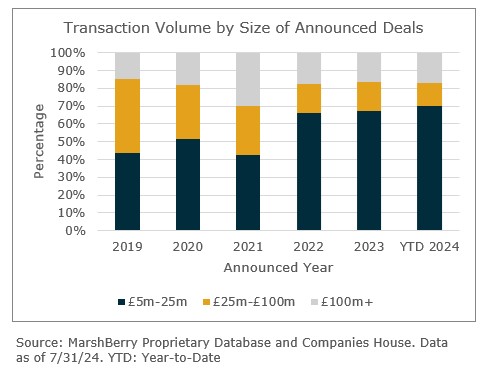

July 2024 was a busy month in the investment sector, with several notable deals involving pensions specialists and support providers in the sector. Most of the deal activity took place among smaller financial planners and wealth managers, and only six deals were worth £5m or more. There was also plenty of speculation in the market about the exit plans for some of the owners of the larger wealth management groups, some of which should be announced in the next few months.

Investment sector M&A market update

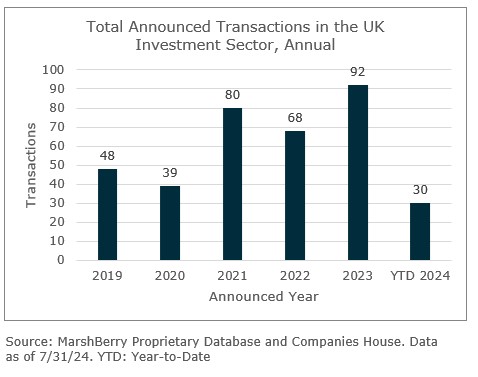

With 30 merger and acquisition (M&A) transactions announced in the sector so far this year, activity is rebounding from the slowdown in the previous quarter. Notably, the consolidation in the wealth management space has largely involved smaller entities below the value limit for tracking deal data and, therefore, disguises the true rise in deal activity. In addition, it is possible that UK consolidators will start to expand offshore. For example, this month Titan Wealth acquired AHR Group, an international wealth management group headquartered in Dubai, United Arab Emirates, with over 150 professionals in seven locations across six jurisdictions and $2bn of assets under advice and under management. Again, that is not included in the data below.

Another factor that has played a major role is the anticipation of increased tax rates on capital gains being announced in the Autumn Budget set for 30 October. That has prompted many private vendors to accelerate their discussions with acquirers in their attempt to conclude the transactions ahead of that date.

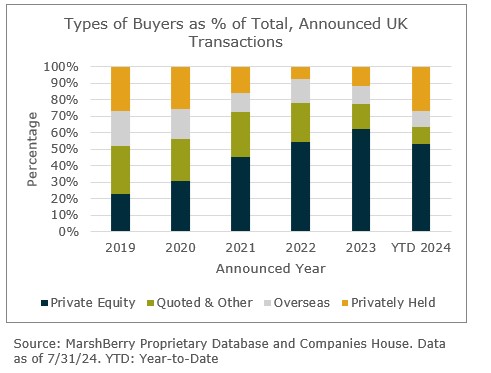

Private equity funds remain a dominant force as investors in the industry, albeit the data would suggest this group has passed its peak last year in terms of deal volumes. Most notable is the increase in privately held business as a proportion of acquirers this year. But, this is more a reflection of the relative decline in private equity funds’ activities than a rise in owner-managed business engaging in acquisitions.

Notable transactions (July 2024):

- The board of Hargreaves Lansdown unanimously agreed to recommend the £5.4bn takeover offer from a private equity consortium comprised of CVC Capital Partners, Nordic Capital, and Platinum Ivy, a subsidiary of the Abu Dhabi Investment Authority. The consortium extended the bid deadline from 19th July to 9th August to finalise its offer and present its plans for Hargreaves Lansdown.

- Söderberg & Partners raised £225m to support its expansion in the UK and Spain, with funding sourced from KKR and TA Associates. The company remains controlled by its founders and chairman, aiming to enhance efficiency through technology and grow its presence in the UK financial advice market. Managing over £60bn in assets and employing 3,000 people across seven countries, the firm has made 14 investments in UK advice firms, including three that were announced in July: HCF Partnership and Essex Financial Management; Grosvenor Consultancy; and Prosperity IFA.

- Marwyn Acquisition Company II Limited (MAC II) acquired pensions services provider InvestAcc for £41.5m. Led by former Curtis Bank CEO, Will Self, MAC II is a special purpose acquisition vehicle (SPAC) targeting the wealth management industry. The acquisition of InvestAcc, funded in part through an equity raise, is the first step in its strategy to build the leading specialist pensions administrator in the UK, focusing initially on the SIPP (self-invested personal pension) sector.

- Isio, the rapidly growing UK pensions, rewards, benefit, and investment advisory firm, secured a new investment from Aquiline Capital Partners to support its continued growth, with Exponent exiting its investment. Over the past four years, Isio has more than doubled its revenue, profit, and headcount, now employing 1,200 people across 10 UK offices.

Other transactions:

- Skerritts Group expanded its presence in the South East and London by acquiring KMG Independent and KMG Investment Management, and London-based Black Swan Financial Planning, adding over £940m in assets under management.

- Redwheel signed a definitive agreement to acquire Ecofin, a specialist in sustainable infrastructure and environment solutions with $1.4bn in assets under management, enhancing Redwheel’s sustainability capabilities.

- Wren Sterling acquired Howe Maxted Financial Services, adding 500 families with £200m in assets to its portfolio, while Howe Maxted’s general insurance division was sold to JM Glendinning.

- PE-backed Pivotal Growth expanded its portfolio with the acquisitions of Charleston Financial Services and Morrison Ward Associates.

- Hoxton Capital Management acquired Chequer Financial Services, marking its fourth UK IFA purchase this year, boosting its client base by 80 households.

- Traditum invested in Method Asset Management, an IFA founded by ex-rugby player Jonnie Whittle, to expand its financial services for high-net-worth clients and businesses.

- Mayfair Equity Partners announced the investment in a majority stake in Jersey-based VG, a leading provider of private wealth and fund administration services.

- Defaqto acquired RSMR to enhance its fund research and ratings capabilities for advisers, integrating RSMR’s expertise into its own platform and expanding distribution among advisers and their clients.

- Oxfordshire-based CMS Wealth announced the acquisition of Hayward Manning, an ultra-high-net-worth advice firm.