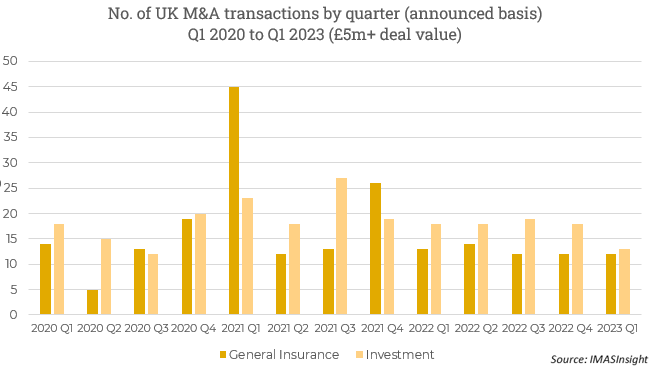

IMAS has tracked announced M&A activity across General Insurance and Investment, two key sectors in UK financial services, for many years. The charts above and below show the volume of transactions by quarter since 2020.

Q1 2023 was broadly in line with the levels of activity seen during 2022, and some way below the record-breaking year of 2021.

The question we are frequently being asked is whether increasing interest rates and the general uncertainly around the UK economy have impacted transaction volumes, and perhaps more importantly, deal pricing?

It typically takes several months from agreeing the headline terms of a deal to actually transacting. The prices of deals being signed and announced today are often a function of decisions taken some six months or even longer ago. Serial buyers, keen to protect their reputations, are naturally reluctant to chip the price during negotiations, despite the increased pressures that many are now facing. A sharp deterioration in market sentiment might remove this inhibition, but this has – based on our experience – so far not occurred.

Insurance

March saw another steady stream of new UK Insurance sector transactions being announced to end a quarter that has seen an above-average level of M&A activity (all deals – note that charts shown in this newsletter are for deals valued at >£5m only). If you are interested in reading more about longer term M&A trends in the sector, our fourth annual UK Insurance Distribution M&A Annual Review was published during the month and can be downloaded here.

As usual, commercial broking led the way in terms of new transaction announcements. Among the more frequent acquirers, J.M. Glendinning Group announced that it had acquired HGV and motor trade specialist New Era Insurance Services in Stoke-on-Trent, which in turn announced its own new deal, adding Inspire Road Risks (trading as courierinsurance. co.uk). Specialist Risk Group added Consort Insurance in Essex, Ardonagh announced a deal for Compass network member Pace Ward in Stoke-on-Trent, GRP-owned Castle Insurance Services added M R Lonsdale & Partners in Durham, and AssuredPartners continued its expansion in the South West with the acquisition of SouthWest Brokers, which trades as Westinsure Plymouth.

Arthur Gallagher was also active during the month, bolstering its leading position in the education sector with the acquisition of FE Protect, a specialist broker focused on the Further Education college segment and based in Formby. Arthur Gallagher separately announced the acquisition of Bay Risk Services, a binder broker in the Lloyd’s and international market, from Optio Group, and the group’s underwriting arm Pen Underwriting added Tay River Holdings, a specialist MGA in marine classes, adding £90 million of GWP.

Away from the ‘usual suspects’, it was reported that private client broker Castleacre Insurance in Suffolk had acquired Merritt Insurance Services in London, and it was announced that London market broker Ballantyne Brokers had undergone an MBO, coming out of US-based K2 Insurance Services.

In the first private equity exit from a UK sector investment of 2023, it was announced that Dunedin-backed Acquis Insurance, which specialises in serving the asset finance industry, has been acquired by NSM Insurance Group. NSM owns several UK businesses including Kingsbridge, which it also acquired from Dunedin, in 2020.

Finally, again in commercial broking, in its annual results for 2022 Ecclesiastical Insurance revealed that in December 2022 its Benefact Broking arm had sold SEIB Insurance Brokers to Lloyd & Whyte. Benefact is already a large minority shareholder in Lloyd & Whyte and the deal increases Benefact’s shareholding in the business, as it gradually moves towards a controlling position.

Investment

The strong deal activity continued in March, primarily driven by several notable IFA transactions. Progeny announced plans to buy chartered financial planning firm Gibbs Denley, extending its national footprint to East Anglia and taking AUM to more than £7.5bn. Fairstone marked its second IFA purchase of the year with Spalding-based advice firm, MT Financial Management, adding £200m to its AUM. Craven Street Wealth boosted its AUM to £1.25bn with the acquisition of London-based Bernard Barrett Associates. Advanta Solutions announced its sixth acquisition in the last 18 months with the purchase of Hertford-based MW Wealth Management, adding £65m in AUM. Perspective completed a hattrick of IFA purchases in March adding £515m in AUM, with the addition of HNH Financial Services, Gould Financial Planning, and Financial Choices IFA, expanding its presence in Huddersfield, Cardiff and Whitstable, respectively. Schroders-owned Benchmark Capital completed its second acquisition in Northern Ireland with the purchase of Kennedy Independent Financial, adding £80m in AUM and further progressing the firm’s plan to build a hub in Derry. Wren Sterling also injected £80m into its AUM with the acquisition of Glasgow-based Active Wealth Management.

There was activity elsewhere in the sector, with AssetCo’s acquisition of Ocean Dial Asset Management for £4.1m, and First Sentier’s majority stake in London-based Credit Manager AlbaCore Capital Group. Marwyn Capital formed Marwyn Acquisition Company II, a vehicle setup to seek out deals with financial advisers, wealth managers, fintech firms and life and pensions companies. Furthermore, there were several reports speculating that Australia-based Macquarie Group is considering a £5bn takeover of London-listed asset manager M&G. Kingswood confirmed that it is considering the sale of its UK business, with a potential value of £250m.

March marked a tumultuous period for the banking subsector, with the fallout of Silicon Valley Bank leading to HSBC acquiring the UK arm for £1, and UBS rescuing Credit Suisse for $3.25bn. It was also reported that Barings is to acquire Australia-based Gryphon Capital Partners, the parent company of Gryphon Capital Investments. The plans to sell the fund administrator, Link Fund Solutions, is in doubt after a senior management crisis at the bidding firm Waystone Group.

*IMAS Corporate Finance LLP has been acquired by MarshBerry.