Having confidently asserted last month that there would be an uptick in mergers and acquisitions (M&A) deal activity in the UK insurance distribution sector in advance of the 30 October budget, the September numbers have conspired to try to disprove this theory! There were only seven new sector deals to report on in the month. But this is a statistical blip – based on MarshBerry’s ongoing projects and discussions in the market, there is strong evidence that a rush is currently underway to finalise a substantial number of transactions this month.

M&A Market Update

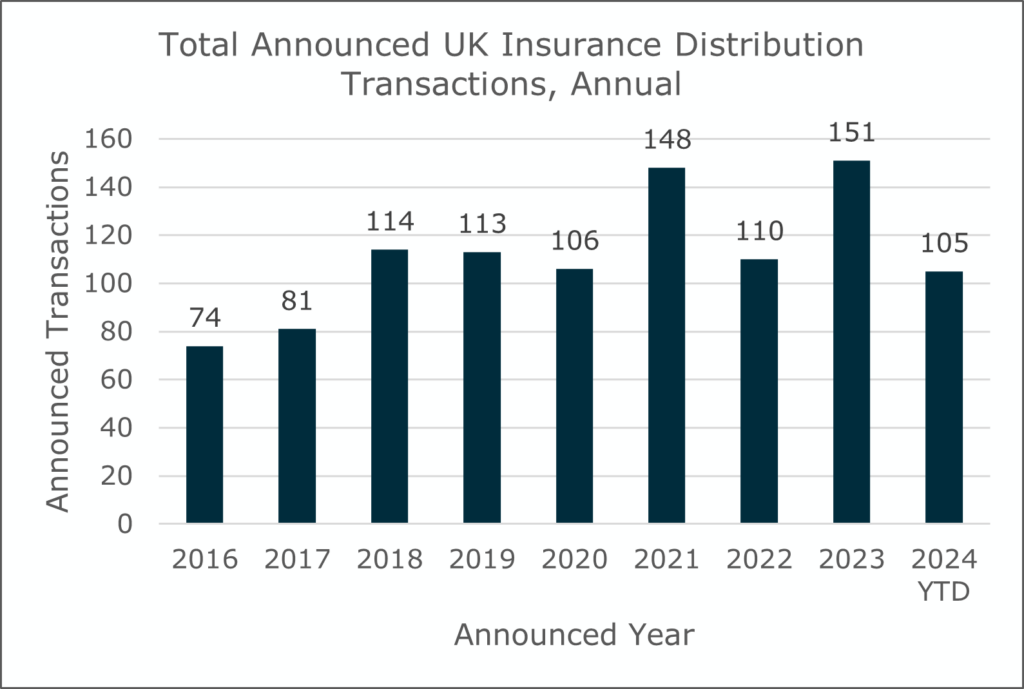

Overall transaction volumes in 2024 continue to lag the record level seen in 2023 and the fewer transactions in September (seven deals vs. 13 in September 2023) has slightly widened the gap. The year-to-date (YTD) deal count stands at 105, which is a 9% decrease compared to the end of Q3 2023. But why was September 2024 quiet if sellers are so keen to get deals done before the budget and a now widely expected increase in Capital Gains Tax? This is likely to be a statistical blip, and a reflection of the natural ‘lag’ of a few days in the timing of most deal announcements. For consistency, deals are counted based on the date of announcement. But most deals legally complete at the month end because this simplifies the accounting for buyers and sellers. They often only announce a few days after this, so deal announcements in the first few days of any month will generally relate to deals that completed on the last day of the previous month.

Based on MarshBerry’s experience and own level of current activity with clients, there are numerous transactions currently at advanced stages of due diligence and racing to complete before 30 October (and thereby announcing this month or early next). MarshBerry advised the sellers on two of the seven sector deals announced in September, two announced deals during August, and have several others underway, some of which will happen before 30 October and others which started later and will now close later in the year. M&A is not an overnight process and, in the UK, even the quickest deals rarely get from start to finish (i.e., completion, including regulatory approval) in less than six months. Deals being announced today are the result of processes that kicked off in the spring, and in many cases much earlier.

Source: MarshBerry Proprietary Database and Companies House. YTD: Year-to-date. Data as of 9/30/24.

Private equity (PE) or PE-backed buyers were behind all transactions announced in September, except one, and on a YTD basis are responsible for 50 of the 105 new deals this year (48%), a slight increase on 2023 (45%). Of course, many smaller deals are done between local and typically privately held brokers that don’t have deep pockets and great access to capital. Stripping out deals with a value of less than £5 million (based on MarshBerry estimates and analysis), the proportion involving PE / PE-backed acquirers increases to 30 out of 43 (or 70%) of the deals done to date in 2024.

Source: MarshBerry Proprietary Database and Companies House. Data as of 9/30/24.

