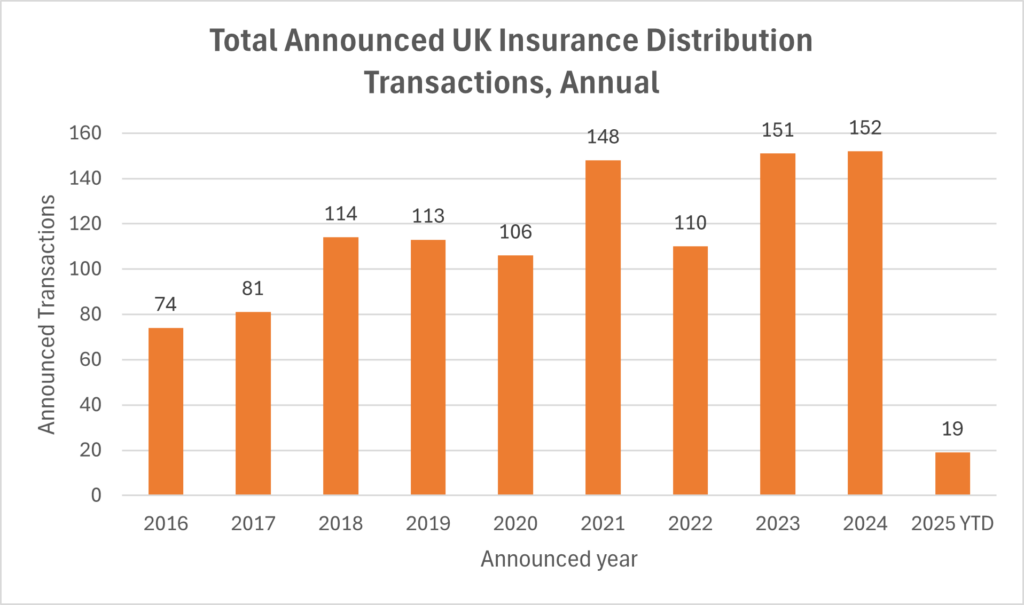

March saw nine new announced transactions involving a UK insurance distribution target, including two high profile new deals, making it a busier month for mergers and acquisitions (M&A) than January or February, but activity levels are still running well below average. Q1 2025 ended with a total of only 19 sector transactions, the lowest since Q2 2020 (remember what was happening then?) and well below the five-year quarterly average of 32. It is now very unlikely that sector deal volumes for 2025 will reach the record levels of 150+ transactions seen in both 2023 and 2024.

M&A Market Update

MarshBerry has previously noted that the unusually busy Q4 2024 for sector deal activity, which had been partly precipitated by the widely trailed increase in Capital Gains Tax in October, may have brought forward some transactions that might have otherwise happened in 2025. Figures for the first quarter of the year appear to bear this out, with only 19 announced transactions on a year-to-date (YTD) basis, which is exactly half the figure seen in Q1 2024 (38).

It would be premature however to suggest that 2025 will be doom and gloom for M&A. There were nine new deals in March, and the first few days of April have seen another clutch of announced transactions. Buyer appetite certainly has not disappeared, and March saw serial acquirers including Specialist Risk Group, Ardonagh, Brown & Brown (Europe) and The Broker Investment Group all open their accounts for 2025 with new UK deals.

