Investment sector M&A market update

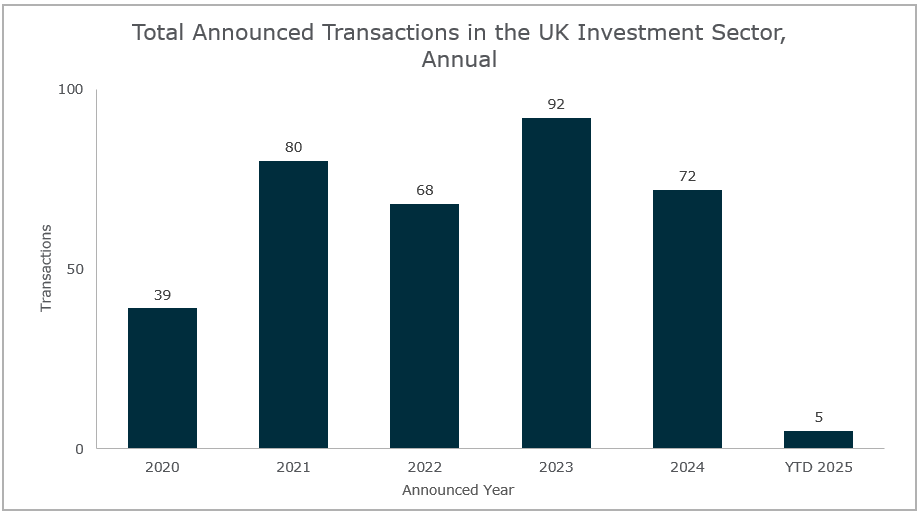

In 2024, the investment sector averaged six merger and acquisition (M&A) deals per month, with Q4 being particularly active. While January 2025 saw a slight dip, with five transactions over £5m, the month still brought plenty of action. Rather than the usual flow of consolidators snapping up financial planning and wealth management firms, this month saw Broadstone, the pension consultancy group, raising capital for growth from a U.S.-based international fund, and Fundment, a platform for the financial advice industry, securing £45m in venture capital investment, bringing fresh dynamics to the sector this month.

Source: MarshBerry Proprietary Database and Companies House. Data as of 1/31/25.

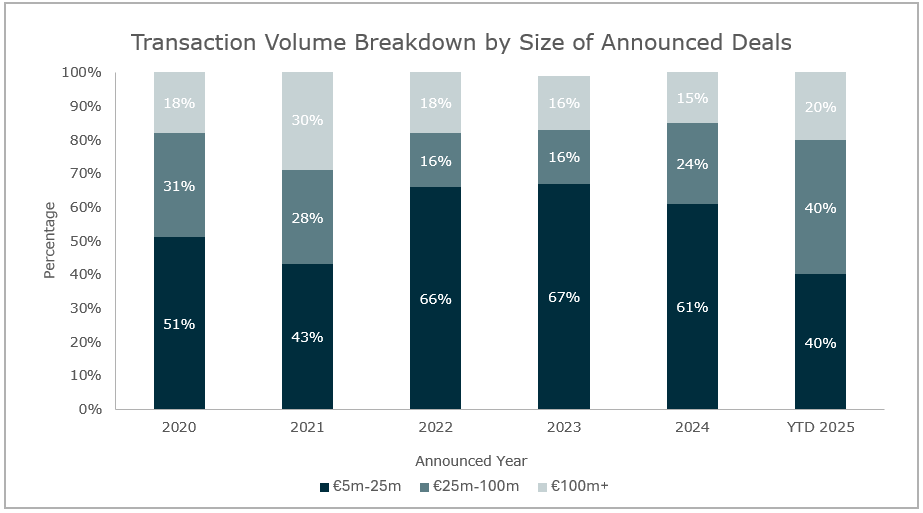

The investment sector saw two deals between £5m and £25m, two deals between £25m and £100m, and one deal exceeding £100m in January. These include the sale by Evelyn Partners of its Fund Solutions business to streamline its services with focus on its core wealth management service, after having also sold their professional services arm to Apax Partners late last year.

