What a difference a year makes

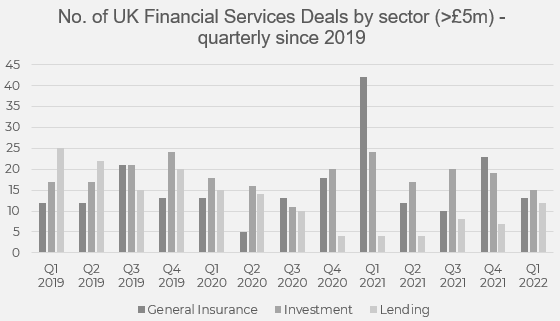

| We track the details of every deal in the UK financial services sector to provide insights into who is buying and the prices being paid. The charts contained in this review summarise the findings.The marked peak in M&A volumes in Q1 2021 is easily explainable; fear that Capital Gains Tax (CGT) would be increased in the Budget. In that quarter almost as many general insurance businesses were sold in the preceding twelve months. What is less clear is why this wasn’t the case the other subsectors where, although deal volumes were up, the increase was marginal. In part this is explained by the fact that in the Investment and Lending sectors more of the deals were corporate to corporate rather than private owner to consolidator – where CGT is an important influence on sellers.In Q1 2022, volumes were significantly down on the quarterly average of 2021. I could give you a list of macro-economic reasons. But don’t overlook institutional failure. The FCA have been struggling to authorise changes in control in a timely fashion. In the past we have had applications approved in less than three weeks. We are now seeing our deals waiting over three months.Valuations have moved considerably since the March 2021 Budget; upwards. We would be delighted to meet and discuss pricing and market conditions generally. We look forward to hearing from you.P.S. We are not tax advisers but we meet those considering selling who have missed out on a simple bit of housekeeping. CGT did not go up in 2021 but Entrepreneurs’ Relief had already been greatly reduced (and renamed Business Asset Disposal Relief) a year before; the lifetime allowance being reduced to £1m and the ownership period increased to two years. If you are contemplating selling in the medium term, do consider making a simple tax-free transfer of some of your shares to your spouse. It could save you £100k – and more if CGT were to rise. |

Insurance

After what has been a rather muted beginning to the year for UK Insurance M&A, March saw a considerable jump in activity, with the highest number of announced deals since March 2021, and the largest single transaction by value on the insurance distribution side since Marsh’s acquisition of JLT in 2018. (note: the list of deals below covers all announced sector M&A, whereas the charts in this newsletter only cover transactions valued at above £5m, hence the greater number of deals noted in this section.)

Grabbing all of the headlines in the month was of course the announcement that Global Risk Partners is to be acquired by Brown & Brown, the listed US broker whose entry into the UK market at scale has been widely predicted for some time. GRP has been the most active buyer of UK insurance distribution businesses by volume since 2016 and it will be interesting to see if this level of activity continues under their new ownership.

The number of UK acquisitions by PE-backed commercial broking consolidators has slowed in recent months, but March saw J.M. Glendinning announce the acquisition of both Astute Insurance Solutions in Northampton and The Sphere Group in Newcastle, and Aston Lark adding Braddons, a specialist broker with expertise in areas including construction and real estate. PIB Group, who have been busy making overseas acquisitions, announced its first UK broking deal in more than six months, with the acquisition of Guest Krieger, a specialist Lloyd’s broker best known for placing Israeli business into the London market. Partners& also made a notable acquisition to extend its footprint into the Scottish market, announcing that it had acquired the MacDonald Group.

Among the less well-known buyers in commercial broking, West Midlands based Think Insurance acquired Sovereign Insurance Services (Langley), and Heath Crawford & Foster (HCF) announced two new acquisitions, Merenda & Co in Southend-on-Sea, and the general insurance division of Essex Financial Management, based in Leigh-on-Sea.

There were two notable MGA deals during the month, with ambitious US group Acrisure announcing that it will acquire Volante Global, an international MGA platform encompassing a number of different brands, and KGM Underwriting (part of A-Plan, which is itself part of Howden … are you keeping up?!) acquiring motor specialist Eridge Underwriting Agency.

