As expected, November 2024 was a busy month for newly announced merger and acquisition (M&A) transactions in UK insurance distribution, as news of deals signed in the days before the new government’s budget on 30 October was released by buyers. With 18 new deals to report on, November was the busiest month of 2024 for sector M&A based on volume. Private sellers who completed deals before that date will have locked in the previous 20% rate of Capital Gains Tax, which increased to 24% from the day of the budget. Due to the delay in reporting many deals and the budget taking place at the end of the month, its overall impact on sector M&A can be seen by looking at combined October and November deal volume.

M&A Market Update

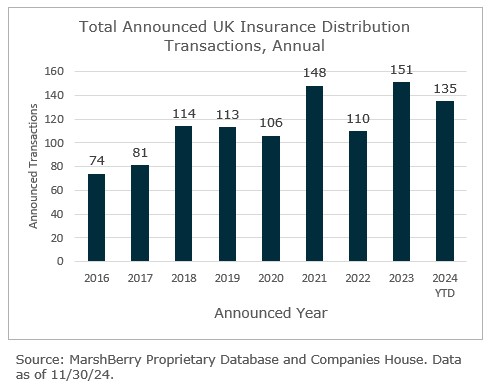

Following the flurry of new deals in October and November, overall transaction volumes in 2024 are almost neck and neck with the record level of 2023. As we approach the year end it appears likely 2024 will end up very close to the overall level of deal activity in 2023. At the end of November, the year-to-date (YTD) deal count stands at 135, only two deals behind the 137 deals at this point in 2023.

What remains to be seen is how much the budget in October brought forward already planned M&A that could result in a more modest flow of new deals over the next few months, which could mean a slower start to 2025 M&A activity. As MarshBerry noted last month, the increase in capital gains tax to 24% is probably not severe enough to make many private sellers fundamentally reevaluate overall plans to sell, and so the tax change is unlikely to have a major long-term impact on sector M&A activity.

In the new year MarshBerry will again be publishing an annual M&A review for the whole of 2024. This very comprehensive report will look closely at the trends and themes coming out of the year. Several of these themes were firmly evident in the November M&A deals. The summarised themes below offer a preview to the conclusions MarshBerry expects to draw in this year’s report.

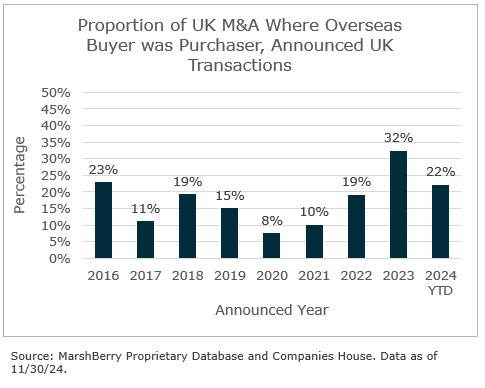

- New overseas buyers entering the UK for the first time: November saw notable acquisitions by leading Australian group Steadfast and U.S. MGA platform Bishop Street Underwriters, which acquired Lloyd’s broker H.W. Wood and MGA Landmark Underwriting, respectively.

- A shift in the identity of the most active UK acquirers: During November three separate firms made three or more sector acquisitions – JMG Group, Seventeen Group, and Partners&. All three will end the year among the top five most active UK acquirers for 2024. But only one of them was in the top five in 2023.

- Smaller deals: Of the 18 new deals reported on during the month, more than half involved targets employing 10 or fewer staff. As the volume of available mid-sized targets for consolidators has reduced, many buyers are demonstrating an increased willingness and ability to do large numbers of often very small deals.

The last point is an important one when looking at the overall level of sector consolidation in the UK. Although the overall volume of M&A in 2024 appears to be broadly consistent with 2023, the number of deals alone does not tell the full story, as the average deal size has been getting smaller over time. The overall pace and opportunity for industry consolidation can be slowing even while the number of announced deals remains high. This helps explain why many of the largest UK consolidators have begun to spend more time on overseas acquisitions, notably in continental Europe, where higher levels of industry fragmentation offer greater scope for inorganic growth.

