The UK Labour Party leadership has declined to offer any guarantees on any other taxes, after having pointedly promised not to raise income tax, national insurance or VAT (Value Added Tax). This suggests that an increase in – or reform of – capital gains tax is likely to happen under a new government.

The last time there was major discussion around an increase in capital gains tax was when the significant scaling back of Entrepreneurs’ Relief in 2020 drove speculation that the rate of capital gains tax would increase significantly in the Spring 2021 budget. Entrepreneurs’ Relief is a form of tax relief that can reduce the tax liability for owners selling part or all of their business.

While there was no change in 2021 to the capital gains tax, the speculation spurred a rush for the exit by business owners that might have been caught by such a change. However, these owners may have benefited from a more thorough and strategic assessment around selling their business during that period. And with 2024’s potential changes to the capital gains tax, owners who take a broader, strategic view around selling their firms will have an advantage.

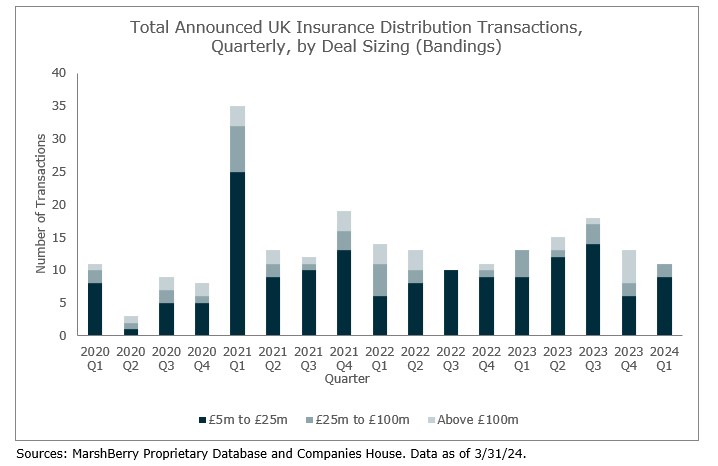

Post the Q1 2021 deal flurry, merger and acquisition (M&A) deal valuations typically rose by some 20% to 30%, as a relative but short-lived abundance of sellers was replaced by relative scarcity, at a time when interest rates were just above zero. This experience backs up MarshBerry’s broad view that the tax regime should be the tail, not the dog, when deciding the appropriate moment to exit. In hindsight, even if capital gains taxes had increased, waiting would have been the right strategy for some owners. Not only would the sale price achieved likely have been higher, but more time could have been invested in ensuring the right partner and the right deal/terms – above and beyond just the headline price.

Disappointingly there is no crystal ball to see the future or guaranteed outcome around capital gains tax, but given that the Labour Party’s overarching public messaging has been centered on pro-business, pro-workers and the party of wealth creation, it is likely the 10% band on the first £1m of gains on business disposals (Business Asset Disposal Relief) will remain, if for no other reason that any increase would not generate significant extra tax revenues.

Increasing capital gains tax is not a simple matter and generally takes time to play out. But doing a good deal also takes time. Buyers, who are paying top dollar for an acquisition target, tend to carry out extensive due diligence to ensure the business they are buying is really as described. Add to that the time needed for legal negotiations and FCA approval, and very few deals take less than six months from start to finish, with most taking much longer.

If now is the right time to sell your business, then why delay?

If a sale is not front of mind, and there is work to do on the continued growth of your business, possible changes in the future rate of the capital gains tax should not bring forward a sale without taking into account the strategic roadmap and plans for the firm.

Whichever camp you fall into, MarshBerry can advise you through the pros and cons, and offer an in-depth valuation analysis based on current insurance distribution M&A deal activity.