Handing over your company to a strong external buyer can be a good decision aligned with your company’s lifecycle. However, when the time comes to transfer ownership, many sellers, feeling a sense of satisfaction and certainty upon receiving concrete interest from a potential buyer, tend to accept the first offer that comes their way. This feeling is even stronger when the offer aligns with or surpasses their expectations of the business’s value. One key reason sellers frequently accept the first offer lies in the concept of cognitive bias. The inclination to “trust your gut” is a common heuristic shaped by personal experiences and instincts. While this approach may feel natural, it doesn’t always lead to the best outcomes.

Keep all options on the table

In a business sale, buyers generally fall into two categories: strategic and financial. The insurance distribution market is currently dominated by strategic buyers—larger brokers, often backed by private equity (PE), actively seeking to acquire smaller firms. In most cases, your first offer will likely come from a well-known strategic buyer in your region. While each strategic buyer has its own unique approach, they all share a common focus: integrating your business into their existing operations to achieve synergies and accelerate growth. Strategic buyers can be domestic or international, operating in either horizontal or vertical markets, and often differ in their cultures, strategies, and operational or financial goals. While some strategic buyers implement significant changes from day one, others prioritize preserving the entrepreneurial spirit and granting as much autonomy as possible.

Financial buyers typically do not operate insurance brokerages themselves and instead view acquiring a company as an investment opportunity. Financial buyers are usually PE firms, family offices or venture capital firms. Historically, these buyers have targeted large corporations, but growing competition has shifted their focus to smaller market segments, increasing demand for broker businesses with revenues starting at € 3 to 5 million, depending on the entrepreneurial spirit of the seller, the territory and portfolio characteristics. Unlike strategic buyers, financial buyers aim to enhance the standalone value of your business and often provide better opportunities to retain management or equity. Unfortunately, many insurance brokers overlook financial buyers, mistakenly assuming their company is too small or lacking the necessary network to connect with this buyer segment.

It is important to keep all options on the table when selling your company. Evaluate different types of buyers, both strategic and financial, and explore a range of transaction structures. These could include a partial sale to your management team or key employees, selling a minority equity stake, partial recapitalization, leveraging debt or share redemption to extract capital from the business, or structuring appealing earn-out arrangements. A well-executed sales process thrives on creativity and innovative thinking, often uncovering unexpected opportunities and delivering outcomes beyond initial expectations.

The broker formation alternative

An often-overlooked alternative in business sales is the concept of broker formation. Many insurance brokerage owners focus solely on their individual situations, unaware that peers in their region or insurance vertical often face similar challenges. By coming together and pooling resources, brokers can create a stronger, more competitive group that not only enhances their market position but also becomes a highly attractive investment opportunity.

Many of the major broker platforms originated from the broker formation processes. For instance, The Ardonagh Group was established in 2017 following a two-year broker formation initiative and now ranks as the sixth-largest insurance broker in the European market. Similarly, both the PIB Group and Markerstudy share comparable origins.

In a broker formation, the firm will integrate their business into a larger entity, fostering collaboration and shared growth. Instead of selling the company outright, owners exchange ownership for shares in a newly formed broker platform. This approach allows firms to remain actively involved as entrepreneurs while benefiting from being part of a larger, more robust organization. Typically, a financial buyer (sponsor) is introduced to provide investment capital, enabling the new company to innovate and acquire additional brokers, fueling further growth.

Download the 2025 Market Report Insurance Distribution in Europe and learn more about the latest trends & developments in the industry, exclusive insights into the Top 20 largest European brokers and get answers to other key questions shaping the future of insurance broking.

MarshBerry is often asked by potential clients “Why do I need an M&A advisor or investment bank to help me sell my business?” After all, acquirers often put a lot of effort into direct negotiations with prospective sellers, citing the savings they will see by handling deals on a one-to-one basis. This might be true, but hard to quantify, considering other factors such as final terms of the agreement and how maximum value is determined. This also doesn’t consider overall cultural fit of the two firms.

A recent client engagement might help answer this question in a better way. MarshBerry was engaged by a client after they were close to signing an agreement with a potential acquirer, only to see it fall through due to a technical issue. The company felt let down by the deal and process – but were recommended to MarshBerry by their lawyer.

MarshBerry produced a short information memorandum about the seller’s business and sent it to a very select list of alternative buyers that felt like a good fit for the client. This list included the original acquirer.

Shortly after the memo went out – that original acquirer phoned and offered a 23% increase over their original offer, on the condition that the business would come off the market.

There is an acute shortage of quality businesses to acquire – and pricing reflects that scarcity. Active buyers in this industry often say that the firms MarshBerry represents are invariably of higher quality than what they generally see. One of the reasons for that? Quality businesses recognise the value of their own advice to clients – utilizing the expertise of a specialist advisor like MarshBerry, when selling their business.

For acquirers – seeing MarshBerry across the table may not always be the best news. At a minimum, it signals that the seller is serious and can’t be taken advantage of, and they will need to pay fair market price or better. But it also means that the deal will ultimately get done.

Benefits of working with an advisor

There’s no argument that many owners could (and do) sell their business on their own. After all, owners know their business the best and are experienced advisors themselves. But for many, this may be the first time (and only time) they will go through this type of transaction. Working with an experienced M&A advisor gives a seller the best chance for finding the right partner and achieving the maximum value for their company.

In addition to “best fit” and “maximum value” there are other ways the right advisor can enhance the selling process for a client. A lot of the process involves stressful or time-consuming tasks, like analysing detailed financial reports, creating timelines, firming deadlines, or pushing back on perceived unfair offers or transaction terms outlined in the Letter of Intent (LOI). LOIs can be complicated and nuanced, and it is not advisable to sign one without an advisor involved.

Perhaps the most critical aspect of having an experienced advisor comes during the due diligence stage which can expose potential pitfalls (i.e., culture clashes, HR issues, strategic misalignment, pro-forma disagreements), saving time down the road and avoiding a potential bad deal.

The right advisor will remove the stress and uncertainty and ensure the process runs smoothly and professionally, while increasing the likelihood of closing the transaction in a timely manner.

Business owners have worked hard, making many important decisions to build and grow their company. This often leads up to making perhaps the most important financial decision of their life – a decision that might only be made once. Owners hire experts all the time to help them with much more low stakes decisions. Why would anyone go it alone for the most important one?

For the latest insights and analysis into the UK insurance distribution landscape and industry trends – download MarshBerry’s Insurance Distribution Market Report – UK.

Looking for the latest analysis and insights into the UK investment sector and key industry trends? Download MarshBerry’s Investment Market Report – UK.