Source: MarshBerry Proprietary Database and Companies House. Data as of 1/31/25.

All deals over £5m this month involved private equity funds, either as a direct investor or via one of their portfolio companies. A similar trend was evident in transactions below £5m, with private equity-backed businesses that made acquisitions in December continuing their activity into January. Notably, Söderberg & Partners announced three more minority investments, Foster Denovo acquired another independent financial advice firm (IFA), and Titan Wealth purchased a Jersey-based IFA. Interestingly, there was only one acquisition by a quoted company this month, with Isle of Man-headquartered Manx Financial Group acquiring the Liverpool-based DFM CAM Wealth for £210k.

Source: MarshBerry Proprietary Database and Companies House. Data as of 1/31/25

Notable transactions (January 2025):

- Evelyn Partners agreed to sell its Fund Solutions business, Evelyn Partners Fund Solutions Limited (EPFL), to Thesis Holdings for an undisclosed sum. EPFL, a leading Independent Authorised Corporate Director (ACD) with £10.6bn in Assets under Governance, will transfer approximately 75 staff to Thesis upon completion expected before the end of the first half of 2025, subject to regulatory approvals. Thesis, which operates £40bn in assets, will add 161 funds across over 40 sponsors and investment managers to its book through the acquisition.

- Lovell Minnick Partners agreed to make a strategic growth investment in Broadstone, enabling the company to expand its client proposition. Broadstone’s management team will retain a significant stake and continue leading the business. The deal, which is expected to close in Q2 2025 subject to regulatory approvals, underscores Broadstone’s growth ambitions. Lovell Minnick Partners aims to support Broadstone’s expansion, particularly in its newly formed Insurance, Regulatory & Risk unit, leveraging its expertise in scaling professional services firms.

Other UK transactions (January 2025):

- WHEB Asset Management was acquired by Foresight Group Holdings, adding £800m in assets under management to Foresight’s Capital Management division.

- Azets Wealth Management acquired Newcastle-based Laurus Associates Limited, enhancing its financial planning capabilities.

- Foster Denovo acquired Verum Wealth, marking its seventh acquisition in just over a year and adding £87m in assets under advice to its Glasgow hub.

- Pathline Pensions acquired Unity Sipp from PSG Sipp’s administrators following its October 2024 collapse, ensuring service continuity for clients while the rest of PSG’s schemes were transferred to Alltrust.

- Isle of Man-based Manx Financial Group acquired Liverpool DFM CAM Wealth, a boutique formed by Derek Gawne and Lizz Ewart, for £210k.

- Titan Wealth has announced the acquisition of Jersey-based Advisa Wealth, managing £525m for 1,800 clients, backed by Parthenon Capital Partners and Hambleden Capital. Additionally, Titan is in due diligence to acquire Norwich-based Finance Shop and merge it with Loveday & Partners.

- PE-backed Pivotal Growth expanded into the protection market with the acquisitions of Northern-Ireland-based Business Protection Solutions Limited and London-based Radcliffe & Newlands Mortgages Limited, strengthening its market position and diversifying its service offerings in business and corporate protection.

- Söderberg & Partners expanded its UK footprint by acquiring minority stakes in three IFA firms—Francis Clark Financial Planning, Qi Financial Solutions, and Radcliffe & Co—advising on over £2.5bn of combined assets.

- Hoxton Wealth acquired Darlington-based Family First Financial Services, adding over £85m in assets under management and strengthening its presence in the north of the UK.

- Perspective Financial Group surpassed its 100th acquisition milestone, acquiring Hallidays Wealth Management, Foinaven Asset Management, Tony Fenton & Sons, PW Financial Management, and the client book of an adviser at Perspective (Home Counties) Ltd, adding £375m in assets under advice, 1,100 households as clients, and expanding its footprint in Derbyshire, Lincolnshire, and Cheshire.