After months of speculation, the wait is over. The new government delivered its first budget on 30 October and – as widely expected – there was an immediate increase in Capital Gains Tax (CGT), with the headline rate increasing from 20% to 24%. After weeks of speculation and careful expectations management, the 4% increase is ultimately a lot less severe than many had feared. But it has precipitated a rush to sell by many vendors ahead of 30 October. In most cases these will be owners who would have already been planning to sell in the near future, but it will lead to a short-term jump in announced merger and acquisition (M&A) volumes across the October and November figures.

M&A Market Update

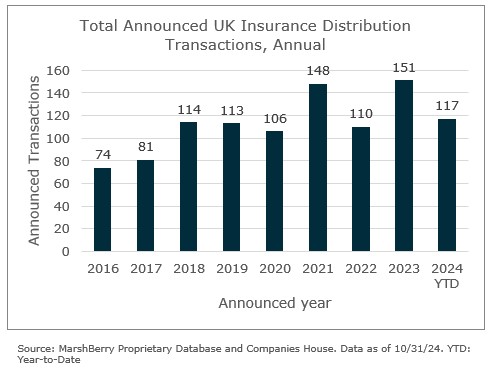

Overall transaction volumes in 2024 remain slightly behind the record level deal volume seen in 2023: at the end of October the year-to-date (YTD) deal count stands at 117, which is 8% behind the same point in 2023. Deal volumes were slightly up in October in a race to beat the budget, but the effect of this has not yet been fully reflected in the figures. Many deals done in the days leading up to 30 October (MarshBerry advised on three in the UK) will only be picked up in next month’s numbers. Indeed, at the time of writing there have already been several sector deals announced in November.

The budget date was set several months ago, with the expectation that CGT would increase. Sellers had time to accelerate sale plans and there has been greater interest over the past few weeks to finalise deals. There was even discussion that CGT could be raised to a level to equalise it with income tax, potentially driving some vendors into unadvised bilateral deals, perhaps with a party that has approached them in the past. We saw a similar phenomenon in Q1 2021 when CGT had been expected to be increased. Sellers may ultimately have ended up doing inferior deals that left more value on the table than the tax saving achieved by rushing.

Doing M&A properly takes time and even the quickest process spans several months. Some sellers will not have been able to get their deals done before the budget. The overnight increase in CGT is frustrating for those owners, but perhaps not as catastrophic as feared. The level of increase is probably not enough to deter many owners from selling, particularly if retirement planning is part of their motivation. MarshBerry does not expect it to significantly impact the volume of businesses coming to market over the medium term.

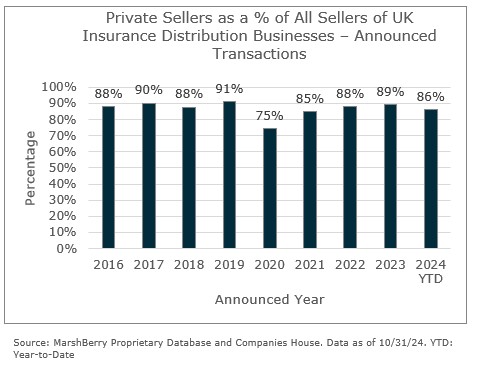

The sellers of insurance distribution businesses in 2024 (and indeed in any given year) are overwhelmingly private owners (86%, YTD, broadly in line with the long-term average). To the extent that the budget was a catalyst for sector M&A this would primarily bring forward divestments by private owners seeking to lock in their tax rate (as CGT is not paid by corporations; corporation tax remains unchanged at 25%). Although, two private equity exits were also announced during the month (n.b. management will have been co-investors with private equity in both targets and will have shared the same concerns as owner-managers with respect to possible tax rate hikes). Perhaps the biggest surprise in the budget was the increase in Employers’ National Insurance, from 13.8% to 15%, and the lowering of the secondary threshold, from £9,100 to £5,000. Staff costs are the largest expense in almost every insurance broker. This extra cost will impact profitability and margins across the board.

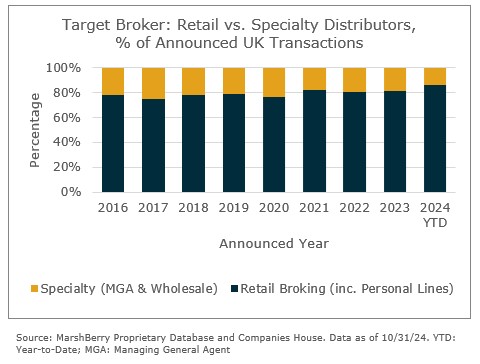

A widely observed trend within the U.S. broking market has been for retail brokers to add specialty (i.e., wholesale and MGA) platforms to their operations. In 2005, there was only one dedicated specialty platform within the top 20 U.S. brokers. In 2024 there were 18. The same trend is increasingly being mirrored in the UK, with the larger broking groups now almost universally taking steps to acquire an MGA platform or a Lloyd’s broker (or both). This was illustrated in October by the Clear Group’s acquisition of Lilley Plummer Risks, their largest acquisition to date. Lilly Plummer gives them a sizeable presence in Lloyd’s with specialties in Marine, Cargo, Property and Reinsurance risks. Whilst the average volume of specialty transactions this year has been relatively muted (14%, YTD), acquiring and building out an MGA platform remains high on the agenda for most of the larger consolidators.

Notable transactions (October 2024):

- Clear Group was the most active consolidator during October, announcing two notable transactions of Lilley Plummer Risks and A-One. Lilly Plummer is Clear’s largest transaction in terms of gross written premiums (GWP) and gives them significant presence in the Lloyd’s market. They also acquired Vision Insurance Services during the month.

- Markerstudy, in conjunction with Pollen Street Capital, agreed to acquire motor specialist Collingwood Insurance Services. The distribution arm of the business will be absorbed by Markerstudy, whilst Pollen Street Capital will manage the insurance carrier side.

- Ryan Specialty announced the acquisition of Innovisk Capital Partners from Abry Partners and BMHS Investments. Innovisk manages a portfolio of specialty MGAs across various commercial line classes in the U.S. and UK.

Other transactions:

- Specialist Risk Group completed the acquisition of Stonehatch Risk Solutions Limited, a specialist global bloodstock and livestock broker.

- Ripe Thinking acquired personal lines MGA GJW Direct from Munich Re.

- Howden Group acquired health, wellbeing and beauty sector industry specialists Associated Beauty Therapists.

- J.M. Glendinning acquired Chester based commercial and personal lines broker Grosvenor Insurance Brokers.

- The Broker Investment Group acquired commercial and personal lines broker Julie Price & Co.

- Academy acquired Hampshire based broker Airsports Insurance Bureau.

- Ardonagh acquired Cornish community broker Rowett Insurance Broking Limited.