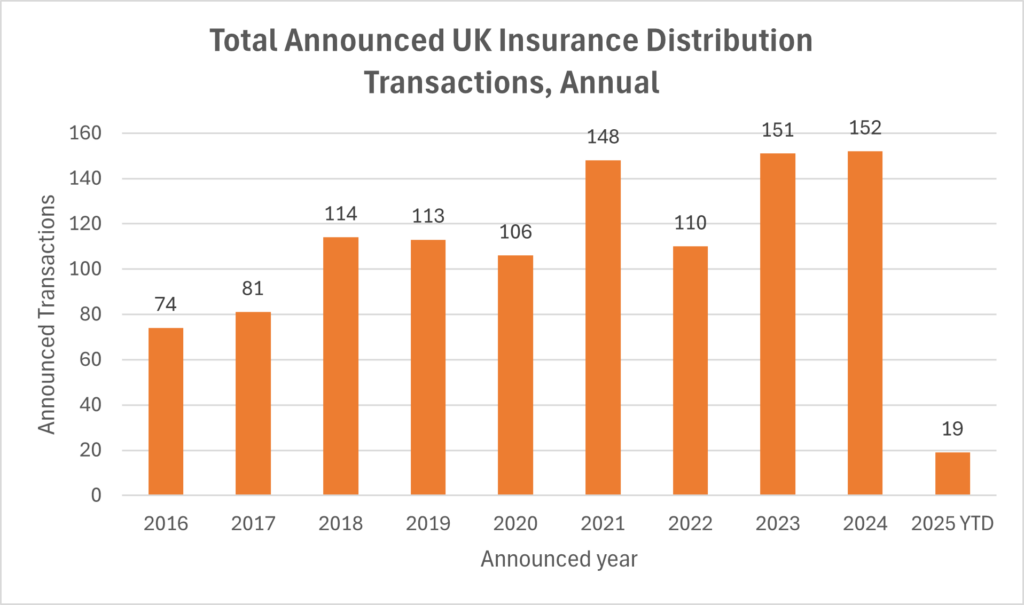

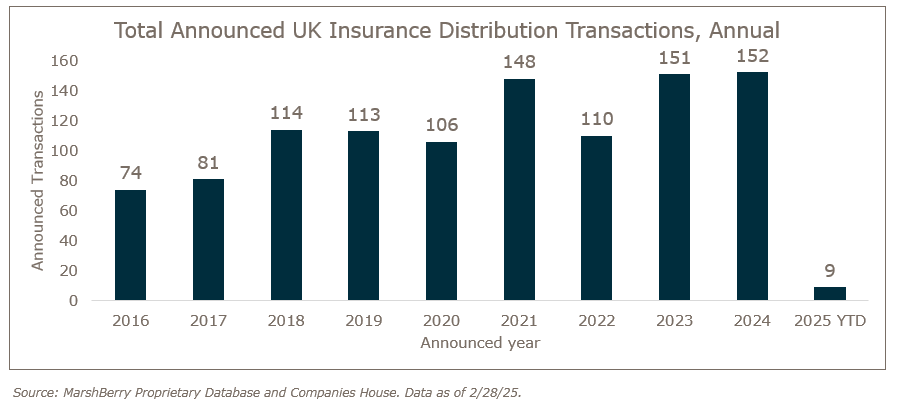

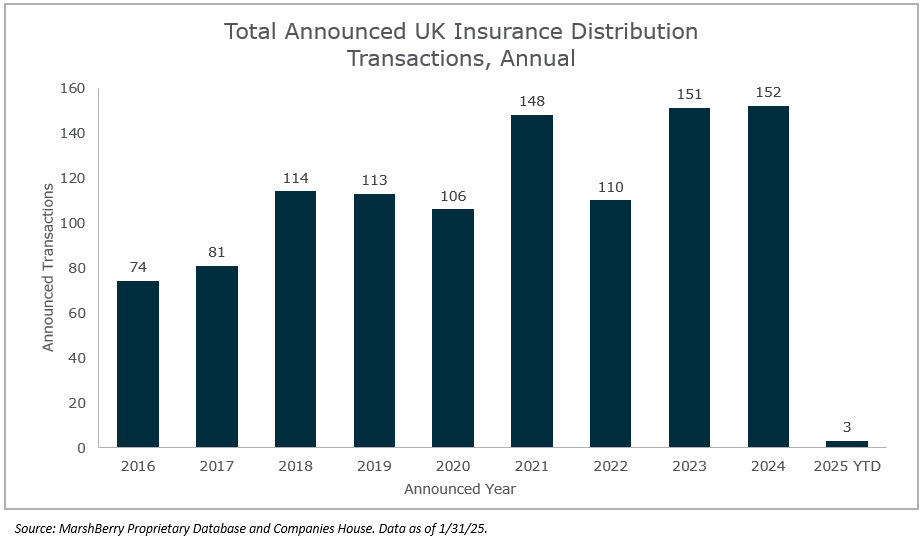

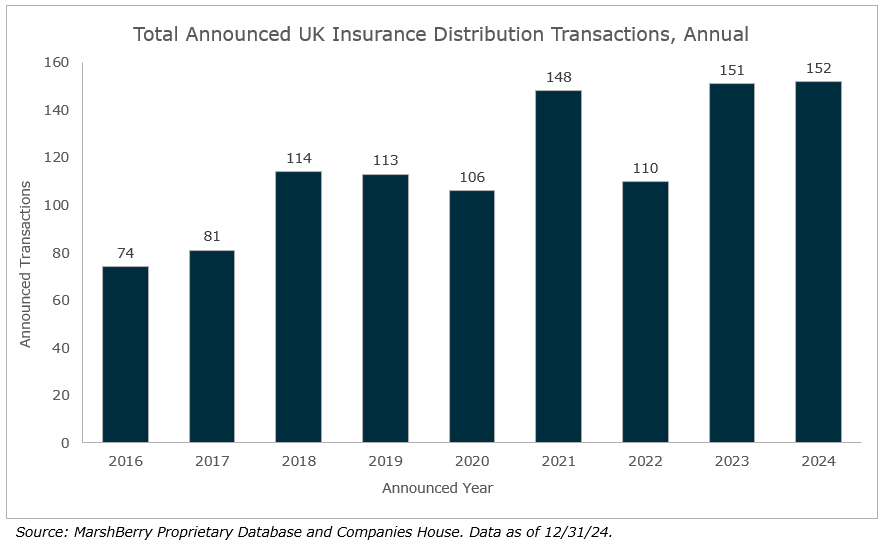

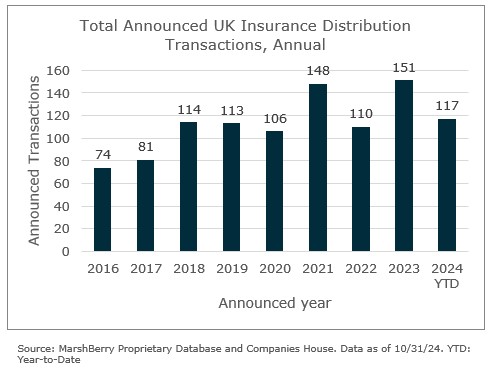

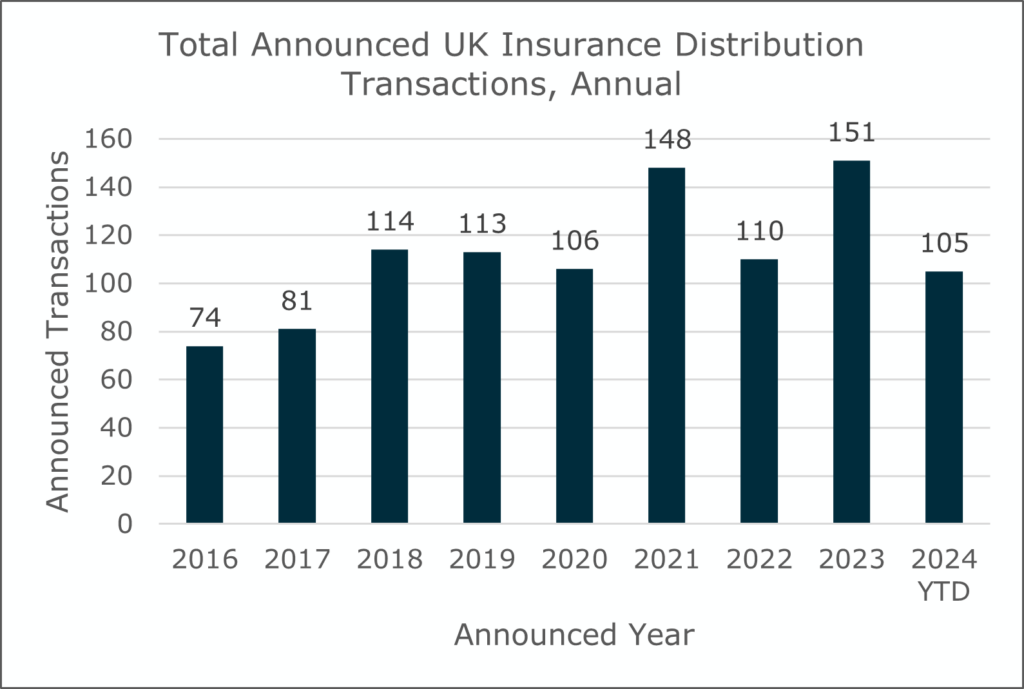

March saw nine new announced transactions involving a UK insurance distribution target, including two high profile new deals, making it a busier month for mergers and acquisitions (M&A) than January or February, but activity levels are still running well below average. Q1 2025 ended with a total of only 19 sector transactions, the lowest since Q2 2020 (remember what was happening then?) and well below the five-year quarterly average of 32. It is now very unlikely that sector deal volumes for 2025 will reach the record levels of 150+ transactions seen in both 2023 and 2024.

M&A Market Update

MarshBerry has previously noted that the unusually busy Q4 2024 for sector deal activity, which had been partly precipitated by the widely trailed increase in Capital Gains Tax in October, may have brought forward some transactions that might have otherwise happened in 2025. Figures for the first quarter of the year appear to bear this out, with only 19 announced transactions on a year-to-date (YTD) basis, which is exactly half the figure seen in Q1 2024 (38).

It would be premature however to suggest that 2025 will be doom and gloom for M&A. There were nine new deals in March, and the first few days of April have seen another clutch of announced transactions. Buyer appetite certainly has not disappeared, and March saw serial acquirers including Specialist Risk Group, Ardonagh, Brown & Brown (Europe) and The Broker Investment Group all open their accounts for 2025 with new UK deals.