In Lloyd’s, Bermudan insurer SiriusPoint announced that it had sold its managing agency Sirius International Managing Agency (SIMA) to Mosaic and also agreed to invest in Mosaic Insurance, as part of a wide-ranging strategic partnership. Separately, listed private equity investor B.P. Marsh & Partners announced that it has acquired a 40% interest in Denison & Partners, a start-up Lloyd’s broker established by Alasdair Ritchie.

In personal lines, short term motor insurer Tempcover announced that it had agreed to be acquired by RVU, the owner of Uswitch, Confused.com and Money.co.uk

There was a flurry of deal activity in the Insurance Services sector during the month. Motor-claims focused insurtech Automated Insurance Services (AIS) was acquired by US data analytics firm Verisk, Sedgwick acquired UK Assistance 247, a home emergency repair fulfilment services business, and US firm Fortegra Group completed the acquisition of ITC Compliance. In loss-adjusting and claims handling, Gallagher Basset UK acquired third-party claims administrator Claims Settlement Agencies, Woodgate & Clark acquired specialist media adjuster Spotlite Claims, Questgates acquired Amedeo Adjusting, and Claims Consortium acquired loss adjuster Roger Rich & Co. Finally, the aforementioned PIB Group also added to its Health & Safety business with the acquisition of Baily Garner (Health & Safety).

Finally, listed specialty insurer Randall & Quilter announced that it is to be acquired by Brickell Insurance Group in a £482m deal backed by 777 Partners, a US investment firm.

Investment

March finished another quarter of buoyant M&A activity in the Investment sector with a number of high-profile announcements, including Royal Bank of Canada’s £1.6bn recommended offer for Brewin Dolphin to create a combined wealth management group with some £64bn of AuM in the UK and the Channel Islands, and Aviva’s acquisition of Succession Wealth for £385m, adding approximately 200 planners and £9.5bn of client assets.

Also in the wealth management market, private equity-backed Amber River announced the acquisition of Cheltenham-based HDA, adding £380m of client assets. Another private equity-backed group, Verso Wealth Management, announced the acquisition of Sunderland-based CDC Wealth Management with over £150m of client assets. Lumin Wealth, 50.1% owned by Swiss financial service company VZ Group, acquired Hertfordshire-based Enhance Wealth Management, increasing its client assets to around £800m and eight shareholder employees at East Yorkshire-based Informed Financial Planning bought a majority stake from founder Kevin Ferriby.

Among the asset managers Gresham House announced the disposal of its entire 23.7% shareholding in Rockwood Realisation Plc, for £8.5m in cash. Sarasin & Partners bought Bread Street Capital, adding private markets investment and product structuring capabilities to its platform. It was also reported that Liontrust Asset Management would pay £51.4m less for Majedie Asset Management, as the former’s share price has fallen since the announcement of the transaction.

Elsewhere in the sector, HPS Investment Partners acquired a controlling stake in the combined platform group made up of Nucleus and James Hay, with the existing private equity owner Epiris retaining a minority interest, and SS&C Technologies concluded its previously announced acquisition of B2B investment platform Hubwise Securities. Aspira Corporate Solutions, a subsidiary of LEBC, acquired employee benefits firm Demna Consulting.

Lending

In the consumer lending space, Lendable secured £210m in equity funding from Ontario Teachers’ Pension Plan Board, valuing the business at £3.5bn. In a bid to accelerate its growth, Nottingham-based consumer lending specialist Oakbrook Finance raised £142m from JP Morgan and alternative investment advisory firm Atalaya Capital Management.

Fund manager Elliott Advisors acquired a majority stake in specialist lending group Enra Specialist Finance from Enra’s management and Exponent Private Equity. Mortgage Advice Bureau agreed to acquire a 75% stake in Fluent Money Group, a telephone advice mortgage broking provider, for £73m. Challenger bank Oxbury raised £31m in its third funding round and acquired its strategic IT partner Naqoda.

Finally, Secure Trust Bank sold its debt purchase business Debt Managers to Intrum UK Finance. Under the transaction, Intrum acquired rights as lender to a portfolio of 650,000 customer loans.

*IMAS Corporate Finance LLP has been acquired by MarshBerry.