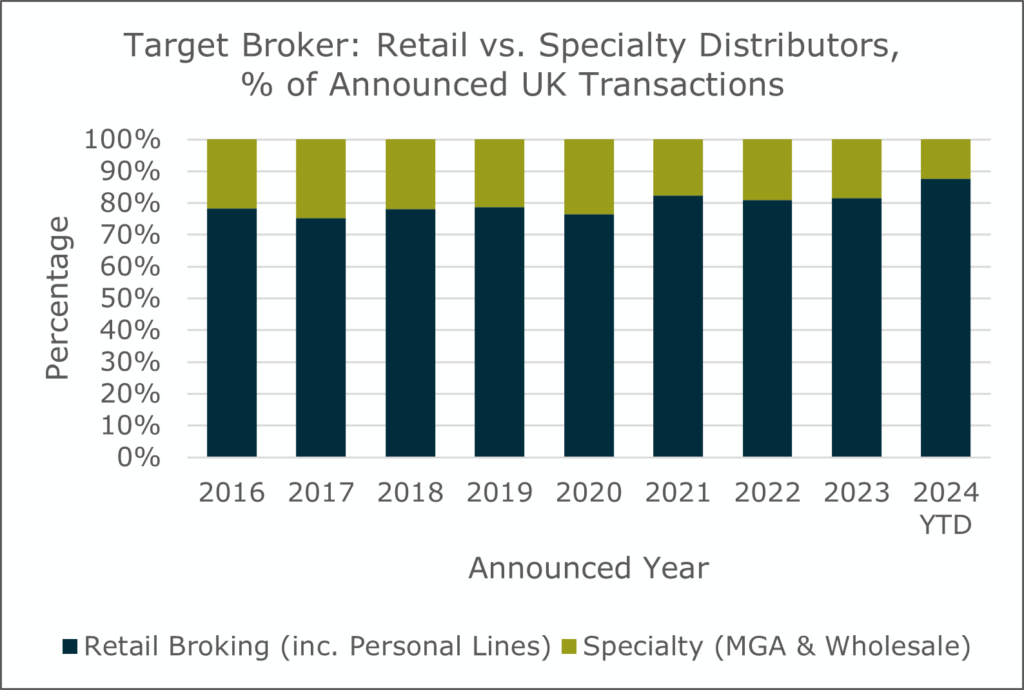

Four of the seven new deals announced in September were for specialty distributors (which MarshBerry defines as MGAs and wholesale brokers, including Lloyd’s Brokers), taking the YTD total to 13 and helping this segment catch up a little on what has otherwise been a relatively slow year. Historically the specialty segment has accounted for approximately 20% of all UK M&A activity. The proportion of UK sector M&A involving specialty targets has actually fallen marginally over the past decade, in contrast to the U.S. experience, where this sector has gradually increased in importance over time, from around 15% of all sector M&A volume ten years ago, to more than 20% in 2023. This is largely explained by the increasing concentration of the Lloyd’s broking market, where years of consolidation have meant that there are now fewer deals left to do. This has been partially offset by the rise of MGA business and M&A involving MGAs, a relatively nascent but important trend in the UK. This has been an ongoing trend in the U.S. market, with a much larger number of MGA platforms with meaningful scale, and where the Specialty segment is consolidating at a much faster pace than the rest of the industry.

Source: MarshBerry Proprietary Database and Companies House. Data as of 9/30/24.

Notable transactions (September 2024):

- Specialist Risk Group (SRG) – now newly backed by Warburg Pincus and Temasek following a refinancing deal that completed during the month – continued its streak of 2024 acquisitions with a deal for Capulus, a leading commercial motor MGA writing more than £50 million of gross written premiums (GWP) that will now become part of SRG’s MX Underwriting arm.

- PIB Group demonstrated that in spite of its M&A focus having increasingly shifted to overseas markets (it has acquired businesses in Ireland, Italy, Spain, Poland and Romania in 2024) that it is still acquisitive in the UK, having added RS Insurance Brokers, a commercial broker in Nottingham.

- PE firm Cinven – which until recently owned Miller – made another investment in the sector with a deal for 50% of Policy Expert, a fast-growing personal lines MGA serving more than 1.5 million UK customers. Cinven has acquired the stake from a subsidiary of the Abu Dhabi Investment Authority (ADIA), which took full control of the business in 2023 following a sale by Primary Group.

Other transactions:

- Clear Group continued the build out of its MGA offering with the addition of Accelerate Underwriting.

- Think Insurance Services in Walsall announced its third Midlands deal with Bromwich Insurance Bureau.

- Howden’s MGA arm DUAL acquired International Passenger Protection (IPP), an MGA focused on the Travel Financial Failure market.

- JMG Group announced its 40th acquisition and cemented its position as the most active UK acquirer in 2024 (based on number of deals) with the addition of Confidential Solutions Group in London.