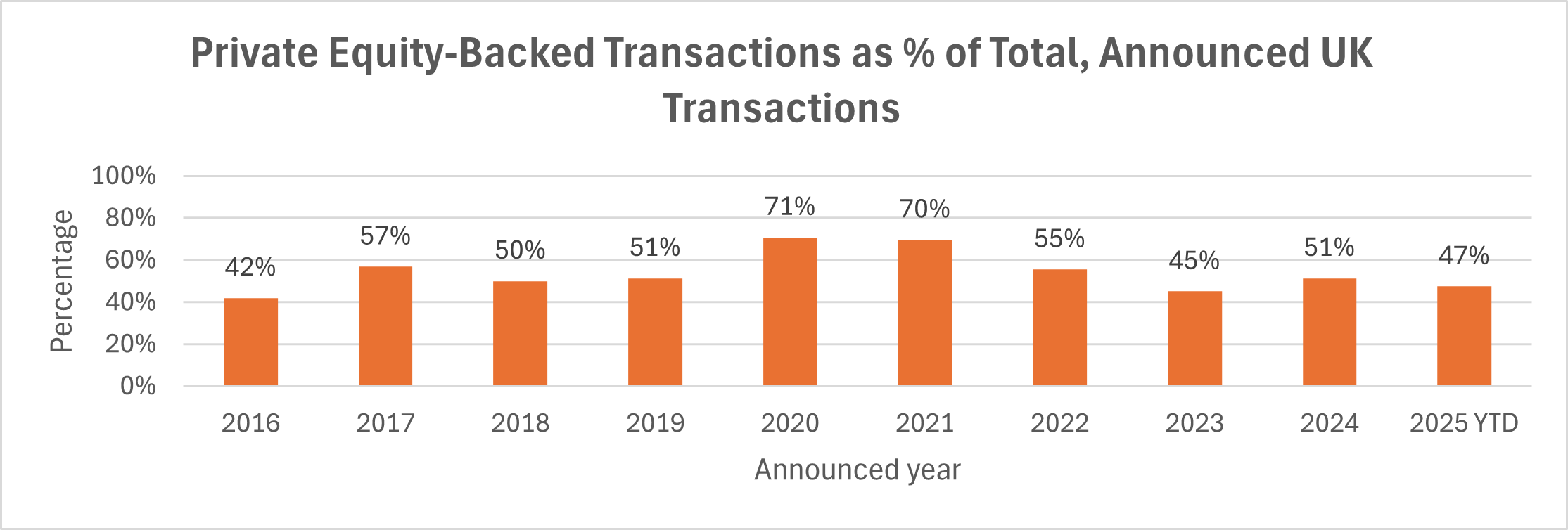

Notably, there were also two new private equity (PE) transactions announced in March, involving two of the largest remaining independent players in the sector, demonstrating that PE, the principal driver behind industry consolidation over many years, remains highly active. Both deals also serve to remind that even the firms that most vehemently insist that they are not for sale will have succession questions to address at some point, which in more cases than not result in a transaction involving third party capital.

Both PE transactions involved the sale of a minority interest, with credit and political risk specialist Berry, Palmer & Lyle (BPL) partnering with Preservation Capital (which is already invested in both BMS and Optio), and Seventeen Group announcing a new investment from IK Partners. Both BPL and Seventeen Group are constituents of the MarshBerry/Insurance Times Top 50 UK Brokers 2024.

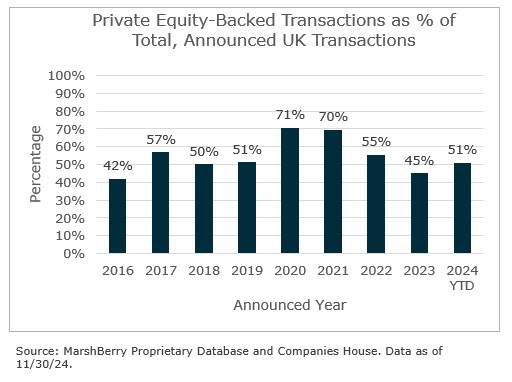

It may be too early in the year to start trying to divine trends, and 19 deals is statistically very little to go on, but PE and PE-backed transactions have accounted for just under half (47%) of all YTD deal activity, broadly in line with the last few years. And two of the biggest PE-backed consolidators in the UK, Howden and PIB Group, have already announced more than one UK transaction in 2025, demonstrating that while their M&A focus may have shifted to overseas markets, they are both still very active and relevant buyers for UK business.

