Partly driven by vendors aiming to finalise deals ahead of the Autumn Budget announcement on 30th October, with expected increases in capital gains tax (CGT), the sector saw unusually high levels of deal activity. Aside from bolt-on acquisitions by wealth management consolidators, volumes were also supported by strategic transactions in asset management and investment consulting, resulting in October being the busiest month of the year in terms of merger and acquisition (M&A) activity.

Investment sector M&A market update

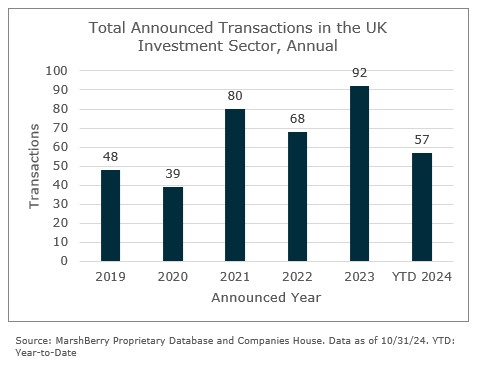

Year-to-date (YTD), the total number of transactions announced (with estimated values at over £5m each) stood at 57, including 15 deals in October alone, aligning with the typical quarterly deal volumes this year. The consolidation in the advice sector continues to be a key driver of activity, in the midst of the Financial Conduct Authority (FCA) conducting a review to assess the prudence of the acquisition-led growth of the consolidators. Undeterred, several consolidators, including Perspective Financial Group, Söderberg & Partners, Foster Denovo and Ascot Lloyd were extraordinarily busy in October and, some made multiple acquisitions of small advice businesses.

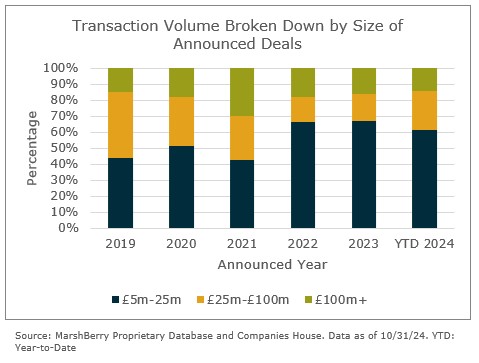

This month’s M&A activity saw seven transactions in the £25m to £100m range, exceeding all the previous months this year. Combined with seven deals valued between £5m and £25m and one deal exceeding £100m—a minority investment by Bain Capital in Openwork, the IFA network—the overall distribution of transaction values year-to-date remained consistent with trends observed in 2022 and 2023 with a slight bias towards the £25m to £100m bracket. This highlights the current focus by financial sponsors on opportunities in the mid-market.

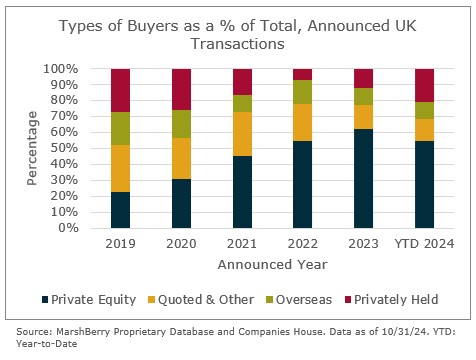

That being said, there’s been an increase in acquisitions by public companies, as exemplified by WTW’s, Arthur J. Gallagher’s, Brooks Macdonald’s and Jupiter Asset Management’s acquisitions announced this month. In fact, over one in four deals this month were acquisitions or investments by quoted companies, marking a significant rise compared to typical levels, while privately held transactions accounted for just above one in ten deals.

Notable transactions (October 2024):

- The Openwork Partnership’s advisers voted in favour of Bain Capital acquiring a 30% minority stake in the network for £120m, pending regulatory approval. This investment aims to strengthen Openwork’s offerings in wealth, mortgage, and protection advice, supporting technology upgrades and strategic growth initiatives across its 4,750-strong adviser network.

- 7IM agreed to acquire Rockhold Asset Management, a subsidiary of ASHL Group, to bolster its managed portfolio services and discretionary management offerings. The deal, which adds around £2bn in client assets, will bring 7IM’s total assets under management (AUM) to £27bn. The acquisition will proceed under Rockhold’s existing brand and management team, pending regulatory approval.

- Arthur J. Gallagher & Co. acquired Redington, a London-based investment consultancy primarily serving pension funds and institutional investors. The acquisition is set to expand Gallagher’s UK advisory services, enhancing capabilities in investment strategy, risk management, and financial sustainability.

- CBPE invested in Clifton Asset Management, a wealth management, and pensions administration firm with £1.8bn in assets under management and administration on behalf of over 9,000 clients. The partnership, pending regulatory approval, aims to accelerate Clifton’s growth through organic expansion and strategic acquisitions, with Clifton’s CEO Neil Greenaway reinvesting alongside CBPE.

Other UK transactions (October 2024):

- WTW invested in Atomos, acquiring a 25% stake to deepen their collaboration and capitalise on Atomos’s growth within the UK wealth management sector.

- Brooks Macdonald acquired LIFT-Financial Group, with c. £1.6bn of assets under advice (AUA), to accelerate growth and expand its reach in UK wealth planning.

- Titan Wealth acquired Ravenscroft Investments’s UK investment management, adding some £600m of AUM.

- Jupiter Asset Management acquired Origin Asset Management, taking on £800m in mostly institutional assets.

- IPS Capital expanded its advisory proposition by acquiring Greenwood Financial Planning, raising IPS Capital’s AUM close to £1bn.

- Cazenove Capital acquired Whitley Asset Management, a boutique advisory providing services for high-net-worth clients.

- Ascot Lloyd expanded in Scotland by acquiring the Fife-based advice firm Create and Prosper with £254m in assets, enhancing its national advisory footprint.

- Foster Denovo expanded its advisory footprint by acquiring 80Twenty, adding a focus on sustainable investing.

- Perspective Financial Group acquired 13 firms in October to beat anticipated CGT rises announced in the budget.

- Fairstone finalised its acquisition of Forbes Lawson Wealth Management, an Aberdeen-based advisory firm, reinforcing its footprint in Scotland.

- Söderberg Partners acquired minority stakes in four UK firms, George Square, Cheltenham IFA Ltd, Bluezone Capital and Alexander Bates Campbell.

- Clarion Wealth Planning’s management team completed a buyout, positioning the firm for independence and growth.

- Towergate Health & Protection bought Benefiz, the employee benefits consultant for SMEs, bringing it in under the Ardonagh Group umbrella.

- Moneybox, a financial app designed to help users save and invest for life goals like retirement and home purchases, raised c. £70m in primary and secondary capital from Apis Partners and Amundi, valuing the company at £550m to enhance product innovation and digital offerings for younger investors.

- Westbridge acquired a majority stake in Causeway Securities, an international distributor of structured products.

- ECI Partners acquired a stake in pensions management and governance services provider Independent Governance Group.