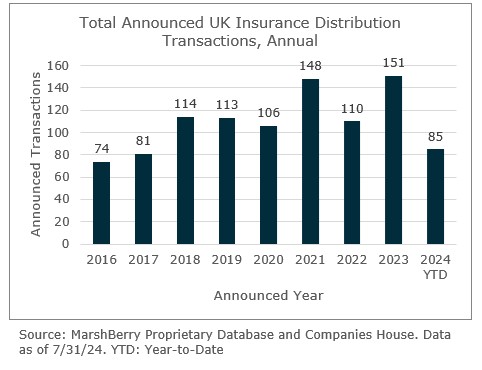

July 2024 saw a new Labour Government sweep into power in the UK and a more muted month for insurance distribution merger and acquisition (M&A) activity. There were only 11 new announced deals to report on, involving ten separate buyers and including two sizeable transactions (involving targets employing more than 100 people). The year-to-date (through 31 July) sector transaction count stands at 85, which is only 9% lower than at the 93 deals recorded at this point in 2023.

Insurance sector M&A market update

While overall transaction volumes are moderately behind 2023’s record year for insurance sector M&A (see “Demand and Supply” the 2023 Insurance Distribution Market Report), it is expected that 2024 should see overall deal count get closer to 150. Deal count alone does not tell the full story however, as the average size of announced deals continues to reduce.

With the Labour Autumn Budget set for 30 October and continued chatter that this date will herald the announcement of an increase in the rate of capital gains tax, many private sellers already in discussions about selling their business are now racing to complete deals before that date. Expect an uptick in deal volumes as we approach the Budget. For prospective sellers that have not yet initiated discussions around a sale, it is now realistically too late to complete a good deal before that date, although it is not yet clear whether any increase in the tax rate would apply from the October budget date or from the beginning of the next tax year (i.e., April 2025).

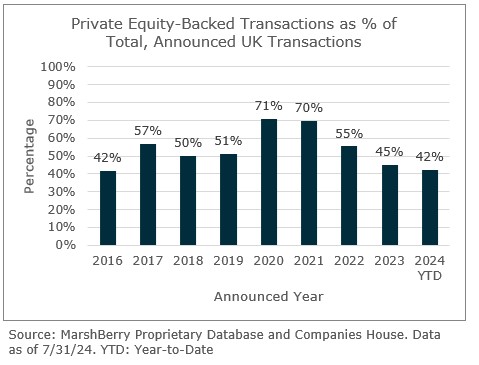

Private equity (PE) and PE-backed buyers have to date accounted for 36 (or 42%) of the transactions in 2024. This is broadly consistent with 2023, but still markedly lower than the historical average. With a perceived greater level of opportunity from continental consolidation – and it is notable that both Brown & Brown and Optio Group announced their largest overseas non-UK deals to date during the month – this reflects the increasing difficulty of achieving the high levels of return required by PE in the increasingly consolidated domestic market. That said, PE capital was behind 8 of the 11 new deals in July 2024 and remains a critical driver of continuing sector M&A.

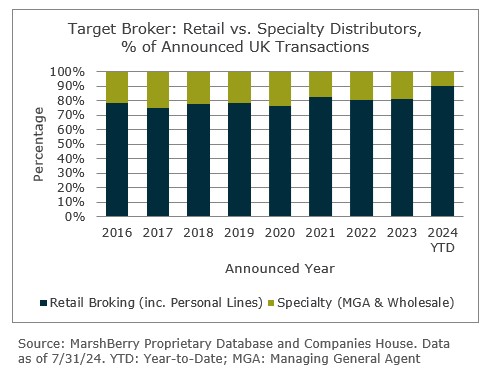

Despite three new deals involving specialty distributors (which MarshBerry defines as MGAs and wholesale brokers, including Lloyd’s Brokers) announced during July, the segment has only accounted for 9% of all announced deals in 2024 (to 31 July), significantly below the ~20% share they have accounted for historically. There has been relatively limited M&A activity in the MGA segment in 2024, with only six deals announced so far, against no fewer than 18 announced at this stage in 2023.

It has been previously noted that a number of the more active PE-backed acquirers in the sector were currently themselves ‘in play’ and are expected to refinance in 2024 (as Specialist Risk Group did last month) or sell to a strategic buyer as part of the “consolidation of consolidators.” The acquisition of Inflexion-backed David Roberts & Partners to BMS (who have hitherto been focused on overseas M&A rather than domestic consolidation) announced last week is illustrative of a trend that is expected to increase, as PE-backed platform businesses that have grown rapidly through M&A begin to come together and form much larger groups. The enlarged BMS following this transaction will employ more than 1,300 staff and control more than $7bn of gross written premiums (GWP).

Notable transactions (July 2024):

- As noted above, BMS Group announced its acquisition of David Roberts & Partners (DR&P) from PE backer Inflexion. DR&P employs c.400 staff in 25 offices in the UK and Europe, handling in excess of £620m GWP.

- Insurer Liberty Mutual announced the sale of Northern Irish personal lines broker Hughes Insurance to Markerstudy. This transaction is consistent with the recent trend of carriers divesting their distributions businesses (see also Allianz selling Premierline to Academy in March 2024).

- Assured Partners acquired Lloyd’s broker Harman Kemp, via the former’s Accretive Insurance Solutions business unit. Harman Kemp places binding and delegated authorities on behalf of mainly North American client base.

Other transactions:

- Specialist Risk Group continued its recent run of deals, announcing two new acquisitions: Tristar Special Risks (an MGA in the PV segment) and Carriagehouse (Equine).

- Ardonagh announced a deal for regional general insurance broker Rollinson Smith & Company in Shropshire.

- Seventeen Group announced its seventh deal of 2024, acquiring Gen2 Broking in Nottingham.

- JMG Group acquired the general insurance business of Howe Maxted in Kent.

- Clear Group announced its acquisition of the business and assets of Maynard Milton Insurance Services in Essex.

- Caledon Group acquired personal lines broker Voyager Insurance Services in Surrey.

- German group Ecclesia acquired the specialist W&I broker Liva Partners, based in London.