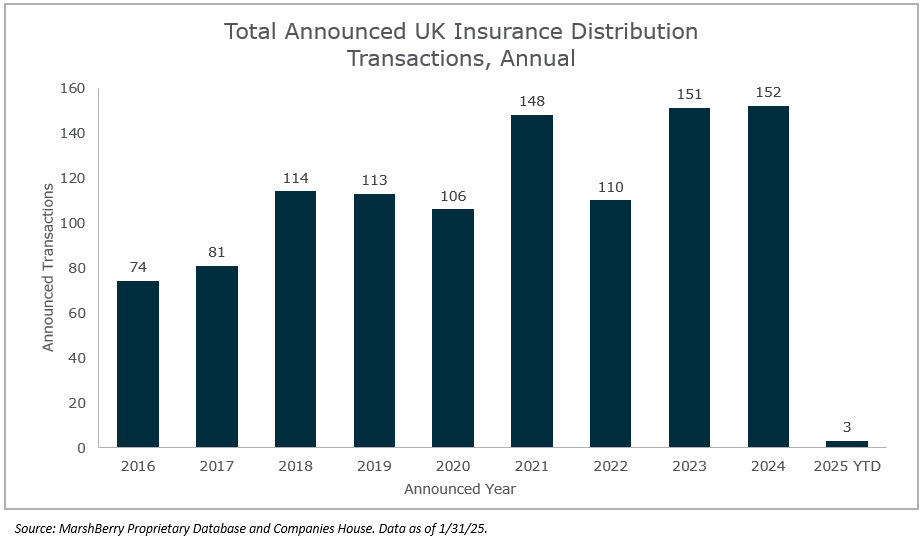

As the new year begins, MarshBerry resets its deal tracker to zero and starts the annual count all over again. Following 2024’s record of 152 total UK merger and acquisition (M&A) transactions and a busy Q4, the market had strong momentum going into January, but the year is off to a slow start. There were only three new deals announced in January, the lowest in any single month since 2017. One cannot read too much into any single month and this may well be a blip, but since 2016 the sector has seen an average of ten new deals a month, so this has been a very quiet start to the year. This also cannot all be ascribed to the ‘January effect’ – since 2016, 9.4% of all sector deals (1,000+) have been announced in January.

M&A Market Update

There are several reasons that January might be a slow month for M&A. Most transactions complete at or very near a month end, often being announced to the target firm’s staff at the same time. A number of UK buyers therefore try to avoid the end of December or first week in January and instead push their new deals out the end of January. However, historically January has not been a quiet month, with an average of 11 UK deals each January since 2016, so the three this month is unusually low.

UK deals also require the consent of the Financial Conduct Authority (FCA) for a change of control to complete and we have some anecdotal evidence (from transactions MarshBerry is currently advising on) that the timing for such approvals might have slowed down a bit recently, pushing back the announcement date of some otherwise agreed transactions.

This newsletter typically includes charts showing trends in year-to-date (YTD) M&A like the percentage of all deals involving a private equity buyer. But with only three deals so far in 2025, this Viewpoint instead looks at some statistics from MarshBerry’s soon-to-be-published UK Insurance Distribution Annual M&A Review for 2024, entitled The Next Chapter. This report, which MarshBerry produces annually, will analyse the UK sector M&A and market structure more broadly, and explore the prevailing trends and themes in UK sector M&A in much greater depth.