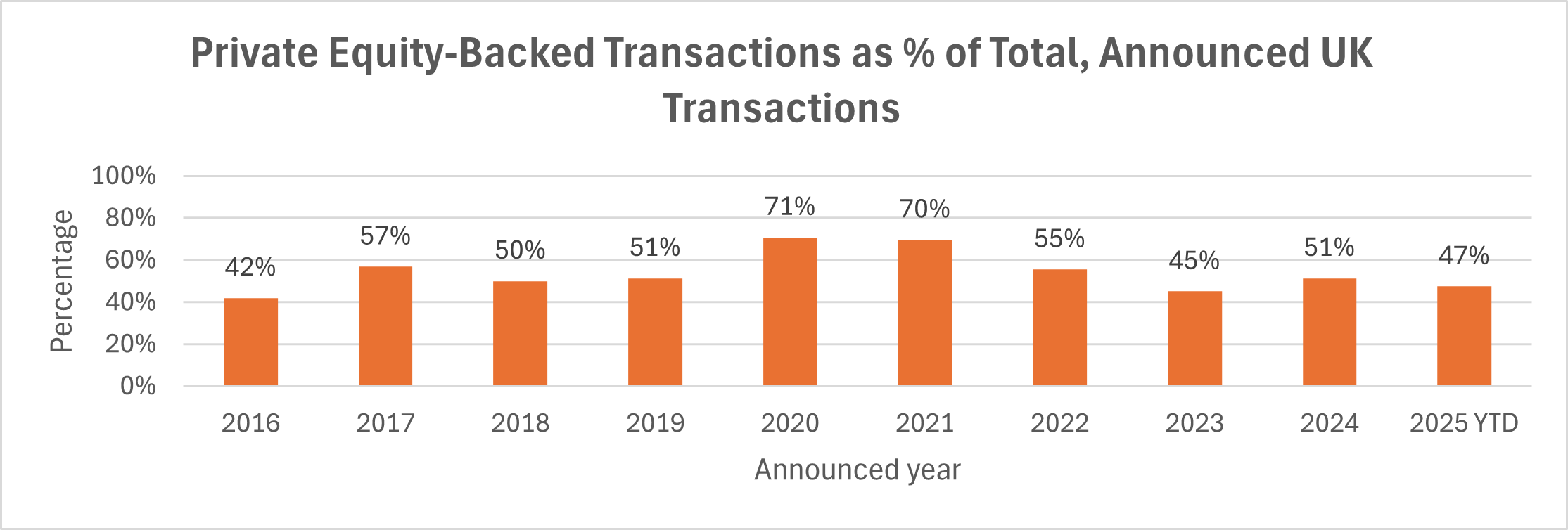

Notably, there were also two new private equity (PE) transactions announced in March, involving two of the largest remaining independent players in the sector, demonstrating that PE, the principal driver behind industry consolidation over many years, remains highly active. Both deals also serve to remind that even the firms that most vehemently insist that they are not for sale will have succession questions to address at some point, which in more cases than not result in a transaction involving third party capital.

Both PE transactions involved the sale of a minority interest, with credit and political risk specialist Berry, Palmer & Lyle (BPL) partnering with Preservation Capital (which is already invested in both BMS and Optio), and Seventeen Group announcing a new investment from IK Partners. Both BPL and Seventeen Group are constituents of the MarshBerry/Insurance Times Top 50 UK Brokers 2024.

It may be too early in the year to start trying to divine trends, and 19 deals is statistically very little to go on, but PE and PE-backed transactions have accounted for just under half (47%) of all YTD deal activity, broadly in line with the last few years. And two of the biggest PE-backed consolidators in the UK, Howden and PIB Group, have already announced more than one UK transaction in 2025, demonstrating that while their M&A focus may have shifted to overseas markets, they are both still very active and relevant buyers for UK business.

