The European insurance distribution market is currently experiencing an increase in mergers and acquisitions (M&A) activity. Large brokers and investors across Europe are keenly aware that this is an opportune time to cement their future positions. There is a race to establish insurance distribution platform companies in strategic European markets to fuel further expansion.

Economic stability and political flux in Europe

With inflation now reduced from its recent highs and interest rates falling, the macroeconomic situation in Europe is significantly more stable than it has been in months. The European Central Bank (ECB) diverged from its trend of raising interest rates in June. Katherine Neiss, Chief European economist at PGIM, has indicated optimism that the ECB could continue to lower rates throughout the latter half of 2024, potentially reaching 3.5% or below by year-end. Decreasing interest rates typically reduce the cost of borrowing, making acquisitions that are debt-financed more accessible and potentially bolstering return on investment (ROI) for investors in the sector.

Politically, the European environment remains turbulent and uncertain. In the past weeks, pivotal elections have taken place for the EU Parliament, the UK, and France. The outcomes were diverse: a shift towards the right in the European Parliament, a decisive mandate for the Labour Party in the UK, and a surprising victory for a left-leaning coalition in France which will have to work with the liberal president. These outcomes may create ongoing uncertainties about how potential tax or regulation changes could impact future transactions in the insurance distribution sector.

A leading group of European brokers is emerging

In Europe’s top-tier M&A markets, the insurance distribution sector remains a standout performer. The future consolidation prospects in Europe’s insurance broker market are driven largely by the attractiveness of the insurance broker business model, the sector’s fragmented landscape, and the transition from founder-led to non-family management due to the aging owner population.

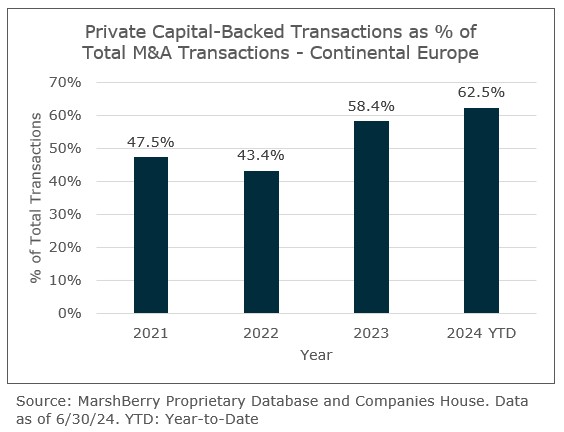

Across Europe, a distinct group of leading European brokers is emerging, establishing strong footholds across multiple countries, and actively engaging in M&A activities. Often backed by private equity or strategic capital, these emerging European brokers are strategically positioned for growth, whether through minority or majority equity stakes.

Prominent European brokers like Howden Group, Ardonagh Group and Söderberg & Partners are increasingly taking a leading role in European consolidation. In the past quarter, for example, Ardonagh Group made a pronounced move in Italy with two acquisitions. At the national level, there are various consolidators across countries attempting to transition from national to cross-border brokers.

M&A market update

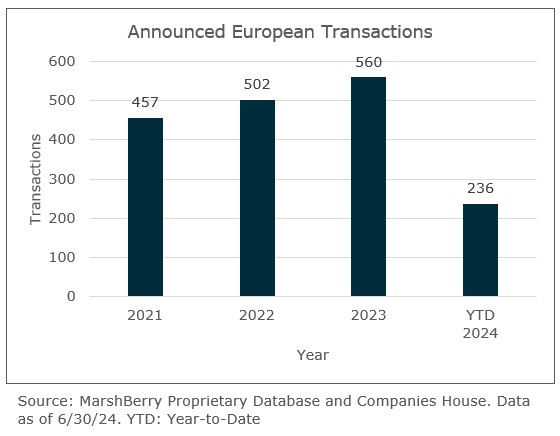

MarshBerry has identified 126 announced M&A transactions among European insurance brokers during the second quarter of 2024. This brings the mid-year 2024 total to 236 announced insurance distribution transactions in Europe (including the UK). Despite this impressive number, it is likely an underestimation as many deals involving smaller brokers tend to go unpublished, making it difficult to include them in total counts. Of the Q2 2024 European transactions, roughly two-thirds were backed by private equity firms.

Notable transactions

Several notable transactions in the second quarter reflect the continued growth and consolidation of the European insurance distribution market.

- April 2024: French Private Equity house BlackFin Capital Partners acquired a majority stake in affinity insurance broker SPB Group.

- May 2024: Warburg Pincus’ owned Blau Direkt took over German ProSecura GmbH, which specializes in commercial lines.

- June 2024: Marsh McLennan, through its subsidiary Mercer, acquired Cardano, a long-term savings specialist in the UK and the Netherlands with USD 66 billion in assets under management.

- June 2024: In Belgium, the recently merged Induver/Clover Group backed by Hg Capital acquired Group Claeys and Bamps-Laevers, increasing their market share in Belgium.

Most active buyers in Europe

Private capital-backed broker groups continued to be the most active acquirers.

- Howden expanded its footprint across Europe, acquiring brokerages in several countries including France, Ireland, Spain, Switzerland, and their native UK.

- MRH Trowe, based in Germany, bolstered its buy-and-build strategy with three acquisitions within the country.

- PIB Group is increasing its position in Central Eastern Europe with acquisitions in Poland and Romania. PIB also acquired a firm in Spain, making it the 15th brokerage acquired in Spain since PIB moved into the Iberian market three years ago.

- Diot-Siaci, the largest French broker with a strong international presence, acquired two companies in France in the second quarter of 2024.

MarshBerry offers industry-leading data and insights, perspectives, and market conditions to help your leadership stay abreast of developments in the insurance industry. Learn more about these perspectives to gain deeper knowledge of trends in the international M&A market through MarshBerry’s in-depth insurance distribution reports for the UK M&A Market and Continental European M&A Market.