Numbers do not lie, but they can be misleading.

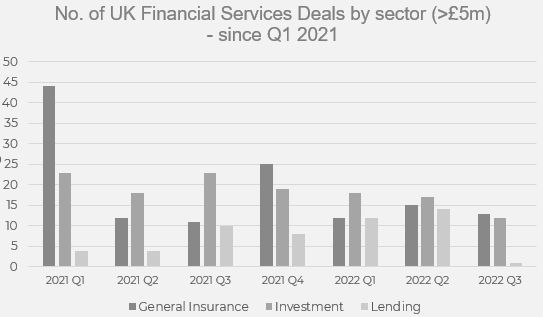

Whilst in Q3 both General Insurance and Investment UK M&A volumes (announced basis) were down, we are not experiencing a marked drop off in demand from buyers. If anything, the opposite.

Before geolocating and other similar technologies became the norm, people used to say “you wait for ages and then three buses all come along at the same time”. Deal volumes can still be like this. Deals announced today started life 9 to 15 months ago, often much longer.

Investors need to put their money somewhere. In times of rapid inflation and (for the time being) historically low interest rates money is no longer a risk-free asset. Investors have been pulling their money out of Tech and other high growth segments. Insurance, especially distribution, looks like something of a relative safe haven.

The Investment sector is somewhat more vulnerable to market sentiment where valuations are generally heavily dependent on AUM (assets under management). MAC (Material Adverse Change) clauses are re-emerging in sale and purchase agreements with split exchange and completion– as regulatory approval is often required for a change of control.

Activity in the Lending sector is typically lower and more volatile. However, the rapidly changing outlook for interest rates and inflation are a complicating factor.

Prospective sellers often ask us “is it a good time to sell?”. Of course, we have to point out that the conditions today are not what really matter; what is more important is what they will be like in six months’ time.

But for the moment there is no buyers’ strike, just continued strong demand for attractive assets. Will this continue? Ask me in six months.

Should I be thinking about selling? Come and talk to us.

Insurance

It is dangerous to try to read too much into a single month – and of course the announced deals in any given month reflects transactions that have been many months or even years in the making – but September 2022 saw the lowest volume of announced UK Insurance M&A for at least four years (when the current author started writing these monthly newsletters). As such, it’s a short note this month and we will be nervously watching to see whether it marks the beginning of any sort of trend.

In broking, PIB Group announced only its third UK deal of 2022, acquiring super yacht specialist Zorab Insurance Services. Clear Group announced that it had acquired LawSure Direct, a legal indemnities broker based in East Sussex, and Acrisure continued its UK expansion with the acquisition of CRK Commercial Insurance Services, a schemes specialist with particular focus on the Engineering, Rope Access and HVAC Industries.

At Lloyd’s, US insurer Westfield Specialty announced that it had acquired Syndicate 1200 from Argo Group International, with a reported purchase price of $125 million.

In personal lines, it was reported that travel specialist Staysure has taken full control of price comparison site Payingtoomuch.com, where it has been the majority shareholder since 2019.

Finally, Companies House filings revealed that Inflexion-backed broker DR&P Group had quietly made another acquisition over the summer, adding MG Insurance Consultants, a wholesale business with a focus on property and trading as MG Underwriting.

Investment

M&A activity in the Investment sector revolved almost solely around wealth management, with the most notable transaction being the completion of RBC’s £1.6bn public takeover of Brewin Dolphin. Kingswood announced the acquisition of a 70% stake in Dublin-based Moloney Investments for a total cash consideration of £23.4m, adding £630m in AUA. Brooks Macdonald acquired Adroit Financial Planning from law firm Slater and Gordon, adding £350m in assets. Radiant Financial announced the acquisitions of Barnstaple-based Irvine Financial Services, Oldham-based Landmark Financial Planning and Andrew Gibbs IFA based in Henley-in-Arden, adding £325m in client assets. Solomon Capital, backed by private equity firm JC Flowers, acquired multi-office advice business Gale and Phillipson. Clifton Asset Management concluded the takeover of Stroud-based financial adviser Noble James Associates, adding £130m in AUA. Evelyn Partners announced the acquisition of the investment management business of Arena Wealth, adding £90m of AUM. Sovereign Capital Partners-backed wealth manager Skerritts acquired Hampshire-based PS Financial Advisers adding £60m in AUA, and Gilson Gray Financial Management, the financial services arm of legal firm Gilson Gray, acquired North Berwick-based Wallace Financial Planning in a seven-figure deal.

Elsewhere in the sector, platform business Parmenion acquired Midlands-based discretionary fund manager Evidence Based Investing, which manages £1.9bn. Parmenion was reported to be looking for a new strategic investor, valuing the company between £300m and £400m. Emerging markets specialist asset manager Somerset Capital, which runs about $5bn in AUM, was reported to be up for sale, with a management buyout or merger potentially on the cards.

Lending

In the lending sector, HSBC made a $35m investment in the UK-based fintech firm Monese, a move that will boost HSBC’s banking-as-a-service proposition. Digital mortgage lender Perenna raised $30m from US venture capital firm IAG Silverstripe in a Series A funding round to fund its growth.

It was reported that the Durham-based digital lender Atom was still considering going public next year after its £700m merger with a US-based SPAC had been called off. Meanwhile, BC Partners and Pollen Street Capital dropped their plans to sell challenger bank Shawbrook given the current uncertain economic climate.

*IMAS Corporate Finance LLP has been acquired by MarshBerry.