February 2025 UK Insurance Distribution M&A Market Update:

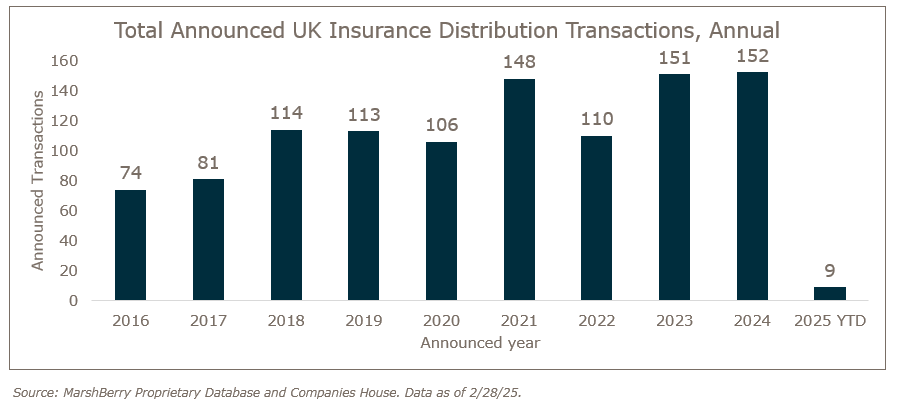

We are now two months into 2025 and the sluggish start to insurance sector merger and acquisition (M&A) activity in January has continued through February. Two months is not a long time in M&A and it is still too early to conclude that this marks any slowdown in overall activity, but if 2025 is to get close to the record level of transaction activity seen in 2024 then there will have to be a marked uptick in the flow of new transactions within the next month or two.

M&A Market Update

In last month’s M&A market update MarshBerry remarked that the low transaction volume could well just be a ‘blip.’ If that was the case, then February is either another blip, or perhaps an early sign that sector M&A activity could slow down in 2025.

Year-to-date there have been only nine UK transactions announced involving an insurance distribution business. At the same point last year there were 23 deals. Since 2016 the monthly average has been 9.6 making the five new deals announced in February another low figure. So, what is going on?

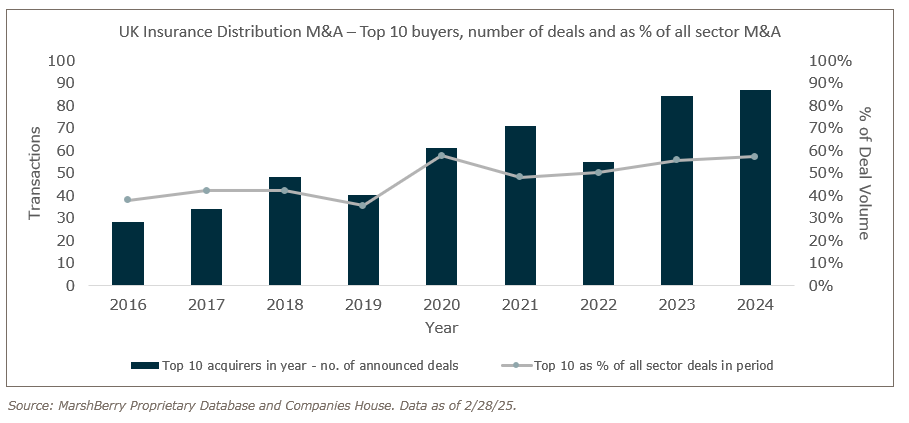

Perhaps some of the most active buyers are focusing on integrating their recent acquisitions or are turning their attention to pursuing deals in other jurisdictions. In any given year, a large proportion of all sector deal activity is driven by a relatively small number of very active buyers, who have the infrastructure and skillset to undertake multiple acquisitions in parallel. More often than not these firms are private equity-backed. In 2024 the ten most active buyers accounted for around 60% of all UK deals, or 55 transactions between them (see also The Next Chapter – MarshBerry’s Annual Insurance Distribution Market Report UK – 2024). Perhaps tellingly, only one of those firms (Howden, #10) has announced a new UK deal in 2025, and none of the top five have. (Although two of them have already announced new deals in Europe.)

It is much too early to conclude that sector M&A activity is slowing down. The key drivers that have driven the high levels of sector consolidation that has characterised the past 10+ years have not gone away. In recent conversations with several active buyers, they have been keen to point out that their pipelines are busy and their appetite for acquisitions is undimmed. The next few months could well see a flurry of new deals announced. And of course, the number of deals alone is not the whole story when it comes to sector M&A. Deal sizes matter too, and February did see one substantial deal in the Lloyd’s broking sector, with Miller’s widely publicised acquisition of AHJ.

The current tax year will end on 5 April 2025. The new tax year beginning on 6 April sees several changes taking effect that will affect brokers. The main rate of Capital Gains Tax of course increased last October, from 20% to 24%, and is the key tax for sellers of a business. But linked to this was an increase in Business Asset Disposal Relief, from 10% to 14%. This was announced in October but is only effective from 6 April 2025. There is a lifetime allowance of £1 million for this relief, so it has a maximum value of £40,000 to any individual seller (a broker with several shareholders could have several) – probably not enough to act as a catalyst for many vendors to race to complete a transaction before the end of the tax year, particularly when in doing so they would be bringing forward the date on which they had to pay the actual tax by a year. Arguably more relevant for owners of brokers will be the surprise increase in Employer’s National Insurance from 6 April, to 15%, which will have an immediate impact on staff costs, adding pressure to profitability and margins.

Notable transactions (February 2025):

- As noted above, specialist (re)insurance broker Miller announced its largest acquisition since returning to independence in 2021 with a deal for AHJ Holdings, the parent of Lloyd’s broker Alwen Hough Johnson and AHJ Europe, in a deal that adds 90 staff across London and Scandinavia.

- While PIB Group continues to grab headlines for its dealmaking across Europe, it demonstrated that it is still a buyer for specialist businesses in the UK with its acquisition of Residentsline, the well-known provider of flats and apartment insurance, based in Wolverhampton. MarshBerry advised Residentsline on the transaction.

- In yet another example of a relatively little-known (at least in the UK) U.S. buyer making an acquisition of a UK business, specialist parametric underwriter NormanMax acquired FloodFlash, an MGA providing parametric commercial flood insurance.

Other transactions (February 2025):

- Commercial broker Macbeth Group announced the acquisition of Insurance Services Surrey, increasing its gross written premiums (GWP) to £45 million.

- Howden announced that it had acquired aviation specialist Forbes Insurance in Leicester, as well as a book of business from Hill Aviation Services.