Estimated Reading Time: 5 mins

While many insurance broking owners want to commit to remaining independent, the current environment of high valuations and heavy consolidation has made internal perpetuation less of a priority for firms.

The Decline of Family-Run Insurance Brokerages in Europe

For decades, insurance brokers have often been family-run businesses, passed down through generations. Children frequently followed in their parents’ footsteps, taking over the firm and maintaining its independent status. This tradition fostered a sense of continuity, trust, and personalized service that resonated with clients. However, in today’s environment of high valuations, is the next generation still prepared—or even able—to step into the role of ownership?

For many insurance broking owners, there is still pride in proclaiming that their business will remain independent by perpetuating to the “next generation”—whether that be family or other trusted leaders of the business. But more often than not, this prideful proclamation has become a hollow promise. In the current environment of high valuations and heavy consolidation, the topic of internal perpetuation, or how to remain independent, has become less and less of a priority for firms. The valuations offered by strategic buyers and investors are simply too enticing to pass up, making it nearly impossible for internal buyers to compete.

Understanding the Insurance Brokerage Valuation Gap

The discrepancy between external and internal value is often referred to as the valuation gap. The gap between what a firm might be valued if sold internally versus what it might fetch if sold externally can be upwards of 50-100% more. Why would a business be valued at a significantly higher price for an external buyer than for someone who’s been working inside for years and wants to become the owner?

Key Factors Driving Higher External Valuations

There are a countless number of variables that figure into what a buyer will pay for a business. And there are different variables involved in determining the value for these two audiences. In an internal plan, there is only one buyer—the internal stakeholder; in external sales, there are, in most cases, multiple potential buyers. The law of supply and demand simply drives up the sales price when there are multiple buyers. Primarily, the difference in value lies in the level of profitability and the multiple that a buyer can, or is willing to, pay.

At its most basic, an external buyer may simply have strategic motivation for paying more, have better access to capital and be able to afford to pay a higher multiple on the profit. Internal buyers have a smaller strategic horizon, may not have the ability to pay more or may need cash flow to finance the debt that enabled the transaction.

The Reality of Insurance Broker Ownership Transfer

For private owners of insurance broking firms, the transfer of ownership is an inevitable part of the business lifecycle. The harsh reality is that most firms have not made the commitment or necessary preparations to sustain continued independence, in part because such preparations often get pushed aside or delayed for other priorities. An owner can’t wake up one morning and confidently decide to retire and hand over the reins to family members, or ask senior leaders to buy them out, without a plan.

Building Sustainable Independence Through Strategic Planning

The reality is that every business owner will eventually need to transfer ownership of their business. It’s not a matter of if—it’s a matter of when. Planning for the long-term sustainability and perpetuation of a business should be viewed as a continuous process with neither a beginning nor an end. Private owners need to have strategies around the most important ingredient—people. They need to create training and mentorship programs, and retain top employees, either family or seniors, through staged ownership opportunities.

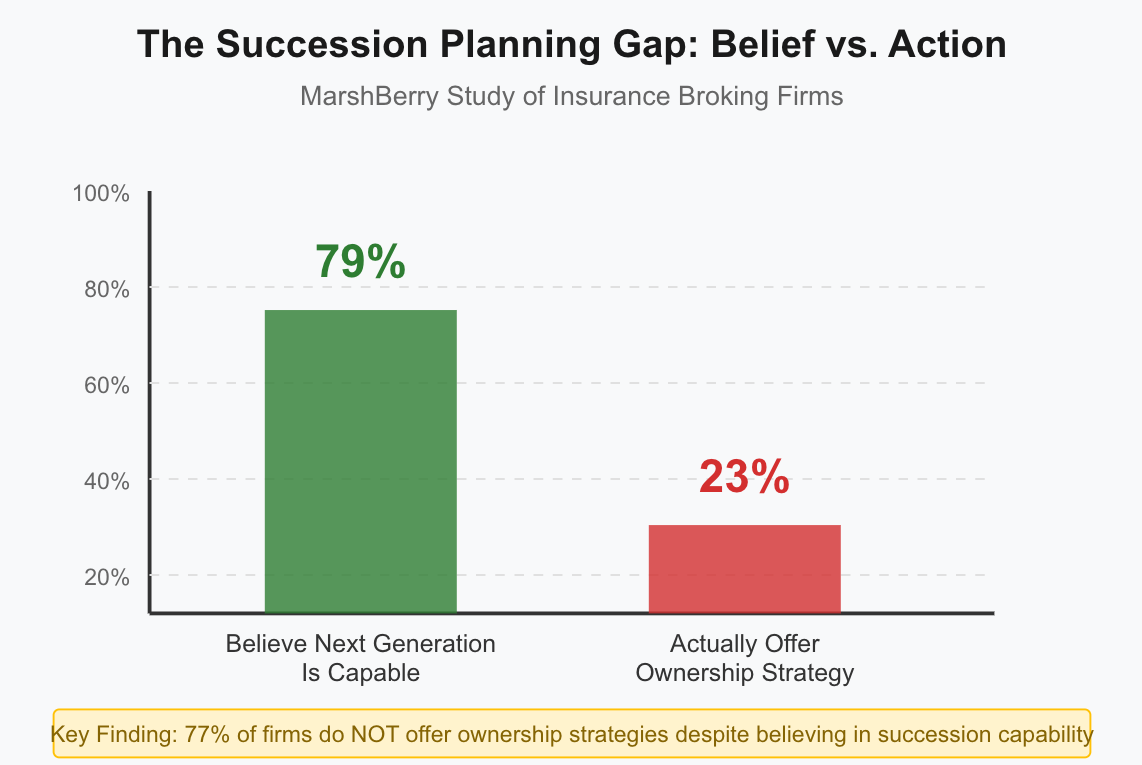

In a MarshBerry study, firms were asked if they believed their next generation of leaders were capable of taking over the firm. An overwhelming majority (79%) stated “yes.” However, when asked if they offered an ownership strategy to top employees, an equally overwhelming majority (77%) said “no.” So, even though most owners wish to preserve their company’s independent status and believe they can, many fail to take proactive steps to achieve it—or simply start too late.

Is Independent Insurance Brokerage a Dying Model?

In today’s market, it’s entirely understandable that many owners opt for capital-strong external buyers during a transition, especially when the valuation gap with internal succession—if it’s even an option—is significant. Passing on your business to a capital-strong external buyer with investment opportunities can be an excellent choice, one that also benefits both employees and clients.

It’s undeniable that the private ownership model for insurance brokers across Europe is therefore on the decline. A significant number of European insurance broking owners are part of the baby boomer generation, at or nearing the inevitable transition of ownership. Many of them have no internal perpetuation plan in place or simply started thinking about it too late. According to MarshBerry benchmark data, the weighted average age for insurance broking owners across Europe is 54 years.

New Models: ESOPs and Shared Ownership Structures

The independent broking model is far from extinct. MarshBerry works with many clients who remain firmly committed to internal perpetuation. Moreover, across Europe, we are seeing a significant rise in new entrepreneurs starting broker businesses. Younger and newly established brokers are leading the way by adopting shared ownership structures, such as Employee Stock Ownership Plans (ESOPs), right from the start. These firms view succession planning not as a one-time event but as an ongoing process—one designed to build legacy-focused business models that ensure independence and sustainability for generations to come.

Download the 2025 Market Report Insurance Distribution in Europe and read about the latest trends and developments in the industry, exclusive insights into the Top 20 largest European brokers and answers to other key questions shaping the future of insurance broking.