After a record-breaking October, merger and acquisition (M&A) transaction volumes unsurprisingly dropped in November. The surge in October was partly driven by business owners rushing to sell before the anticipated increase in capital gains tax rates being announced in the Autumn Budget. There was more activity in investment management and continuing consolidation in wealth management, as well as cross-border consolidation in securities exchange platforms, involving strategic acquirers and consolidators.

Investment sector M&A market update

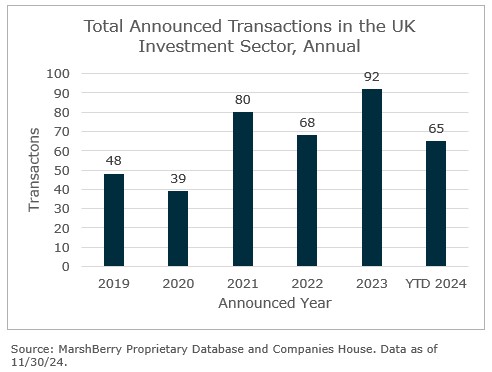

There were eight deals recorded in the month of November, bringing the year-to-date (YTD) total to 65 transactions estimated to be worth over £5m each. Whilst significantly below the extraordinarily busy October, which saw 17 transactions, it still counted higher than the YTD monthly average of six deals (and higher than last year’s average of 7.7 deals per month). Half of the deals were acquisitions of asset management and trading platform firms. The other half was accounted for by smaller wealth management businesses being acquired by larger peers.

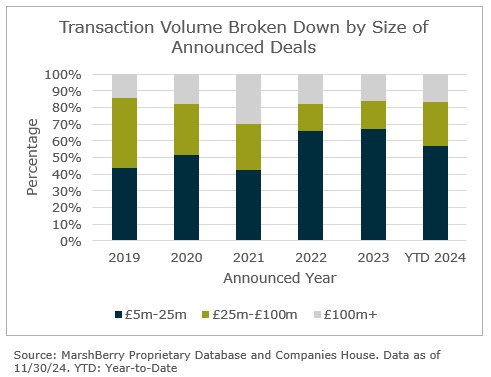

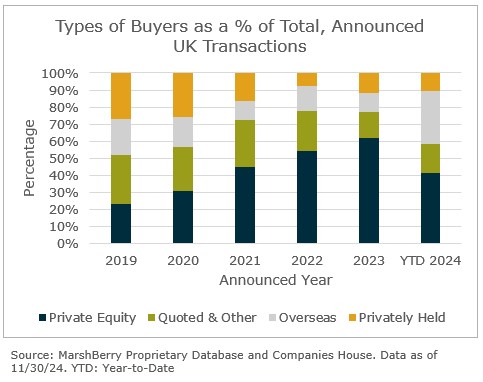

Five of the deals have an estimated value between £5m and £25m, two deals between £25m and £100m, and one deal exceeding £100m, including the £207m public offer for Aquis Exchange by SIX Group, the main stock exchange in Switzerland. This follows the broader trend of declining public ownership of companies in the sector which has seen public companies be taken off the market including, most recently, Hargreaves Lansdown, Mattioli Woods and STM Group. The shift reflects the growing interest from private equity funds and strategic acquirers in arguably under-valued opportunities for long-term value in the public market.

Having said that, half of the deal count this month was accounted for by public companies acquiring businesses, including Aviva-owned Succession Wealth and Pinnacle Investment Management (being listed in Australia). Additionally, there was a rise in the proportion of overseas buyers acquiring UK-based firms with the number YTD nearly tripling compared to last year.

Notable transactions (November 2024):

- Evelyn Partners agreed to sell its professional services division, including tax, assurance and advisory services, for a reported £700m, to the private equity fund Apax. Pending regulatory approval, the deal is expected to complete in early 2025, with the division, including 1,600 staff across 15 offices, to be rebranded to Smith & Williamson (S&W) to honour its heritage. The deal will allow Evelyn Partners to focus on its wealth management operations.

- SIX Group agreed to acquire Aquis Exchange plc for £207m, valuing shares at 727 pence each—a 120% premium over Aquis’s recent share price. Aquis, a multi-product European exchange group, operates across trading, technology, and data services. The deal aligns with SIX’s strategy to enhance its pan-European exchange capabilities, combining Aquis’ technologies with SIX’s platform to create a competitive growth listing venue.

- Ninety-One announced that it is acquiring the assets of Sanlam Investment Management. The transaction will result in £17bn of client assets moving to Ninety-One, of which £3.4bn are based in the UK. Ninety-One will assume the responsibility for managing the assets, with Sanlam’s UK entity, Sanlam UK Investments, remaining under the ownership of the Sanlam Group.

Other UK transactions (November 2024):

- Mattioli Woods acquired North-West based financial planning firm Cullen Wealth.

- Brooks Macdonald enhanced its regional reach by acquiring CST Wealth Management, a Welsh financial planning firm.

- One Four Nine acquired Castlegate Capital, a chartered financial planning firm in the UK.

- ASHL sold Lync Wealth Management to a 7IM subsidiary. Lync Wealth Management, managing £500m, plans to acquire up to seven advice firms while remaining tied to ASHL’s Lyncombe network.

- Advanta Wealth acquired City Financial Planning, adding £800m in assets under advice (AUA) and offices in Bath and Exeter.

- Succession Wealth strengthened its regional footprint by acquiring True Wealth Group, a Leeds-based financial planning firm.

- WBR Group acquired Bristol-based NM Perris & Co Ltd (trading as Brunel Trustees), adding £300m in AUA. The transaction also included the acquisitions of associated companies Brunel Trustees Limited and Omniphi Systems Limited.

- The Penny Group expanded its advisory services by acquiring Whiting Financial Limited, a Surrey-based IFA with £90m of AUA.

- Margetts Wealth Management announced a management buy in with Directors Ian Butler and James Vickers taking equal stakes, joining the Chairman Kevin Smith. The deal allows the Birmingham-based firm to remain independent and focus on growth.

- Tavistock Investments announced the acquisition of London-based DFM Alpha Beta Partners. Alpha Beta has £3bn in AUM and will further Tavistock’s presence in the UK retail market.

- Australia’s Pinnacle Investment Management strengthened its position in the UK funds market by acquiring a 25% stake in Pacific Asset Management.

- MKC Wealth expanded its operations in the North with the acquisitions of Stockport-based IFA Warr & Co Independent Financial Advisers Limited and Urmston-based Halstead Independent Financial Management.