As we move towards the summer and an upcoming election, there has been very little slowdown in UK insurance merger and acquisition (M&A) activity, which on a year-to-date (YTD) basis is moderately behind the same period in 2023, but still above the longer-term average. Investment M&A activity saw less activity than expected.

There were 12 new UK insurance deals to report on during May, involving seven separate buyers. What has been striking about the month of May is the number of larger deals announced. At the beginning of the month there had been no UK sector deals above £100m in 2024. Now there have been three. (See ‘notable transactions’ below.)

Since 2016 the number of £100m+ transactions has averaged 5.4 per year. With several other large UK brokers currently either ‘in play’ or rumored to be coming to market in 2024, there will likely be more this year. The sellers of these businesses will mainly be private equity (PE) firms. The more interesting question is whether the buyers of these targets will be PE firms or trade/strategic.

The upcoming UK election has again raised the prospect of an increase in the current level of capital gains tax. When an increase has been floated in the past it has proven to be a catalyst for some private sellers, most notably in 2021. It will be interesting to see whether the same phenomenon occurs in 2024 – and given the long lead time required to sell a business whether owners can beat a potential increase.

Insurance M&A market update

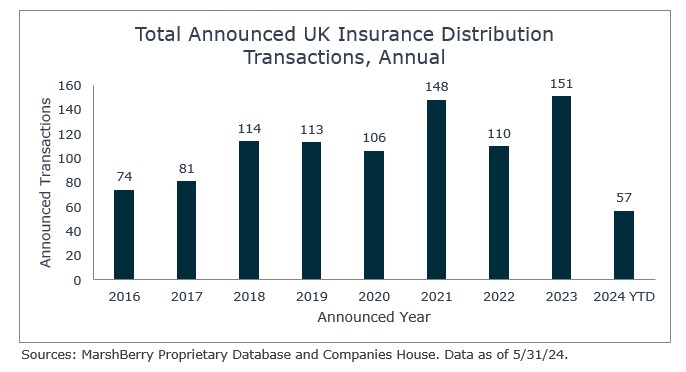

Through the end of May 2024, there have been 57 announced insurance distribution M&A transactions in the UK. During the same period last year, the figure was 65 – a 12% decrease year over year. But 2023 was a record year (see Demand And Supply, our annual UK sector report) and 2024 is still tracking be a very active year.

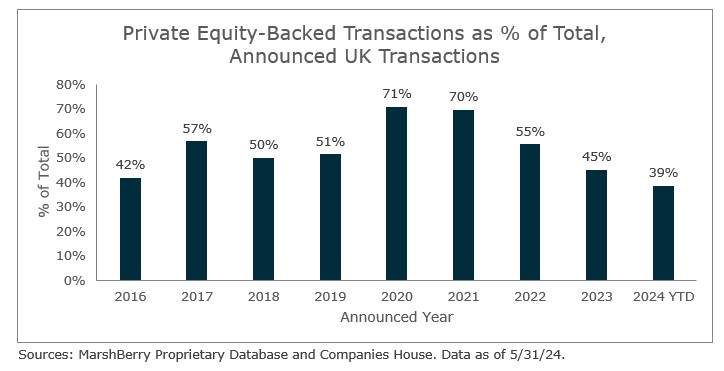

Private Equity and PE-backed buyers have accounted for 22 (or 39%) of the transactions in 2024. This is a decrease from previous years and suggests a continuing fall in private capital participation in UK sector consolidation. This reflects the fact that many of the most active buyers in the UK are now overseas-owned (e.g., Brown & Brown), and that some of the most historically active PE-backed domestic consolidators are now more focused on international growth.

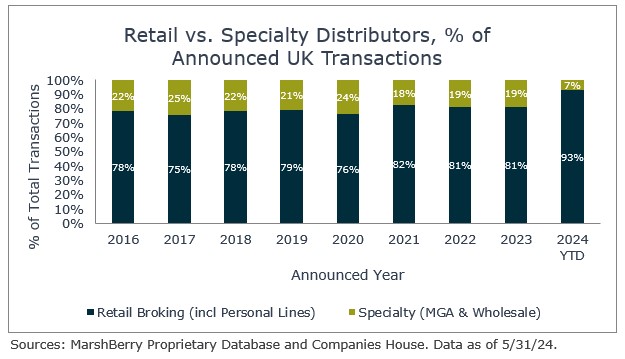

Deals involving specialty distributors (which MarshBerry defines as MGAs and wholesale brokers, including Lloyd’s Brokers) have accounted for only four (or 7%) of the announced deals in 2024 so far, a sharp decrease from the ~20% share they have accounted for historically. This may be a statistical blip that corrects as the year continues, but it is notable that following a record year for M&A involving UK MGAs in 2023 (23 announced deals) that there has been almost no M&A activity in 2024.

