Source: IMASinsight

We track the details of every deal in the UK financial services sector to provide us with insights into who is buying and the prices being paid. The charts contained in this review summarise the findings.

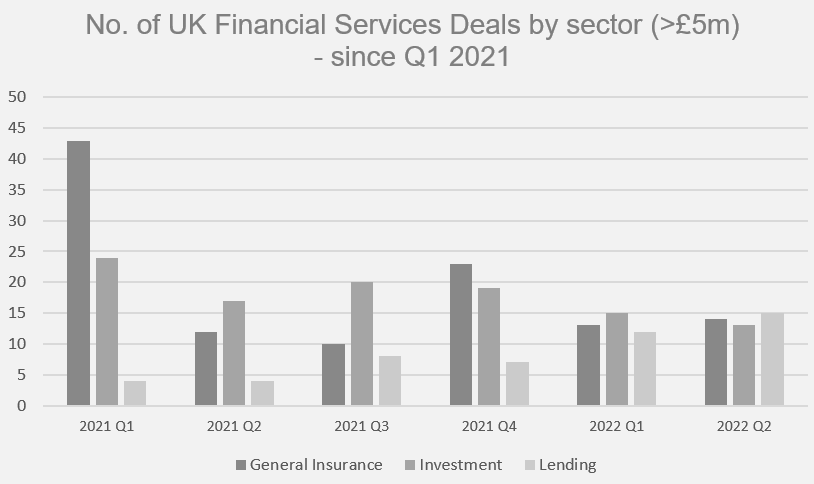

The first half of 2022 has been relatively unexciting. This contrasts with the current political scene exemplifying the adage that “a week is a long time in politics”. Private M&A transactions (rather than quoted company transactions), which the great majority of deals are, typically take between 6 and 12 months to complete and this means that the level of announced deals tends to be relatively stable, albeit we have commented in the past about the peak in Q1 2021 driven by a fear of CGT increasing.

The figures above would look very different if expressed as a percentage of the total population of companies in each sector. Looking at groups with values in excess of £5m, we estimate that the Investment sector is over 3 times the size of the General Insurance sector (the Lending sector on this basis is some 30% larger than the insurance sector). Seen in this context the Insurance sector is undergoing a far higher rate of consolidation, which is happening across the board. The Investment sector consolidation is happening at pace but within particular sub sectors such as wealth and fund management.

The relative scarcity of available assets has seen prices of insurance businesses climb significantly. In all three sectors we see the rate at which existing companies are acquired significantly outstripping the creation of new entities. A significant factor to starting a financial services business are regulatory hurdles. An unintended consequence (and benefit for some) of greater regulations is the increase in capital value of businesses within the sector, albeit this impact takes many years to manifest itself.

Insurance

June was a busy month for UK Insurance M&A with 12 new transactions to report on, the second highest monthly total to date in 2022 (after March, where the end of the tax year is invariably a catalyst for private sellers), with deal activity in the month overwhelmingly focused on the commercial broking segment.

The two largest deals in the month saw another transformational deal for Howden, which acquired US-based TigerRisk Partners in a $1.6bn transaction that will enhance its reinsurance and capital markets capability, and the acquisition of The Clear Group by Goldman Sachs Asset Management in a secondary private equity transaction that sees Clear’s previous backer ECI Partners divesting after four years.

Six separate consolidators were responsible for eight of the commercial broking transactions announced during the month. Global Risk Partners announced the acquisition of Prescott Jones in Wales and, via its hub broker County Group, Taylor Francis, which has offices in Newport and Aylesbury. J.M. Glendinning made another two acquisitions in Scotland with a deal for GS Group, a leading independent broker based in Perth and, via investee business Greenwood Moreland, R C McLeish, a broker in Lanarkshire. Other broking consolidators active during the month included the aforementioned Clear Group, which announced the acquisition of ProAktive in Yorkshire, and PIB Group, which announced a deal for health and wellbeing specialist Balens in Worcestershire. US brokers were also active, with Arthur J Gallagher announcing the acquisition of Erimus Group, expanding its presence in the North East, and Acrisure acquiring Russell Scanlan in Nottingham.

Finally, two other broking deals saw Lloyd & Whyte announce the acquisition of Naturesave Policies in Devon, and Jukes Insurance in the West Midlands acquired North Warwick Insurance Services.

Investment

M&A activity across the investment sector continued apace in June, despite the recent volatility in equity markets.

US-based private equity firm Lovell Minnick Partners acquired a majority stake in London & Capital, the London-based wealth manager for domestic and international high-net-worth and ultra-high-net-worth individuals. Private equity backed professional services firm Progeny announced the acquisition of The Fry Group, a business covering tax, estate and financial planning services, bringing its total AUM to £5.5bn. Hawksmoor Investment Management, part of the Hurst Point Group, which is backed by US private equity house The Carlyle Group, acquired Salisbury and Harrogate-based Gore Browne Investment Management. Lumin Wealth acquired South East-based Ashridge Financial Management, adding £85m in AUM. Marygold & Co, a subsidiary of US listed firm The Marygold Companies, acquired Northampton-based Tiger Financial & Asset Management for a total of £2.4m including net current assets, adding £42m in AUM. It was also reported (yet again) that Caledonia Investments is set to put 7IM up for sale in the autumn, seeking a valuation of about £400m for the firm.

In the asset management space, UK-listed AssetCo acquired Edinburgh-based SVM Asset Management for £11m, adding £586m in AUM. Dual-listed asset manager Janus Henderson Group announced the sale of its £1bn Janus Henderson Property Fund to an undisclosed buyer. Foresight Group acquired the technology ventures division, including the management, of Downing’s Venture Capital Trust and Enterprise Investment Scheme businesses, that have a combined AUM of £275m, for an initial consideration of £13.6m.

LSE-listed Abrdn acquired a stake in platform and wealthtech software firm Nucoro, while Australian-listed FNZ led a Series-A investment in fintech start up Bondsmith.

Elsewhere in the sector, Lloyds Banking Group acquired Cavendish Online, a leading UK protection provider, for £12m.

Lending

In a relatively quiet month, Barclays Bank acquired specialist lender Kensington Mortgages for £2.3bn from private equity firms Blackstone and Sixth Street. In a further development, investment management firm Pimco bought £5bn of Kensington Mortgages’ residential loan book, a part of the portfolio that Barclays did not purchase.

In the challenger banking space, Starling agreed to buy a £500m mortgage book from specialist lender Masthaven in a move to further expand its mortgage portfolio. SME challenger bank Allica secured £25m in funding from its existing investors Atalaya Capital Management and Warwick Capital Partners and a £30m debt facility from British Business Investments.

Elsewhere, Fintech lender Uncapped acquired Sugar, a specialist finance provider for gaming and digital apps.

*IMAS Corporate Finance LLP has been acquired by MarshBerry.