth pockets, including increased accounts sizes, vertical specialization, vertical integration and cost-cutting technology solutions. Subsequently, high organic growth and high margins increase the capacity to invest and innovate into adjacent segments and geographies.

Driving organic growth through AI

AI is rapidly becoming a key driver of growth for broker firms. According to a recent study, an impressive 85% of insurance executives believe that AI will fundamentally transform their business model.1 Furthermore, insurance brokers are projected to be one of the sectors most impacted by AI adoption, particularly in productivity and growth, according to research firm AI Risk. Insurance brokers who effectively utilize AI will likely experience greater organic growth and be among the top performers in the industry. While AI will likely have a positive impact on firms’ organic growth rates, firms will still need high-performing professionals to effectively implement their AI strategies and operations.

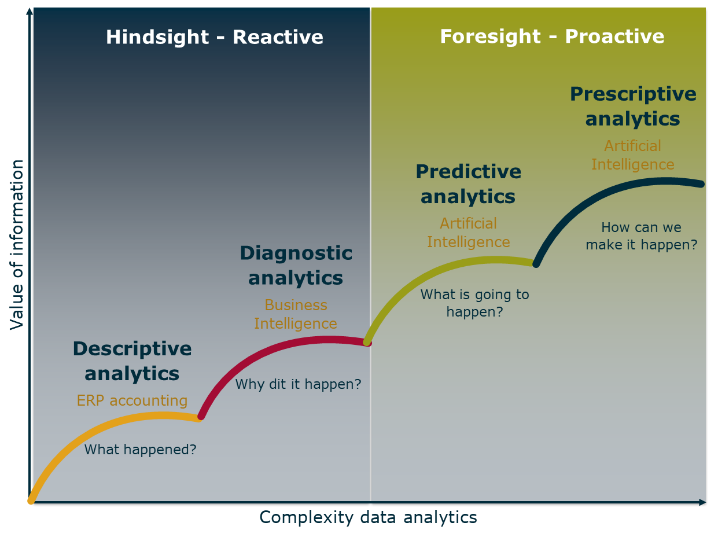

The profound impact of AI can be largely attributed to its capacity to analyze vast datasets, generate valuable insights, and enhance decision-making processes. One significant area where AI is impacting the insurance broker sector is data analysis. With the explosion of big data and the advancement of AI technologies, insurance brokers now have the tools to gain deeper insights into their client base, client behavior, and market trends. AI algorithms can process and analyze enormous volumes of data in real time, enabling brokers to conduct predictive analyses and shift toward a more proactive business model.

One of the key advantages of AI for insurance brokers is its ability to provide high-quality, actionable predictions directly within front-end applications and to a firm’s sales team. This capability enables them to:

- Reduce churn: Predict which customers are likely to cancel their policies and take proactive steps to retain them.

- Increase policy density: Identify opportunities for cross-selling and up-selling, enhancing overall policy coverage.

- Target high growth pockets: Focus on specific verticals within the market that are experiencing rapid growth or show significant potential for expansion.

- Boost efficiency: Optimize operational efficiency and reduce costs.

- Enhance producer efficiency: Allow producers to concentrate on the most valuable tasks by streamlining their workload and focusing on high-impact activities, including sales and client communications.

Source: Onesurance.

Thought Leadership Events

At a MarshBerry event, the outcomes are just as important as the experience. Attendees leave with the most advanced data, cutting-edge insights, new relationships, and key takeaways that will help them innovate their businesses. Join other insurance agencies and brokerage executives, along with MarshBerry advisors, at a MarshBerry event to explore strategies that will help you lead your firm to growth and profitability and learn how to maximize shareholder value.