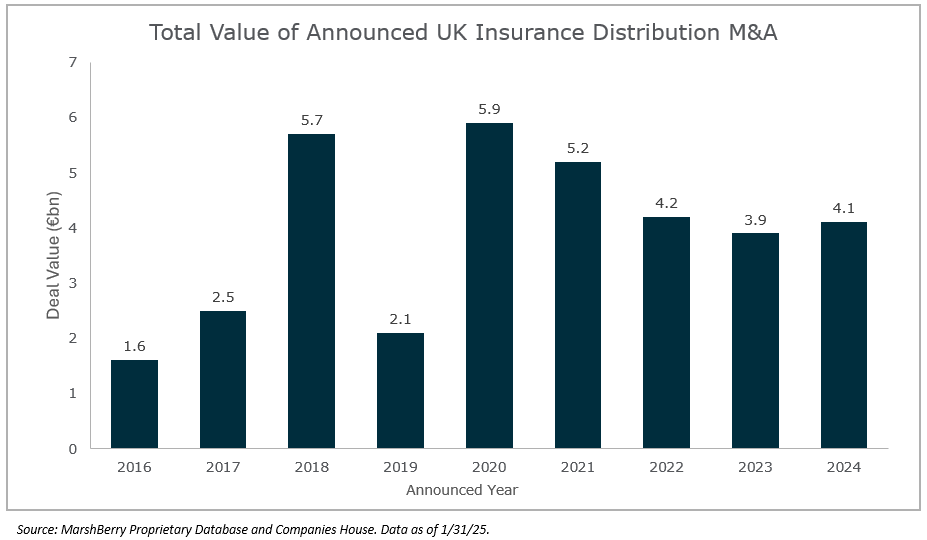

MarshBerry analyses every sector transaction in the UK, including looking closely at the headcount and reported financials of each target firm, to establish an estimated value of every deal where this is not announced. In 2024 the value of all announced deals was an estimated £4.1bn, just marginally up on the £3.9bn in 2023.

On the record deal count in 2024 of 152 (vs. 151 in 2023) meant that the average deal size was broadly consistent with the previous year, but below the longer-term average. Higher deal volumes are not translating to a higher total value of M&A transactions, as many domestic consolidators are undertaking a higher number of small deals than ever before to maintain their momentum as the number of medium-sized available acquisition targets diminishes. At the beginning of 2024 there were 659 separate UK insurance distribution groups reporting to employ ten or more staff. By the end of the year, as a result of sector M&A, this had reduced to only 604.

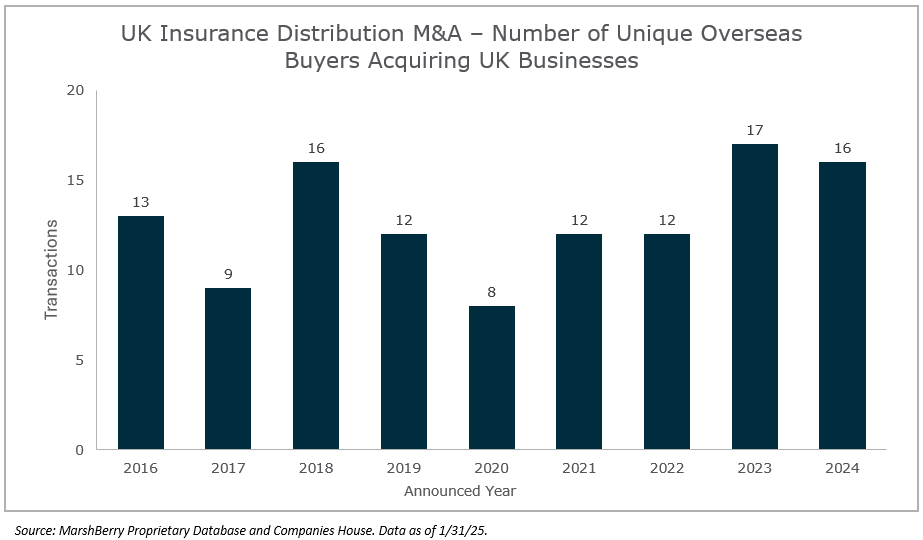

One of the new deals announced in January 2025 involved a U.S. buyer. Sector M&A has become more international. This is going in both directions – overseas buyers coming into the UK, but also UK buyers going overseas. In 2024 Specialist Risk Group was one of the top five most active buyers. In January the firm announced their biggest deal to date, but it was outside the UK – a partnership with Germany’s Ecclesia that will see them acquire that business’s Dutch and Belgian assets, with Ecclesia becoming a shareholder in SRG. In 2024, 20% of all UK sector M&A involved an overseas buyer, and 16 separate overseas buyers announced deals here.

Newly announced transactions (January 2025):

- Inflexion-backed Acorn Group acquired telematics personal lines broker MyPolicy (previously owned by Inflexion) from management.

- Adler Fairways acquired Buckinghamshire-based commercial broker Giles Insurance Consultants.

- US broker SIG Insurances Holdings acquired specialist sports & prize insurance MGA Hedgehog Risk.