Notable transactions (May 2024):

- Although strictly an Australian deal, the announcement that Ardonagh has agreed to acquire ASX-listed PSC Insurance for A2.3bn has major implications for the UK, where PSC has been a frequent acquirer and is a top 50 broker, employing more than 300 staff across its owned businesses, which include Paragon and Carroll & Partners.

- In the largest PE transaction of the year so far, Warburg Pincus and Temasek agreed to acquire Specialist Risk Group (SRG), the owner of Miles Smith, from U.S. PE firm HGGC, in a deal worth more than £1bn. SRG is a top 50 broker employing more than 600 staff and placing more than £1bn of premium.

- U.S. firm NSM Insurance, which already owns several UK businesses including Kingsbridge and First Underwriting, announced that it had agreed to acquire travel specialist InsurEVO from PE investor Synova. InsurEVO owns the leading AllClear Travel Insurance and InsureandGo brands, which together have more than 3 million customers.

Other transactions:

- Acrisure announced the acquisition of WHR McCartney in Scotland, Financial and Credit Insurance in Kent, and Global Broking Solutions in East Sussex.

- JMG Group acquired Hamilton Robertson Insurance Brokers in Scotland and SIA Insurance (including its Evergreen Insurance Services subsidiary) in Surrey.

- Brown & Brown (Europe) acquired BNF Insurance Services in Essex and Garratts Insurance Brokers Limited in Preston.

- The Broker Investment Group increased its investment in Pumawell (trading as Hathaway & Cope) to 75%; and has taken a minority 49% stake in Deva Risk Group, the owner of Daulby Read in Chester.

Investment M&A market update

May 2024 saw less M&A activity in the investment sector than anticipated. Notably, PE-backed MKC Wealth made two acquisitions, by purchasing Dartford-based Gibson Lamb and Macclesfield-based Mulberry Financial. The founders of both businesses have decided to exit the investment industry, prompting MKC’s financial planners to assume client support responsibilities following a transition period.

Other transactions:

- Canaccord Genuity Wealth Management announced the acquisition of Cambridge-based financial planner Cantab Asset Management, adding £900m in assets under management (AUM). The deal is expected to be finalised by September 30, 2024.

- Palatine private equity portfolio company My Pension Expert acquired the advice firm Tenet&You, which previously operated as an appointed representative of the Tenet Group. This acquisition adds £490min assets under administration to My Pension Expert, taking its total client assets to around £1bn.

- Advanta Solutions made its eighth acquisition, London-based IFA Penney, Ruddy & Winter, adding £240m to its AUM.

- Investment bank, Zeus Capital, purchased the capital markets division of wealth manager WH Ireland. The deal is anticipated to close by mid-July, with only £1 of the £5m total consideration being paid upfront, with the remainder contingent on performance.

- MWA Financial acquired Kent-based Knighthood Financial Advice, adding £100m in AUM to the group. The transaction marks MWA’s first significant acquisition fully funded by private equity firm Coniston Capital.

- Titan Wealth announced the acquisition of Wigmore Associates Wealth Management, a London-based investment boutique, increasing its AUM to over £17.4bn. This follows Titan’s acquisition of Loveday & Partners in April.

- Bowmore Wealth Group propelled its assets under advice beyond £400m with the acquisition of Independent Financial Strategies, a North Oxfordshire-based IFA.

- AFH Financial Group announced the acquisition of Berkshire-based A&J Wealth Management. Following the transaction, the firm will be rebranded to AFH Wealth Management Cookham.

MarshBerry remains resolutely focused on providing our clients with access to the fullest range of options, ensuring the best fit – and typically the best price – if and when they come to sell. Talking about these issues is always valuable, whether you plan to sell now, or in the years to come.