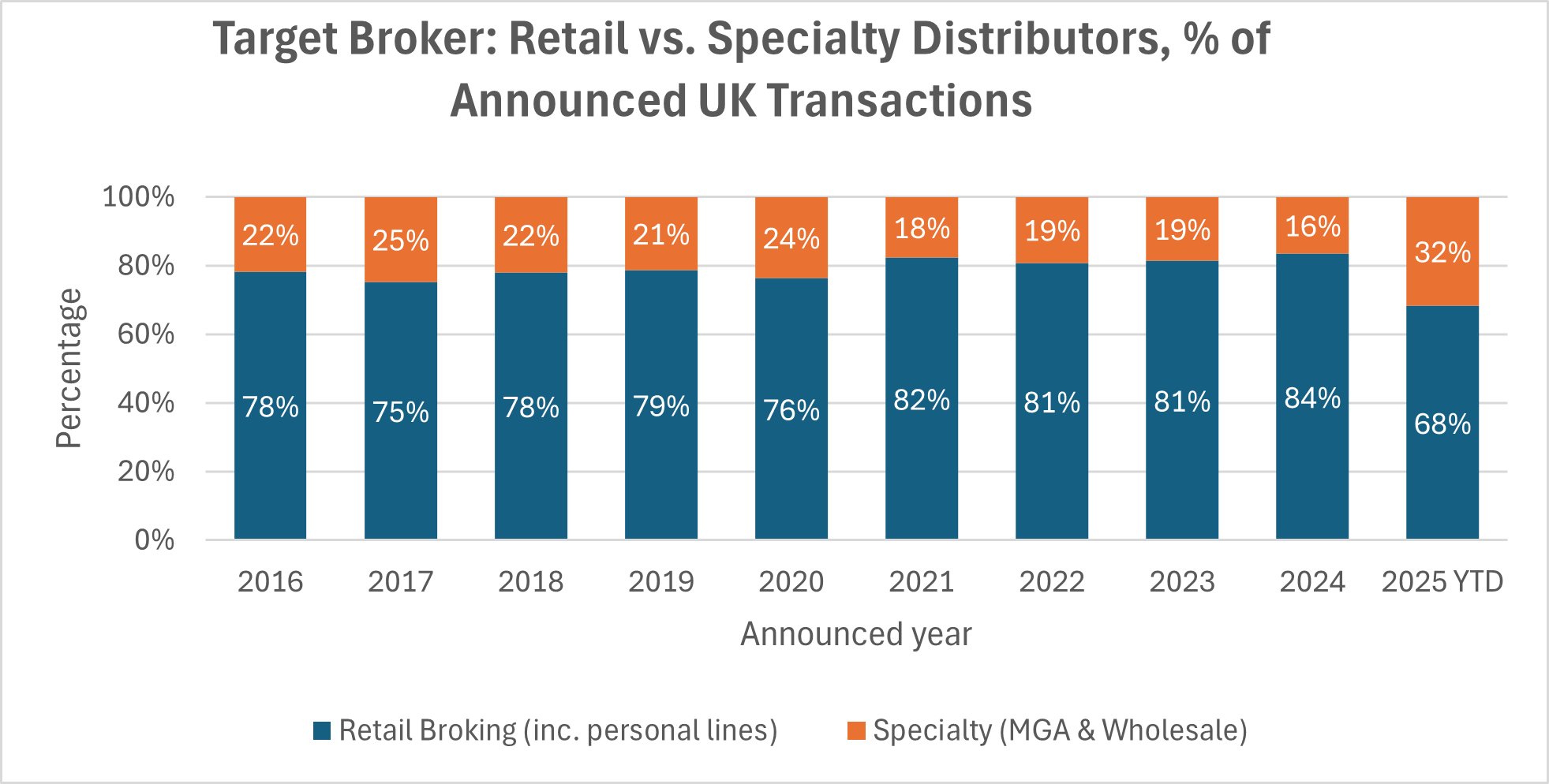

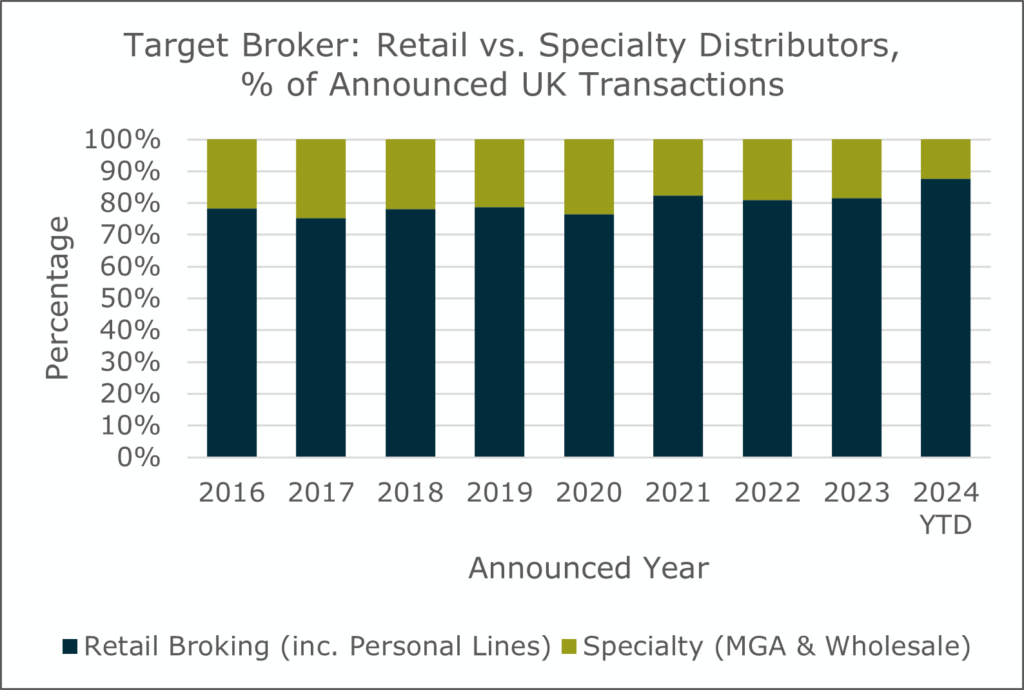

Year-to-date there have been six transactions involving specialty businesses (MGAs and wholesale broking, including Lloyd’s brokers), which is proportionally well ahead of the longer-term average, although as the year progresses this may well move back towards the longer-term average. What is very clear however is the continuing level of interest in these businesses, from both domestic broking groups, dedicated MGA groups, and particularly from overseas buyers. This international interest is not limited to the U.S. MarshBerry is currently acting as a sell-side adviser for five separate specialty businesses in the UK, in processes that are all at a relatively advanced stage. There’s been no let-up in demand, including from a number of parties that, should they complete, will be new entrants to the UK.

Notable transactions (March 2025):

- Berry Palmer & Lyle (BPL), the leading credit and political risk broker, announced a new minority investment from Preservation Capital Partners (PCP), a specialist financial services investor that has also backed Optio and BMS in the UK.

- Seventeen Group, which includes the James Hallam retail business and was one of the most active acquirers in the UK in 2024, announced that it had received a minority investment from European mid-market PE firm IK Partners.

- PIB Group announced its second UK deal in as many months with the acquisition of Litica, a market-leading litigation insurance MGA and Lloyd’s coverholder, which has grown rapidly including across several international markets

Other transactions (March 2025):

- Specialist Risk Group announced its first UK deal of 2025 by acquiring Brentacre Insurance, a specialist broker focused on insurance for modified and performance vehicles.

- Ardonagh Advisory announced the acquisition of Anderson & Co., a long-established broker and Aviva Club 110 member based in Blackpool. MarshBerry advised Anderson & Co. on the transaction.

- The Broker Investment Group (TBIG) backed BEAM Insurance Solutions acquired KDH Insurance Brokers, a £4m gross written premiums (GWP) broker in Shropshire.

- Benefact-owned charities insurance specialist Access Insurance acquired Ladbrook Insurance, another charities focused broker, based in Derbyshire.

- Howden, via its Howden Scotland business (formerly Bruce Stevenson) acquired SKB Independent Insurance Brokers in Edinburgh.

- Brown & Brown (Europe) acquired Premier Commercial (PremCo), an MGA and Lloyd’s coverholder with a construction specialisation, based in Edinburgh.

If you have questions about Today’s ViewPoint, or would like to learn more about how MarshBerry can help your firm determine its path forward, please email or call John Nisbet, Managing Director, at +44 (0)20 7444 4398.

While many insurance broking owners want to commit to remaining independent, the current environment of high valuations and heavy consolidation has made internal perpetuation less of a priority for firms.

For decades, insurance brokers have often been family-run businesses, passed down through generations. Children frequently followed in their parents’ footsteps, taking over the firm and maintaining its independent status. This tradition fostered a sense of continuity, trust, and personalized service that resonated with clients. However, in today’s environment of high valuations, is the next generation still prepared—or even able—to step into the role of ownership?

For many insurance broking owners, there is still pride in proclaiming that their business will remain independent by perpetuating to the “next generation”—whether that be family or other trusted leaders of the business. But more often than not, this prideful proclamation has become a hollow promise. In the current environment of high valuations and heavy consolidation, the topic of internal perpetuation, or how to remain independent, has become less and less of a priority for firms. The valuations offered by strategic buyers and investors are simply too enticing to pass up, making it nearly impossible for internal buyers to compete.

A looming gap in valuation

The discrepancy between external and internal value is often referred to as the valuation gap. The gap between what a firm might be valued if sold internally versus what it might fetch if sold externally can be upwards of 50-100% more. Why would a business be valued at a significantly higher price for an external buyer than for someone who’s been working inside for years and wants to become the owner?

There are a countless number of variables that figure into what a buyer will pay for a business. And there are different variables involved in determining the value for these two audiences. In an internal plan, there is only one buyer—the internal stakeholder; in external sales, there are, in most cases, multiple potential buyers. The law of supply and demand simply drives up the sales price when there are multiple buyers. Primarily, the difference in value lies in the level of profitability and the multiple that a buyer can, or is willing to, pay. At its most basic, an external buyer may simply have strategic motivation for paying more, have better access to capital and be able to afford to pay a higher multiple on the profit. Internal buyers have a smaller strategic horizon, may not have the ability to pay more or may need cash flow to finance the debt that enabled the transaction.

Actions speak louder than words

For private owners of insurance broking firms, the transfer of ownership is an inevitable part of the business lifecycle. The harsh reality is that most firms have not made the commitment or necessary preparations to sustain continued independence, in part because such preparations often get pushed aside or delayed for other priorities. An owner can’t wake up one morning and confidently decide to retire and hand over the reins to family members, or ask senior leaders to buy them out, without a plan.

The reality is that every business owner will eventually need to transfer ownership of their business. It’s not a matter of if—it’s a matter of when. Planning for the long-term sustainability and perpetuation of a business should be viewed as a continuous process with neither a beginning nor an end. Private owners need to have strategies around the most important ingredient—people. They need to create training and mentorship programs, and retain top employees, either family or seniors, through staged ownership opportunities.

In a MarshBerry study, firms were asked if they believed their next generation of leaders were capable of taking over the firm. An overwhelming majority (79%) stated “yes.” However, when asked if they offered an ownership strategy to top employees, an equally overwhelming majority (77%) said “no.” So, even though most owners wish to preserve their company’s independent status and believe they can, many fail to take proactive steps to achieve it—or simply start too late.

Does this mean the independent broker model is going extinct?

In today’s market, it’s entirely understandable that many owners opt for capital-strong external buyers during a transition, especially when the valuation gap with internal succession—if it’s even an option—is significant. Passing on your business to a capital-strong external buyer with investment opportunities can be an excellent choice, one that also benefits both employees and clients.

It’s undeniable that the private ownership model for insurance brokers across Europe is therefore on the decline. A significant number of European insurance broking owners are part of the baby boomer generation, at or nearing the inevitable transition of ownership. Many of them have no internal perpetuation plan in place or simply started thinking about it too late. According to MarshBerry benchmark data, the weighted average age for insurance broking owners across Europe is 54 years.

The independent broking model is far from extinct. MarshBerry works with many clients who remain firmly committed to internal perpetuation. Moreover, across Europe, we are seeing a significant rise in new entrepreneurs starting broker businesses. Younger and newly established brokers are leading the way by adopting shared ownership structures, such as Employee Stock Ownership Plans (ESOPs), right from the start. These firms view succession planning not as a one-time event but as an ongoing process—one designed to build legacy-focused business models that ensure independence and sustainability for generations to come.

Download the 2025 Market Report Insurance Distribution in Europe and read about the latest trends and developments in the industry, exclusive insights into the Top 20 largest European brokers and answers to other key questions shaping the future of insurance broking.

February 2025 UK Insurance Distribution M&A Market Update:

We are now two months into 2025 and the sluggish start to insurance sector merger and acquisition (M&A) activity in January has continued through February. Two months is not a long time in M&A and it is still too early to conclude that this marks any slowdown in overall activity, but if 2025 is to get close to the record level of transaction activity seen in 2024 then there will have to be a marked uptick in the flow of new transactions within the next month or two.

M&A Market Update

In last month’s M&A market update MarshBerry remarked that the low transaction volume could well just be a ‘blip.’ If that was the case, then February is either another blip, or perhaps an early sign that sector M&A activity could slow down in 2025.

Year-to-date there have been only nine UK transactions announced involving an insurance distribution business. At the same point last year there were 23 deals. Since 2016 the monthly average has been 9.6 making the five new deals announced in February another low figure. So, what is going on?