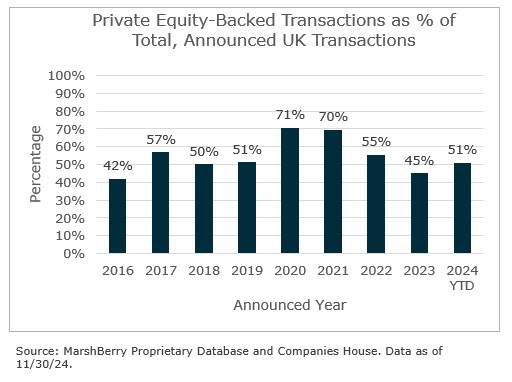

Private Equity and PE-backed buyers have accounted for 69 (or 51%) of the transactions in 2024. This is a slight increase from 2023 and explained by the fact that several of the newer PE-backed consolidators (Partners&, JMG Group, Specialist Risk Group) have been very active in 2024, often doing quite small deals, whereas the most consistently busy acquirer of the past few years, Brown & Brown (Europe), has been slightly quieter. There has also been an increased level of PE activity in the personal lines segment in 2024, which is shaping up to be the busiest year on record for M&A in this subsector, with 26 deals announced to date (the previous high was 20 in 2021).

The proportion of insurance distribution sector M&A where the purchaser was an overseas buyer has fallen in 2024 (YTD), albeit from a record level in 2023, and at 22% of all deals it is still substantially above the long-term average. This is again partly explained by Brown & Brown (Europe) doing fewer deals in 2024 than it has historically. The drop in no way reflects any decreased interest in UK targets from overseas buyers. In 2024 YTD there have been acquisitions of UK targets involving 17 separate overseas buyers. This is same as the number of unique overseas buyers in 2023. Furthermore, only six of these buyers acquired UK targets in 2023 and 2024. There have been 28 unique overseas buyers of UK businesses in the sector since the beginning of 2023. Cross-border M&A is here to stay.

Notable transactions (November 2024):

- Aon UK made a major return to UK M&A after several years with its acquisition of Griffiths & Armour, the Liverpool-based broker and Assurex Global network member best known for its PI expertise. The business employs c.200 staff.

- Steadfast Group, the largest general insurance broker network and the largest group of insurance underwriting agencies in Australasia, announced that it will acquire Lloyd’s broker H.W. Wood, as well as HWI France, considerably expanding its London market capabilities.

- Connection Capital announced an investment alongside management in Hood Group, a personal lines business offering white-label solutions for consumer brands, as well as via its own direct-to-market channel and employing more than 250 staff. The deal is the fifth new Private Equity investment into a UK personal lines business in 2024, a record number for any one year.

Other transactions:

- Specialist Risk Group continued its run of recent deals with NW Re, a reinsurance broker active across Property Facultative Reinsurance and Excess of Loss Insurance.

- Seventeen Group announced it had made four new acquisitions in the run-up to the October budget: UK & Global Insurance Brokers, B.T.I.C., Nelsons Insurance Services, and R R M Firm.

- Clear Group acquired schemes specialist CoverMarque, based in Hampshire.

- Partners& was reported in the trade press to have added Brooks Braithwaite, commercial broker JB Brokers, and MGA Prosure Solutions.

- Brown & Brown (Europe) added Crosby Insurance Brokers, a commercial broker in the North East.

- JMG Group announced the acquisition of Nash Warren, a motor trade specialist in the West Midlands, as well as Elevate Insurance Brokers in Bedfordshire, and Tim Hinchcliffe Commercial Brokers in Blackburn.

- Adler Fairways acquired 1Stop Insurance Consultants in Surrey.

- Redbird Capital backed US underwriting platform Bishop Street Underwriters acquired Landmark Underwriting, a multi-class MGA operating in the London market.