As the UK considers what impact the fiscal plans of the newly elected Labour government may have on individuals and businesses, now is a good time to look at merger and acquisition (M&A) activity in the investment space for H1 2024.

Investment sector M&A market update

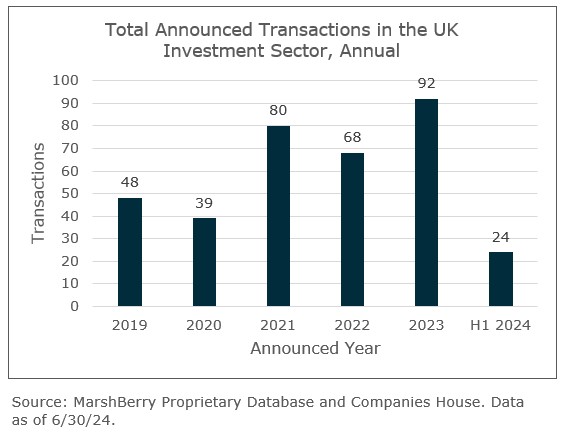

At the halfway point in 2024, there have been 24 M&A transactions announced in the UK Investment sector (each with an estimated value of £5m or more), showing a sharp drop in activity from the previous three years. The deal count in Q1 this year was substantially below the level reached in Q4 2023 and, similarly, Q2 of this year was less than half of Q1, so the trend is seemingly pointing downwards.

Perhaps this is not surprising in the light of the record high levels of transactions over the last three years, especially against the backdrop of increasing cost of capital and the pressures of Consumer Duty.

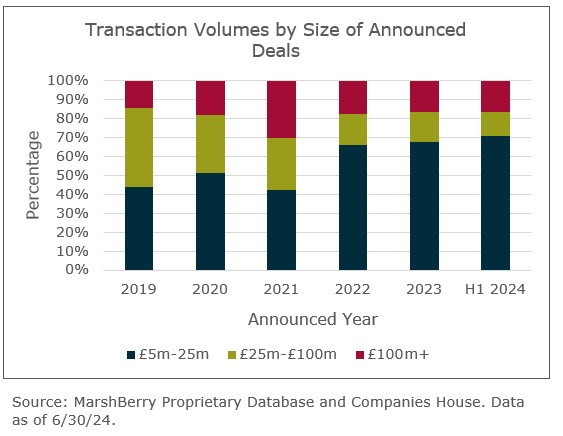

Volumes have also become increasingly biased towards smaller transactions, which made up almost three quarters of all deals in the first half of this year – an all-time high. For this segment of the market, funding and integration of operations are for many buyers less challenging and remain very much core to their bolt-on growth strategies.

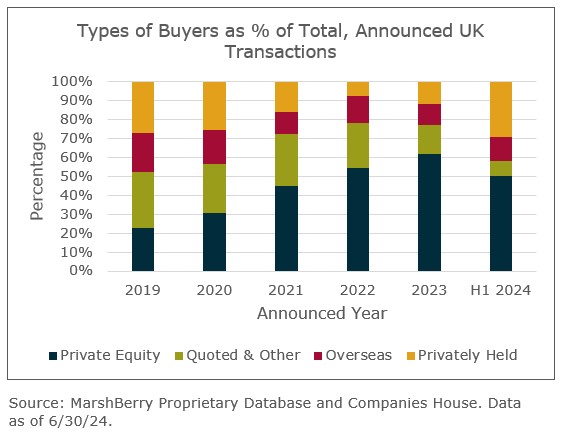

In recent years, deal activity has been boosted by private equity (PE) backed “buy-and-build” vehicles. However, their consolidation of the market has slowed down quite significantly this year and almost one in every third acquisition in the first half of this year was sponsored by North American PE funds. Their scale and ambitions have supported slightly larger acquisitions by more selective acquirers than the usual suspects among the “consolidators.”

What is also noteworthy is the increased percentage of transactions involving privately owned acquirers this year. It has reverted back to its “norm” seen in 2019 and 2020 of little over a quarter of the volumes, when other categories of buyers were less prominent.

In the meantime, public companies continued their decline as a buyer category and were, in fact, more likely to be at the receiving end of a bid, such as in the cases of Hargreaves Lansdown and Mattioli Woods.

Notable transactions (June 2024):

- The board of Hargreaves Lansdown announced that it is willing to unanimously recommend a £5.4bn takeover offer from a private equity consortium consisting of CVC Capital Partners, Nordic Capital and Platinum Ivy (a subsidiary of the Abu Dhabi Investment Authority). The consortium has until 19th July to finalise its bid and outline its plans for Hargreaves Lansdown.

- Succession Wealth announced the acquisition of London-based advice firm London Wall Partners. The acquisition adds £900m of client assets, and marks Succession Wealth’s fourth acquisition under Aviva ownership and its second in 2024.

- The equity investment trusts Alliance Trust and Witan announced a merger creating a £5bn super fund. The tie-up, which is subject to shareholder approval, would see the £1.8bn Witan portfolio rolled into Alliance Trust under the new banner of Alliance Witan.

Other transactions:

- In a push to focus on wealth management, WH Ireland announced that it had sold its capital markets arm to investment bank Zeus Capital for up to £5m.

- Milecross Financial expanded its operations to the south-east with the acquisition of Surrey-based financial advice firm, The Centre Court Partnership, adding 2,000 clients and £40m of assets.

- Hoxton Capital Management made its third IFA acquisition of the year with the purchase of Devine Financial Management. Devine operates from offices in London and Southend.

- MPA Financial Management announced the acquisition of Worcester-based Suckling Waddington and Partners.

- Sale-based pensions administrator iPensions Group announced the acquisition of a legacy SIPP and SSAS book from Morningstar Wealth Retirement Services.

- IFA network ValidPath facilitated the purchase of Ledbury-based firm Winnell Douglas through its succession solution tool.

- Newcastle Financial Advisers bought Hexham-based financial planning firm Keith Dyson Financial Consultancy, adding 300 clients.

- Alpha Financial Markets, an LSE-listed consultant to wealth and asset management firms, was acquired by listed private investments firm Bridgepoint.

- Fintel announced it had acquired Threesixty from abrdn. Threesixty provides compliance and business support services to wealth and asset management firms.