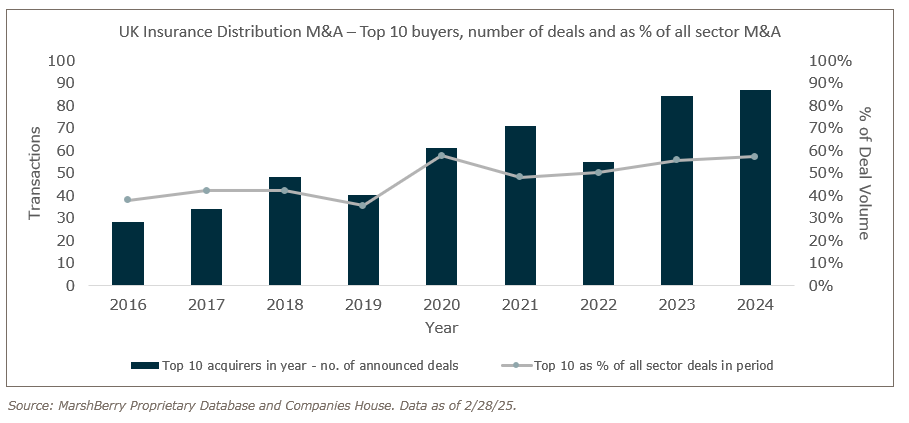

Perhaps some of the most active buyers are focusing on integrating their recent acquisitions or are turning their attention to pursuing deals in other jurisdictions. In any given year, a large proportion of all sector deal activity is driven by a relatively small number of very active buyers, who have the infrastructure and skillset to undertake multiple acquisitions in parallel. More often than not these firms are private equity-backed. In 2024 the ten most active buyers accounted for around 60% of all UK deals, or 55 transactions between them (see also The Next Chapter – MarshBerry’s Annual Insurance Distribution Market Report UK – 2024). Perhaps tellingly, only one of those firms (Howden, #10) has announced a new UK deal in 2025, and none of the top five have. (Although two of them have already announced new deals in Europe.)

It is much too early to conclude that sector M&A activity is slowing down. The key drivers that have driven the high levels of sector consolidation that has characterised the past 10+ years have not gone away. In recent conversations with several active buyers, they have been keen to point out that their pipelines are busy and their appetite for acquisitions is undimmed. The next few months could well see a flurry of new deals announced. And of course, the number of deals alone is not the whole story when it comes to sector M&A. Deal sizes matter too, and February did see one substantial deal in the Lloyd’s broking sector, with Miller’s widely publicised acquisition of AHJ.

The current tax year will end on 5 April 2025. The new tax year beginning on 6 April sees several changes taking effect that will affect brokers. The main rate of Capital Gains Tax of course increased last October, from 20% to 24%, and is the key tax for sellers of a business. But linked to this was an increase in Business Asset Disposal Relief, from 10% to 14%. This was announced in October but is only effective from 6 April 2025. There is a lifetime allowance of £1 million for this relief, so it has a maximum value of £40,000 to any individual seller (a broker with several shareholders could have several) – probably not enough to act as a catalyst for many vendors to race to complete a transaction before the end of the tax year, particularly when in doing so they would be bringing forward the date on which they had to pay the actual tax by a year. Arguably more relevant for owners of brokers will be the surprise increase in Employer’s National Insurance from 6 April, to 15%, which will have an immediate impact on staff costs, adding pressure to profitability and margins.

Notable transactions (February 2025):

- As noted above, specialist (re)insurance broker Miller announced its largest acquisition since returning to independence in 2021 with a deal for AHJ Holdings, the parent of Lloyd’s broker Alwen Hough Johnson and AHJ Europe, in a deal that adds 90 staff across London and Scandinavia.

- While PIB Group continues to grab headlines for its dealmaking across Europe, it demonstrated that it is still a buyer for specialist businesses in the UK with its acquisition of Residentsline, the well-known provider of flats and apartment insurance, based in Wolverhampton. MarshBerry advised Residentsline on the transaction.

- In yet another example of a relatively little-known (at least in the UK) U.S. buyer making an acquisition of a UK business, specialist parametric underwriter NormanMax acquired FloodFlash, an MGA providing parametric commercial flood insurance.

Other transactions (February 2025):

- Commercial broker Macbeth Group announced the acquisition of Insurance Services Surrey, increasing its gross written premiums (GWP) to £45 million.

- Howden announced that it had acquired aviation specialist Forbes Insurance in Leicester, as well as a book of business from Hill Aviation Services.

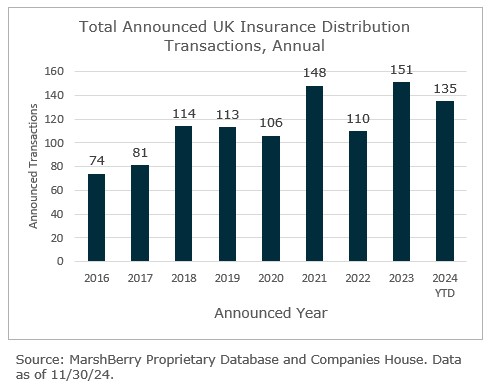

As the new year begins, MarshBerry resets its deal tracker to zero and starts the annual count all over again. Following 2024’s record of 152 total UK merger and acquisition (M&A) transactions and a busy Q4, the market had strong momentum going into January, but the year is off to a slow start. There were only three new deals announced in January, the lowest in any single month since 2017. One cannot read too much into any single month and this may well be a blip, but since 2016 the sector has seen an average of ten new deals a month, so this has been a very quiet start to the year. This also cannot all be ascribed to the ‘January effect’ – since 2016, 9.4% of all sector deals (1,000+) have been announced in January.

M&A Market Update

There are several reasons that January might be a slow month for M&A. Most transactions complete at or very near a month end, often being announced to the target firm’s staff at the same time. A number of UK buyers therefore try to avoid the end of December or first week in January and instead push their new deals out the end of January. However, historically January has not been a quiet month, with an average of 11 UK deals each January since 2016, so the three this month is unusually low.

UK deals also require the consent of the Financial Conduct Authority (FCA) for a change of control to complete and we have some anecdotal evidence (from transactions MarshBerry is currently advising on) that the timing for such approvals might have slowed down a bit recently, pushing back the announcement date of some otherwise agreed transactions.

This newsletter typically includes charts showing trends in year-to-date (YTD) M&A like the percentage of all deals involving a private equity buyer. But with only three deals so far in 2025, this Viewpoint instead looks at some statistics from MarshBerry’s soon-to-be-published UK Insurance Distribution Annual M&A Review for 2024, entitled The Next Chapter. This report, which MarshBerry produces annually, will analyse the UK sector M&A and market structure more broadly, and explore the prevailing trends and themes in UK sector M&A in much greater depth.

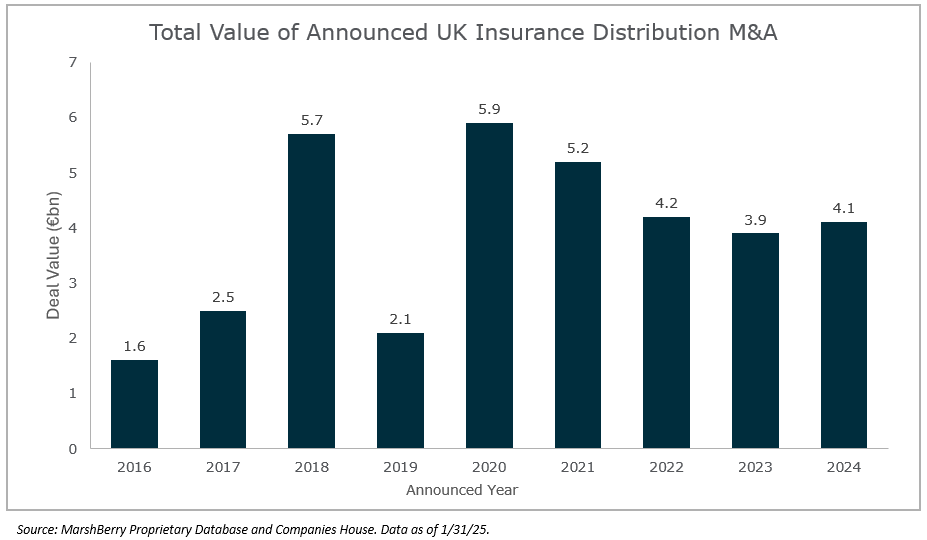

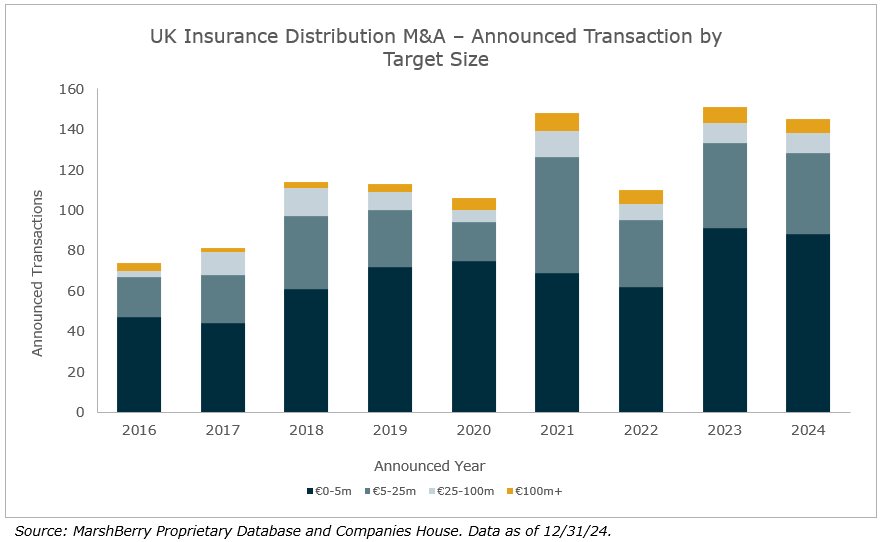

MarshBerry analyses every sector transaction in the UK, including looking closely at the headcount and reported financials of each target firm, to establish an estimated value of every deal where this is not announced. In 2024 the value of all announced deals was an estimated £4.1bn, just marginally up on the £3.9bn in 2023.

