July has seen the UK wake up to a new government, under a Labour party with a strong mandate from the electorate for fiscal reform. However, Labour party leadership has been carefully courting business for some time and is expected to be cautious in enacting the sorts of major or immediate changes that might impact mergers and acquisitions (M&A).

So rather than speculate on how possible tax or policy tweaks might impact the future direction of dealmaking in the insurance distribution sector, now is an opportunity to look at H1 2024 in context and reflect on what has happened over the past six months.

Insurance M&A market update

June saw 14 new sector deals announced, which included two notable deals involving overseas buyers, one private equity (PE) secondary deal, as well as a large number of smaller consolidation deals involving several of the ‘usual suspects.’

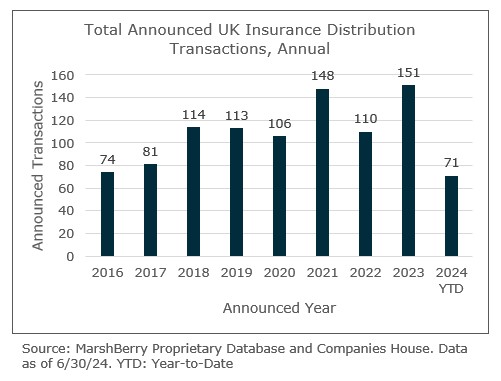

At the halfway point in 2024, there have been 71 announced insurance distribution M&A transactions in the UK, involving 37 unique buyers. For the same period in 2023 there were 75 announced transactions, which was also 50% of the total volume of deals announced in the year, suggesting a very consistent rate of deal flow over the past 18 months.

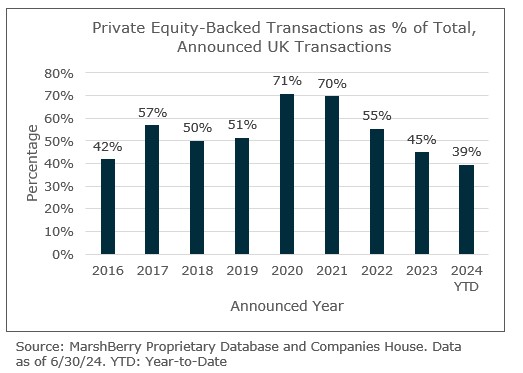

Does this mean nothing much is changing? Well, not quite. Drilling down into the details, a few interesting observations arise. As noted in last month’s Viewpoint (available here), the proportion of deals involving PE and PE-backed buyers was at a multi-year low. Year-to-date (YTD) in June it stood at 39%, a substantial reduction from the approximately 70% of all deals in 2020 and 2021. However, there have already been four direct PE transactions (as opposed to involving a PE-backed acquirer) in the sector in 2024, twice as many as in the whole of 2023.

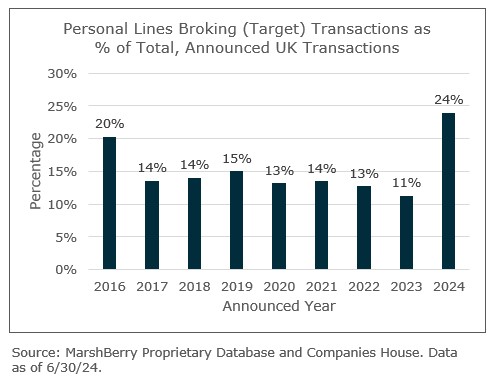

Another interesting feature of 2024 has been the unusually high number of deals involving personal lines businesses. Almost a quarter of all deals in 2024 so far have involved a personal lines target, compared to a longer-term average of less than 15% of all sector deals. There have been 17 personal lines deals so far in 2024, the same as the total number announced during all of 2023. Is this a statistical blip, or has the notoriously difficult segment finally found favour among consolidators and investors? Most of these deals have been in non-motor business and several have involved PE buyers. Very few have involved buyers engaged in commercial business. It is a trend to continue monitoring closely in 2024.

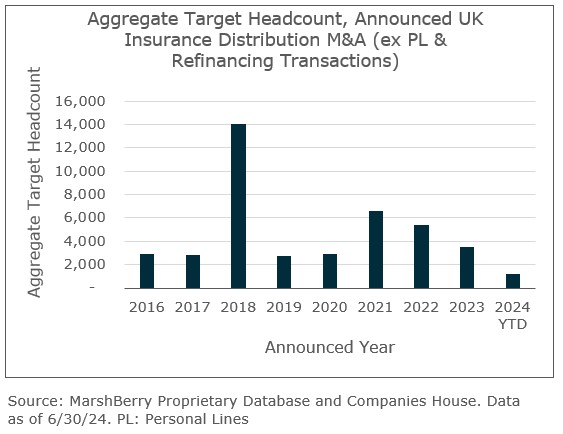

Given a greater proportion of personal lines deals, then the number of commercial lines deals must have fallen. What is more, the average size of those deals has continued to fall, reflecting a long-running UK trend that MarshBerry has been commenting on for some time – that the volume of mid-sized broking targets available for consolidators has been greatly diminished. Excluding personal lines targets and refinancing deals (which are not industry consolidation per se), more than 70% of all announced M&A transactions involved a target with a value estimated to be below £5m. There have been no deals involving targets valued at £25m-£100m in 2024 so far, against a longer-term average of eight per year.

Headcount analysis of all M&A targets tells the same story – the average headcount of targets acquired in 2024 YTD has been 23. The average across all announced deals since 2016 has been 54. Consolidators are having to do a greater number of smaller deals, because the supply of mid-sized targets has been greatly reduced. Using headcount as a broad proxy for brokerage income suggests that in spite of the large volume of announced deals, overall consolidation activity in commercial lines has been falling since its peak in 2021.

Notable transactions (June 2024):

- U.S. insurer Ambac Financial Group announced it had reached a deal to acquire a 60% interest in Beat Capital Partners, the underwriting and MGA incubation platform backed by investors including Bain Capital, who will remain as a minority investor in the business alongside management. Beat’s businesses produced more than $500m of gross written premium (GWP) in 2023.

- Listed Australian group AUB Group, which also owns Tysers in the UK, announced a deal to acquire 40% of Momentum Broker Solutions, an authorised representative network. Momentum has more than 100 partners overseeing more than £90m of annual premium.

- In the second PE secondary transaction in the sector in two months, Perwyn Advisors announced it has acquired Atec Group, the digital personal lines and SME broker backed by Kester Capital since 2017 when they acquired Ceta. The business has grown from £25m of GWP to £75m in that period, mainly organically.

Other transactions:

- Seventeen Group continued their recent run of regional acquisitions, announcing three new deals during the month – Wisemans Insurance Services, North West Risk Solutions, and East Pennine Insurance.

- JMG Group announced two new deals, adding Executive Insurance Solutions and Gleaming Insurance Services.

- Brown & Brown (Europe) acquired family-owned Rollins Insurance Brokers in Northern Ireland.

- Ardonagh added high street broker BP Insurance Brokers in Lancashire.

- AssuredPartners announced the acquisition of Everett Mead and its Appointed Representative ACG Broking Services.

- Welsh broker F R Ball Insurance announced a deal for Howell Insurance in Llantwit Major.

- Jensten Group announced a deal for Chris Knott Insurance Consultants in East Sussex.

- Specialist Risk Group added schemes broker Strategic Insurance Services in West Sussex.