February 2025 UK Investment Sector M&A Market Update:

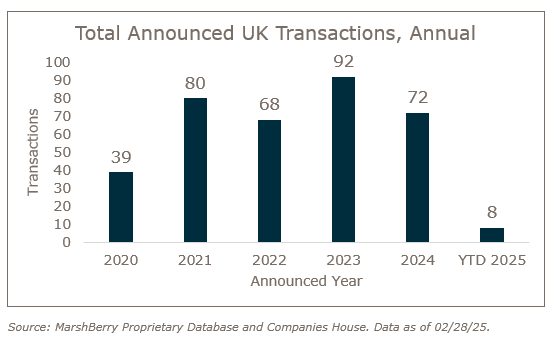

The volume of investment sector merger and acquisition (M&A) transactions was low in February with just three transactions over £5m, half of the average monthly deal volume in 2024. One took place in the actuarial and employee benefits consultancy area and two were consolidations in the wealth management space. The latter included Shackleton, formerly named Skerritts Consultants. It was featured more than once in the news during the month, after announcing the acquisition of an IFA in Norwich, as well as Shackleton’s private equity (PE) backer, Sovereign Capital’s planned exit.

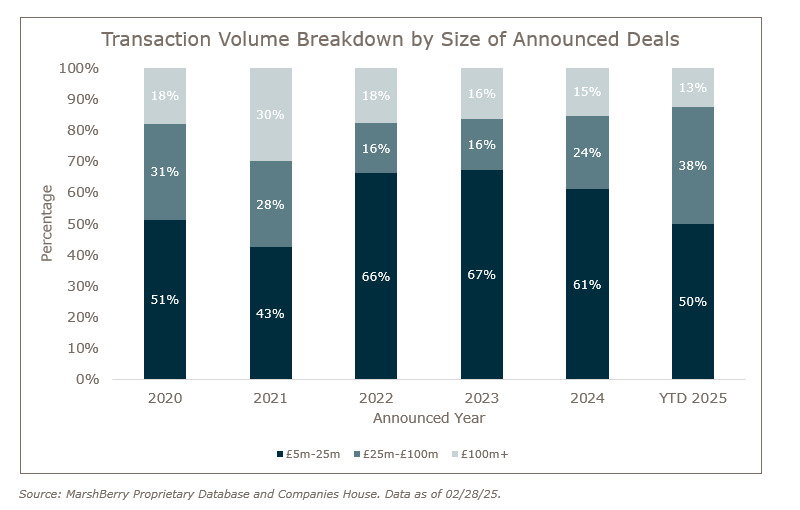

So far this year, the majority of transactions have been small, ranging from £5m to £25m. Three of the deals have been between £25m and £100m, and one has surpassed £100m in value. The largest deal this month involved XPS Pensions Group, the FTSE 250-listed pensions consultancy and administration business, acquiring Polaris Actuaries and Consultants.

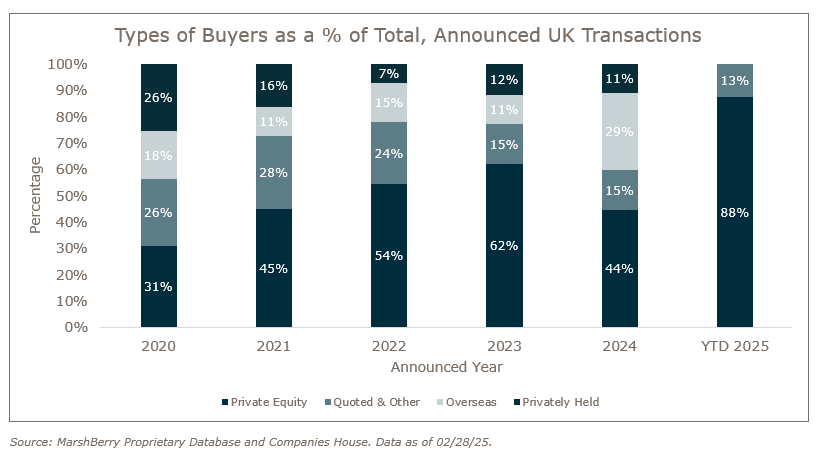

Among the buyers, PE has been a very dominant force. Nearly 90% of the acquirers this year are linked to PE, either as direct investors in firms or via their portfolio companies. Whilst the consolidation of the wealth management market has counted for a large proportion of the capital deployed, other sectors have also had their fair share of the flow to date, including in the pensions consultancy and administration market.

Notable transactions (February 2025):

- XPS Pensions Group agreed to acquire Polaris Actuaries and Consultants for up to £58.4m, with an initial cash payment of £23.4m and a further contingent payment of up to £35m in three years subject to performance targets. The acquisition accelerates XPS’s expansion in the UK insurance consulting market, providing immediate access to key insurer relationships. Polaris will integrate into XPS’s insurance team, enhancing its service offering and growth potential.

- Saltus acquired Newcastle-based Lowes Financial Management, which advises on £1bn in client assets and employs 90 staff. This follows Saltus’s acquisition of Tavistock’s advice network in October and GM2 in 2023. Since 2022, when Preservation Capital Partners took a majority stake, Saltus has grown rapidly, managing £7.5bn in assets and employing over 300 people. The firm has also launched a partnership programme to support advice firms with scaling, compliance, and buyout capital.

- It was reported that Sovereign Capital is targeting a £600m valuation for Shackleton (formerly Skerritts), with around a dozen PE firms, including U.S.-based Stone Point Capital, expressing interest in acquiring the advice group. Investment bank Lazard is advising on the sale, which remains in the early stages. Since backing Shackleton in March 2021, Sovereign Capital has supported 16 acquisitions, including £1bn AUM Ellis Bates, Save & Invest, and this month, Norfolk-based Harrold Financial Planning, which added £300m in assets and expanded Shackleton’s presence into the East of England. Shackleton now manages £5.5bn in assets and employs 81 advisers across 17 UK locations as it continues its national growth strategy.

Other UK transactions (February 2025):

- Benchmark Capital, part of the Schroders Group, acquired Robertson Baxter, a four-adviser firm with £200m in client assets. The deal expands Benchmark’s adviser base with full integration expected over two years.

- Fairstone expanded its Scottish presence by acquiring a stake in Edinburgh-based 336 Financial Management through its Downstream Buy-out (DBO) scheme.

- Verso Group acquired WH Ireland’s Henley-on-Thames-based wealth team, who advise on £150m in assets, as part of its goal to reach £5bn in assets under management by 2027.

- Lumin Wealth acquired Berkshire-based Professional Financial Centre, adding over £50m in assets under management. This marks Lumin’s ninth acquisition since 2019, as it continues to expand with the backing of Switzerland’s VZ Group.

- WBR Group acquired Standard Life’s SSAS book, adding 270 schemes and £403m in assets, with clients continuing to be managed by the same team.

British groups were also busy abroad, including:

- IQ-EQ acquired Agama Group, expanding its regulatory compliance services in France and Luxembourg. The deal strengthens IQ-EQ’s presence in continental Europe, with Agama’s leadership team remaining in place.

- M&G acquired a 70% stake in Stockholm-based P Capital Partners, expanding its £73bn private markets business. The deal aligns with M&G’s strategy to grow in private markets and is expected to close in mid-2025.