On the record deal count in 2024 of 152 (vs. 151 in 2023) meant that the average deal size was broadly consistent with the previous year, but below the longer-term average. Higher deal volumes are not translating to a higher total value of M&A transactions, as many domestic consolidators are undertaking a higher number of small deals than ever before to maintain their momentum as the number of medium-sized available acquisition targets diminishes. At the beginning of 2024 there were 659 separate UK insurance distribution groups reporting to employ ten or more staff. By the end of the year, as a result of sector M&A, this had reduced to only 604.

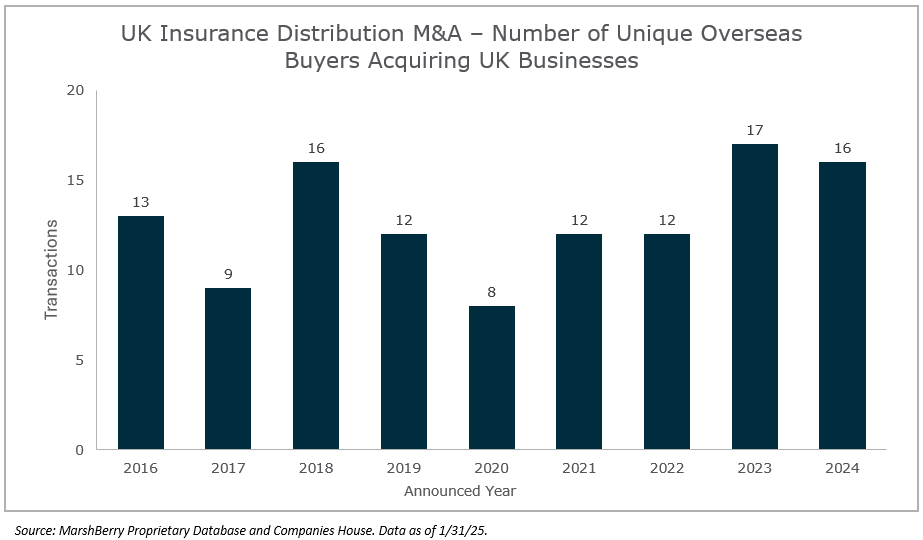

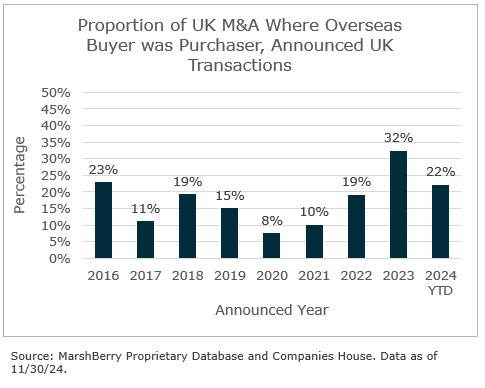

One of the new deals announced in January 2025 involved a U.S. buyer. Sector M&A has become more international. This is going in both directions – overseas buyers coming into the UK, but also UK buyers going overseas. In 2024 Specialist Risk Group was one of the top five most active buyers. In January the firm announced their biggest deal to date, but it was outside the UK – a partnership with Germany’s Ecclesia that will see them acquire that business’s Dutch and Belgian assets, with Ecclesia becoming a shareholder in SRG. In 2024, 20% of all UK sector M&A involved an overseas buyer, and 16 separate overseas buyers announced deals here.

Newly announced transactions (January 2025):

- Inflexion-backed Acorn Group acquired telematics personal lines broker MyPolicy (previously owned by Inflexion) from management.

- Adler Fairways acquired Buckinghamshire-based commercial broker Giles Insurance Consultants.

- US broker SIG Insurances Holdings acquired specialist sports & prize insurance MGA Hedgehog Risk.

2024 has come to a close, and as MarshBerry analyses detailed deal data ahead of the publication of our annual 2024 Insurance Distribution Market Report – UK in a few weeks’ time, the full year figures show a busy year for mergers and acquisitions (M&A). 2024’s deal volumes are almost identical to 2023 and set a new record for announced deals. However, the number of deals alone tells only part of the story. To really understand the impact of M&A on market structure it is necessary to look at who is buying and selling, the mix of businesses being acquired, and the size of deals. Taken together, this info presents a picture of an increasingly mature domestic consolidation and a more international M&A landscape where cross-border activity has become more common, involving both overseas buyers acquiring in the UK and UK buyers becoming more active in overseas markets.

M&A Market Update

Overall transaction volumes in 2024 finished almost exactly in line with last year, with a deal count of 152, one higher than last year’s 151 deals. This makes 2024 the most active year ever in the sector and while broadly in line with 2023 and 2021, it is substantially higher than the long-term average. There were only ten new deals to report on in December*, but Q4 – which contained the October budget with its increase in the main rate of Capital Gains Tax that many vendors had raced to beat – ended with 41 announced transactions, the second-most active quarter on record.

* Note: Eagle eyed readers may notice that the total of 152 deals is more than 10 higher than the 135 deals we had at 30 November 2024 in last month’s Viewpoint. This is because at the year-end we have undertaken a deep dive process that has identified several previously unreported deals, all of which were very small and not widely reported on at the time.

Of the ten newly announced deals in December, all were generally smaller in terms of both headcount and valuation, which has been a common feature in 2024, particularly in commercial broking. As MarshBerry has previously discussed, the average size of acquired targets in commercial broking has continued to trend downwards, as selected consolidators pursue a strategy of acquiring smaller targets (which are generally unadvised and less expensive) in higher volumes. There were more sub-£5m transactions in 2024 than in any other year. (Enterprise Value basis and based on MarshBerry estimates where consideration was not disclosed.)

The most significant deal in the month from a market structure point of view was actually a U.S. transaction, with implications for the UK – Arthur J Gallagher’s announced acquisition of AssuredPartners adds more than £100m in brokerage and c.850 staff in the UK. AssuredPartners is a top 50 UK broker and has been a reasonably active acquirer recently, having done more than a dozen deals over the past two years, including for several sizeable businesses. As with Aon’s acquisition of NFP earlier in 2024, it is an example of how consolidation out of the U.S., at the very top of the market, can reduce the number of in-market buyers (read: options for sellers) for the remaining medium to large targets in the UK.

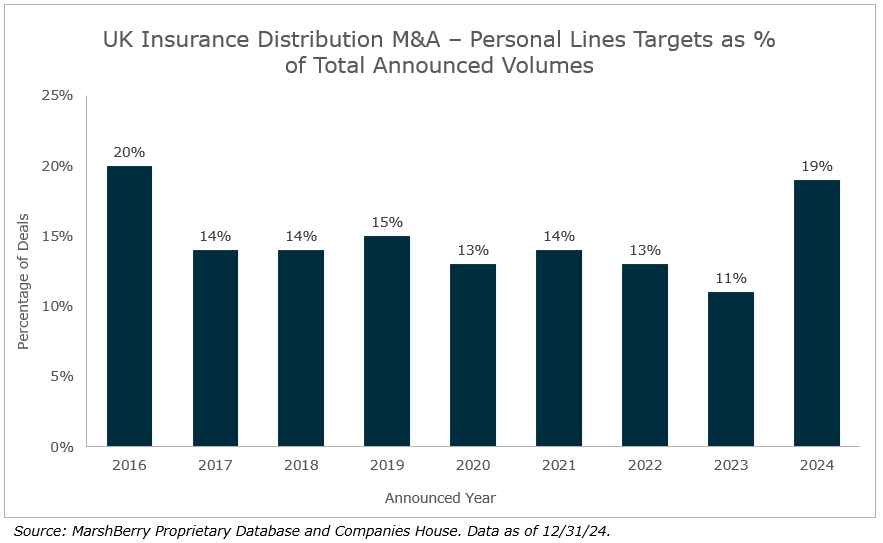

Two of the deals in December involved personal lines targets and an interesting feature of 2024 has been the jump in the proportion of deals in this segment. Over the year almost one in five deals was for a personal lines business. Furthermore, of the six new direct acquisitions of UK businesses by private equity in 2024, five involved personal lines targets (and the only one which didn’t, Specialist Risk Group, was a secondary buyout). Having spent years out of favour, both strategic and financial buyers are taking a greater interest in personal lines, where the typically lower levels of renewal retention and chokehold on distribution by price comparison websites in the major lines have historically made the segment less appealing than commercial business, but where the opportunities to establish a competitive advantage and grow quickly in digital are arguably stronger.