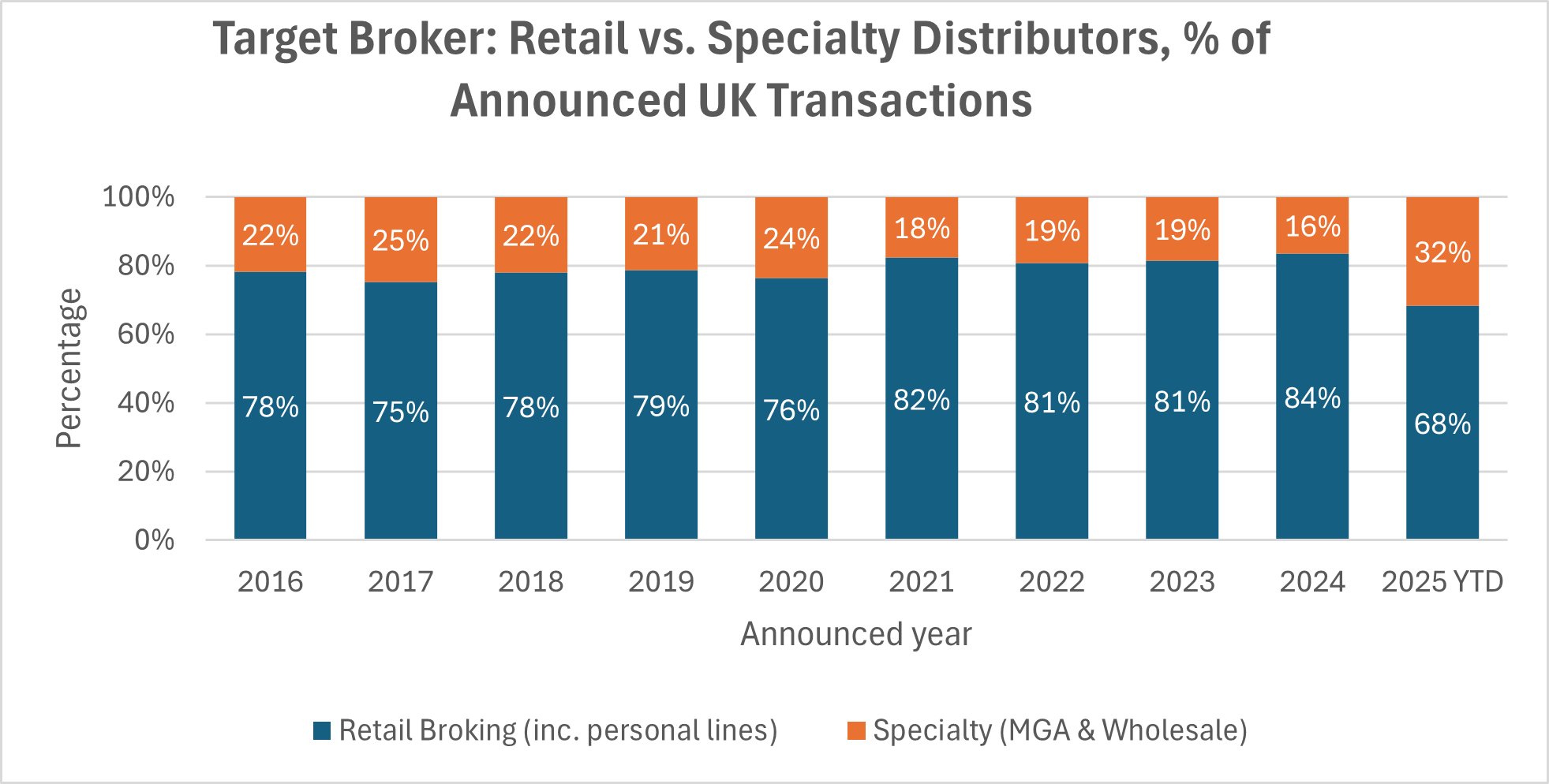

Year-to-date there have been six transactions involving specialty businesses (MGAs and wholesale broking, including Lloyd’s brokers), which is proportionally well ahead of the longer-term average, although as the year progresses this may well move back towards the longer-term average. What is very clear however is the continuing level of interest in these businesses, from both domestic broking groups, dedicated MGA groups, and particularly from overseas buyers. This international interest is not limited to the U.S. MarshBerry is currently acting as a sell-side adviser for five separate specialty businesses in the UK, in processes that are all at a relatively advanced stage. There’s been no let-up in demand, including from a number of parties that, should they complete, will be new entrants to the UK.

Notable transactions (March 2025):

- Berry Palmer & Lyle (BPL), the leading credit and political risk broker, announced a new minority investment from Preservation Capital Partners (PCP), a specialist financial services investor that has also backed Optio and BMS in the UK.

- Seventeen Group, which includes the James Hallam retail business and was one of the most active acquirers in the UK in 2024, announced that it had received a minority investment from European mid-market PE firm IK Partners.

- PIB Group announced its second UK deal in as many months with the acquisition of Litica, a market-leading litigation insurance MGA and Lloyd’s coverholder, which has grown rapidly including across several international markets

Other transactions (March 2025):

- Specialist Risk Group announced its first UK deal of 2025 by acquiring Brentacre Insurance, a specialist broker focused on insurance for modified and performance vehicles.

- Ardonagh Advisory announced the acquisition of Anderson & Co., a long-established broker and Aviva Club 110 member based in Blackpool. MarshBerry advised Anderson & Co. on the transaction.

- The Broker Investment Group (TBIG) backed BEAM Insurance Solutions acquired KDH Insurance Brokers, a £4m gross written premiums (GWP) broker in Shropshire.

- Benefact-owned charities insurance specialist Access Insurance acquired Ladbrook Insurance, another charities focused broker, based in Derbyshire.

- Howden, via its Howden Scotland business (formerly Bruce Stevenson) acquired SKB Independent Insurance Brokers in Edinburgh.

- Brown & Brown (Europe) acquired Premier Commercial (PremCo), an MGA and Lloyd’s coverholder with a construction specialisation, based in Edinburgh.

If you have questions about Today’s ViewPoint, or would like to learn more about how MarshBerry can help your firm determine its path forward, please email or call John Nisbet, Managing Director, at +44 (0)20 7444 4398.