Newly announced transactions (December 2024):

- Abbey Insurance Brokers completed a book deal for the assets and liabilities of fellow Northern Ireland based commercial broker Wallace Insurance Brokers.

- Partners& continued to build out its presence in the Midlands and North of England with two new acquisitions, Elliot Westland Insurance Brokers and Midlands Insurance Services.

- Industry stalwart Derek Coles led a Management Buyout (MBO) of Uris Group, the business he has previously owned and sold, from Ardonagh, in another recent example of a large consolidator divesting a non-core business.

- Specialist Risk Group acquired specialist broker R3.

- Lycetts acquired Newcastle commercial lines broker Cheviot Insurance Services.

- J.M. Glendinning acquired North Wales holiday park specialist broker Anchor Insurance and Midlands-based commercial lines broker The Risk Hub.

- Financial Affairs acquired Lancashire based personal lines broker Owen & Ewing Insurance Brokers.

- Brown & Brown (Europe) acquired Hampshire-based commercial lines broker Addingstone Insurance Solutions.

As expected, November 2024 was a busy month for newly announced merger and acquisition (M&A) transactions in UK insurance distribution, as news of deals signed in the days before the new government’s budget on 30 October was released by buyers. With 18 new deals to report on, November was the busiest month of 2024 for sector M&A based on volume. Private sellers who completed deals before that date will have locked in the previous 20% rate of Capital Gains Tax, which increased to 24% from the day of the budget. Due to the delay in reporting many deals and the budget taking place at the end of the month, its overall impact on sector M&A can be seen by looking at combined October and November deal volume.

M&A Market Update

Following the flurry of new deals in October and November, overall transaction volumes in 2024 are almost neck and neck with the record level of 2023. As we approach the year end it appears likely 2024 will end up very close to the overall level of deal activity in 2023. At the end of November, the year-to-date (YTD) deal count stands at 135, only two deals behind the 137 deals at this point in 2023.

What remains to be seen is how much the budget in October brought forward already planned M&A that could result in a more modest flow of new deals over the next few months, which could mean a slower start to 2025 M&A activity. As MarshBerry noted last month, the increase in capital gains tax to 24% is probably not severe enough to make many private sellers fundamentally reevaluate overall plans to sell, and so the tax change is unlikely to have a major long-term impact on sector M&A activity.

In the new year MarshBerry will again be publishing an annual M&A review for the whole of 2024. This very comprehensive report will look closely at the trends and themes coming out of the year. Several of these themes were firmly evident in the November M&A deals. The summarised themes below offer a preview to the conclusions MarshBerry expects to draw in this year’s report.

- New overseas buyers entering the UK for the first time: November saw notable acquisitions by leading Australian group Steadfast and U.S. MGA platform Bishop Street Underwriters, which acquired Lloyd’s broker H.W. Wood and MGA Landmark Underwriting, respectively.

- A shift in the identity of the most active UK acquirers: During November three separate firms made three or more sector acquisitions – JMG Group, Seventeen Group, and Partners&. All three will end the year among the top five most active UK acquirers for 2024. But only one of them was in the top five in 2023.

- Smaller deals: Of the 18 new deals reported on during the month, more than half involved targets employing 10 or fewer staff. As the volume of available mid-sized targets for consolidators has reduced, many buyers are demonstrating an increased willingness and ability to do large numbers of often very small deals.

The last point is an important one when looking at the overall level of sector consolidation in the UK. Although the overall volume of M&A in 2024 appears to be broadly consistent with 2023, the number of deals alone does not tell the full story, as the average deal size has been getting smaller over time. The overall pace and opportunity for industry consolidation can be slowing even while the number of announced deals remains high. This helps explain why many of the largest UK consolidators have begun to spend more time on overseas acquisitions, notably in continental Europe, where higher levels of industry fragmentation offer greater scope for inorganic growth.

Private Equity and PE-backed buyers have accounted for 69 (or 51%) of the transactions in 2024. This is a slight increase from 2023 and explained by the fact that several of the newer PE-backed consolidators (Partners&, JMG Group, Specialist Risk Group) have been very active in 2024, often doing quite small deals, whereas the most consistently busy acquirer of the past few years, Brown & Brown (Europe), has been slightly quieter. There has also been an increased level of PE activity in the personal lines segment in 2024, which is shaping up to be the busiest year on record for M&A in this subsector, with 26 deals announced to date (the previous high was 20 in 2021).

The proportion of insurance distribution sector M&A where the purchaser was an overseas buyer has fallen in 2024 (YTD), albeit from a record level in 2023, and at 22% of all deals it is still substantially above the long-term average. This is again partly explained by Brown & Brown (Europe) doing fewer deals in 2024 than it has historically. The drop in no way reflects any decreased interest in UK targets from overseas buyers. In 2024 YTD there have been acquisitions of UK targets involving 17 separate overseas buyers. This is same as the number of unique overseas buyers in 2023. Furthermore, only six of these buyers acquired UK targets in 2023 and 2024. There have been 28 unique overseas buyers of UK businesses in the sector since the beginning of 2023. Cross-border M&A is here to stay.

Notable transactions (November 2024):

- Aon UK made a major return to UK M&A after several years with its acquisition of Griffiths & Armour, the Liverpool-based broker and Assurex Global network member best known for its PI expertise. The business employs c.200 staff.

- Steadfast Group, the largest general insurance broker network and the largest group of insurance underwriting agencies in Australasia, announced that it will acquire Lloyd’s broker H.W. Wood, as well as HWI France, considerably expanding its London market capabilities.

- Connection Capital announced an investment alongside management in Hood Group, a personal lines business offering white-label solutions for consumer brands, as well as via its own direct-to-market channel and employing more than 250 staff. The deal is the fifth new Private Equity investment into a UK personal lines business in 2024, a record number for any one year.

Other transactions:

- Specialist Risk Group continued its run of recent deals with NW Re, a reinsurance broker active across Property Facultative Reinsurance and Excess of Loss Insurance.

- Seventeen Group announced it had made four new acquisitions in the run-up to the October budget: UK & Global Insurance Brokers, B.T.I.C., Nelsons Insurance Services, and R R M Firm.

- Clear Group acquired schemes specialist CoverMarque, based in Hampshire.

- Partners& was reported in the trade press to have added Brooks Braithwaite, commercial broker JB Brokers, and MGA Prosure Solutions.

- Brown & Brown (Europe) added Crosby Insurance Brokers, a commercial broker in the North East.

- JMG Group announced the acquisition of Nash Warren, a motor trade specialist in the West Midlands, as well as Elevate Insurance Brokers in Bedfordshire, and Tim Hinchcliffe Commercial Brokers in Blackburn.

- Adler Fairways acquired 1Stop Insurance Consultants in Surrey.

- Redbird Capital backed US underwriting platform Bishop Street Underwriters acquired Landmark Underwriting, a multi-class MGA operating in the London market.

After months of speculation, the wait is over. The new government delivered its first budget on 30 October and – as widely expected – there was an immediate increase in Capital Gains Tax (CGT), with the headline rate increasing from 20% to 24%. After weeks of speculation and careful expectations management, the 4% increase is ultimately a lot less severe than many had feared. But it has precipitated a rush to sell by many vendors ahead of 30 October. In most cases these will be owners who would have already been planning to sell in the near future, but it will lead to a short-term jump in announced merger and acquisition (M&A) volumes across the October and November figures.

M&A Market Update

Overall transaction volumes in 2024 remain slightly behind the record level deal volume seen in 2023: at the end of October the year-to-date (YTD) deal count stands at 117, which is 8% behind the same point in 2023. Deal volumes were slightly up in October in a race to beat the budget, but the effect of this has not yet been fully reflected in the figures. Many deals done in the days leading up to 30 October (MarshBerry advised on three in the UK) will only be picked up in next month’s numbers. Indeed, at the time of writing there have already been several sector deals announced in November.

The budget date was set several months ago, with the expectation that CGT would increase. Sellers had time to accelerate sale plans and there has been greater interest over the past few weeks to finalise deals. There was even discussion that CGT could be raised to a level to equalise it with income tax, potentially driving some vendors into unadvised bilateral deals, perhaps with a party that has approached them in the past. We saw a similar phenomenon in Q1 2021 when CGT had been expected to be increased. Sellers may ultimately have ended up doing inferior deals that left more value on the table than the tax saving achieved by rushing.

Doing M&A properly takes time and even the quickest process spans several months. Some sellers will not have been able to get their deals done before the budget. The overnight increase in CGT is frustrating for those owners, but perhaps not as catastrophic as feared. The level of increase is probably not enough to deter many owners from selling, particularly if retirement planning is part of their motivation. MarshBerry does not expect it to significantly impact the volume of businesses coming to market over the medium term.

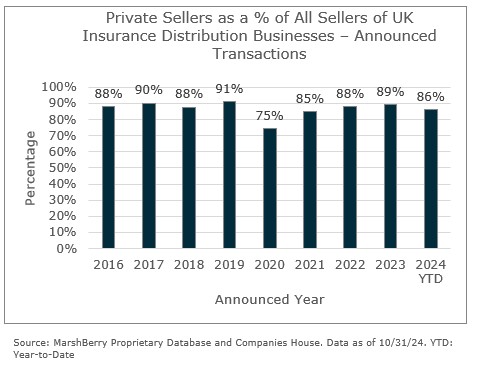

The sellers of insurance distribution businesses in 2024 (and indeed in any given year) are overwhelmingly private owners (86%, YTD, broadly in line with the long-term average). To the extent that the budget was a catalyst for sector M&A this would primarily bring forward divestments by private owners seeking to lock in their tax rate (as CGT is not paid by corporations; corporation tax remains unchanged at 25%). Although, two private equity exits were also announced during the month (n.b. management will have been co-investors with private equity in both targets and will have shared the same concerns as owner-managers with respect to possible tax rate hikes). Perhaps the biggest surprise in the budget was the increase in Employers’ National Insurance, from 13.8% to 15%, and the lowering of the secondary threshold, from £9,100 to £5,000. Staff costs are the largest expense in almost every insurance broker. This extra cost will impact profitability and margins across the board.

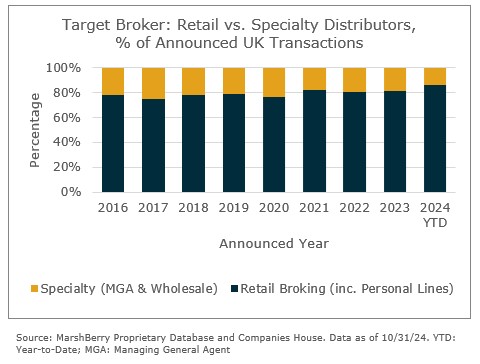

A widely observed trend within the U.S. broking market has been for retail brokers to add specialty (i.e., wholesale and MGA) platforms to their operations. In 2005, there was only one dedicated specialty platform within the top 20 U.S. brokers. In 2024 there were 18. The same trend is increasingly being mirrored in the UK, with the larger broking groups now almost universally taking steps to acquire an MGA platform or a Lloyd’s broker (or both). This was illustrated in October by the Clear Group’s acquisition of Lilley Plummer Risks, their largest acquisition to date. Lilly Plummer gives them a sizeable presence in Lloyd’s with specialties in Marine, Cargo, Property and Reinsurance risks. Whilst the average volume of specialty transactions this year has been relatively muted (14%, YTD), acquiring and building out an MGA platform remains high on the agenda for most of the larger consolidators.

Notable transactions (October 2024):

- Clear Group was the most active consolidator during October, announcing two notable transactions of Lilley Plummer Risks and A-One. Lilly Plummer is Clear’s largest transaction in terms of gross written premiums (GWP) and gives them significant presence in the Lloyd’s market. They also acquired Vision Insurance Services during the month.

- Markerstudy, in conjunction with Pollen Street Capital, agreed to acquire motor specialist Collingwood Insurance Services. The distribution arm of the business will be absorbed by Markerstudy, whilst Pollen Street Capital will manage the insurance carrier side.

- Ryan Specialty announced the acquisition of Innovisk Capital Partners from Abry Partners and BMHS Investments. Innovisk manages a portfolio of specialty MGAs across various commercial line classes in the U.S. and UK.

Other transactions:

- Specialist Risk Group completed the acquisition of Stonehatch Risk Solutions Limited, a specialist global bloodstock and livestock broker.

- Ripe Thinking acquired personal lines MGA GJW Direct from Munich Re.

- Howden Group acquired health, wellbeing and beauty sector industry specialists Associated Beauty Therapists.

- J.M. Glendinning acquired Chester based commercial and personal lines broker Grosvenor Insurance Brokers.

- The Broker Investment Group acquired commercial and personal lines broker Julie Price & Co.

- Academy acquired Hampshire based broker Airsports Insurance Bureau.

- Ardonagh acquired Cornish community broker Rowett Insurance Broking Limited.

Having confidently asserted last month that there would be an uptick in mergers and acquisitions (M&A) deal activity in the UK insurance distribution sector in advance of the 30 October budget, the September numbers have conspired to try to disprove this theory! There were only seven new sector deals to report on in the month. But this is a statistical blip – based on MarshBerry’s ongoing projects and discussions in the market, there is strong evidence that a rush is currently underway to finalise a substantial number of transactions this month.

M&A Market Update

Overall transaction volumes in 2024 continue to lag the record level seen in 2023 and the fewer transactions in September (seven deals vs. 13 in September 2023) has slightly widened the gap. The year-to-date (YTD) deal count stands at 105, which is a 9% decrease compared to the end of Q3 2023. But why was September 2024 quiet if sellers are so keen to get deals done before the budget and a now widely expected increase in Capital Gains Tax? This is likely to be a statistical blip, and a reflection of the natural ‘lag’ of a few days in the timing of most deal announcements. For consistency, deals are counted based on the date of announcement. But most deals legally complete at the month end because this simplifies the accounting for buyers and sellers. They often only announce a few days after this, so deal announcements in the first few days of any month will generally relate to deals that completed on the last day of the previous month.

Based on MarshBerry’s experience and own level of current activity with clients, there are numerous transactions currently at advanced stages of due diligence and racing to complete before 30 October (and thereby announcing this month or early next). MarshBerry advised the sellers on two of the seven sector deals announced in September, two announced deals during August, and have several others underway, some of which will happen before 30 October and others which started later and will now close later in the year. M&A is not an overnight process and, in the UK, even the quickest deals rarely get from start to finish (i.e., completion, including regulatory approval) in less than six months. Deals being announced today are the result of processes that kicked off in the spring, and in many cases much earlier.

Source: MarshBerry Proprietary Database and Companies House. YTD: Year-to-date. Data as of 9/30/24.

Private equity (PE) or PE-backed buyers were behind all transactions announced in September, except one, and on a YTD basis are responsible for 50 of the 105 new deals this year (48%), a slight increase on 2023 (45%). Of course, many smaller deals are done between local and typically privately held brokers that don’t have deep pockets and great access to capital. Stripping out deals with a value of less than £5 million (based on MarshBerry estimates and analysis), the proportion involving PE / PE-backed acquirers increases to 30 out of 43 (or 70%) of the deals done to date in 2024.

Source: MarshBerry Proprietary Database and Companies House. Data as of 9/30/24.

Four of the seven new deals announced in September were for specialty distributors (which MarshBerry defines as MGAs and wholesale brokers, including Lloyd’s Brokers), taking the YTD total to 13 and helping this segment catch up a little on what has otherwise been a relatively slow year. Historically the specialty segment has accounted for approximately 20% of all UK M&A activity. The proportion of UK sector M&A involving specialty targets has actually fallen marginally over the past decade, in contrast to the U.S. experience, where this sector has gradually increased in importance over time, from around 15% of all sector M&A volume ten years ago, to more than 20% in 2023. This is largely explained by the increasing concentration of the Lloyd’s broking market, where years of consolidation have meant that there are now fewer deals left to do. This has been partially offset by the rise of MGA business and M&A involving MGAs, a relatively nascent but important trend in the UK. This has been an ongoing trend in the U.S. market, with a much larger number of MGA platforms with meaningful scale, and where the Specialty segment is consolidating at a much faster pace than the rest of the industry.

Source: MarshBerry Proprietary Database and Companies House. Data as of 9/30/24.

Notable transactions (September 2024):

- Specialist Risk Group (SRG) – now newly backed by Warburg Pincus and Temasek following a refinancing deal that completed during the month – continued its streak of 2024 acquisitions with a deal for Capulus, a leading commercial motor MGA writing more than £50 million of gross written premiums (GWP) that will now become part of SRG’s MX Underwriting arm.

- PIB Group demonstrated that in spite of its M&A focus having increasingly shifted to overseas markets (it has acquired businesses in Ireland, Italy, Spain, Poland and Romania in 2024) that it is still acquisitive in the UK, having added RS Insurance Brokers, a commercial broker in Nottingham.

- PE firm Cinven – which until recently owned Miller – made another investment in the sector with a deal for 50% of Policy Expert, a fast-growing personal lines MGA serving more than 1.5 million UK customers. Cinven has acquired the stake from a subsidiary of the Abu Dhabi Investment Authority (ADIA), which took full control of the business in 2023 following a sale by Primary Group.

Other transactions:

- Clear Group continued the build out of its MGA offering with the addition of Accelerate Underwriting.

- Think Insurance Services in Walsall announced its third Midlands deal with Bromwich Insurance Bureau.

- Howden’s MGA arm DUAL acquired International Passenger Protection (IPP), an MGA focused on the Travel Financial Failure market.

- JMG Group announced its 40th acquisition and cemented its position as the most active UK acquirer in 2024 (based on number of deals) with the addition of Confidential Solutions Group in London.