September saw significant transactions and high levels of merger and acquisition (M&A) deal activity in the investment sector. Prominent quoted companies sold non-core subsidiaries and the consolidators continued to acquire smaller wealth managers across the country. In fact, September was one of the busiest months this year.

Investment sector M&A market update

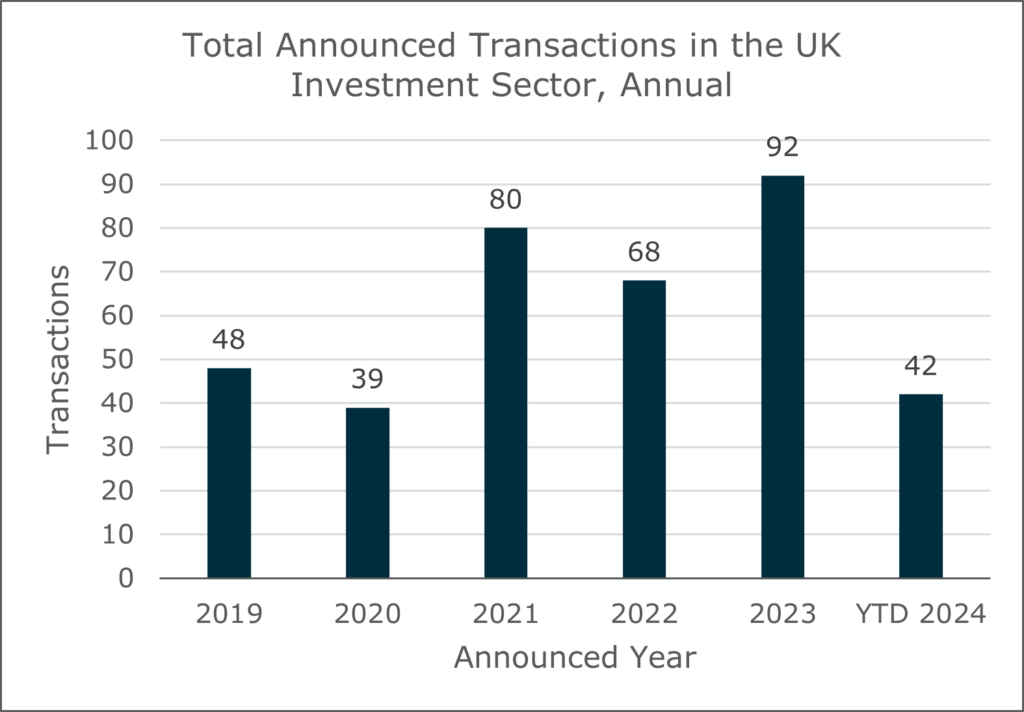

At of the end of September, a total of 42 deals valued at over £5m have been announced in the investment sector year-to-date (YTD), including 17 in the last quarter. Following the typical summer slowdown, M&A activity significantly rebounded in the month, reflecting the seasonal trends commonly observed in the market.

It involved the usual activity by consolidators acquiring smaller wealth management firms, some of which may have been prompted by owners seeking to realise value ahead of the widely anticipated increase in capital gains taxes to be announced in the Autumn Budget at the end of October. More notably, three public companies announced the sales of non-core subsidiaries to private equity funded companies and vehicles.

Source: MarshBerry Proprietary Database and Companies House. Data as of 10/1/24.

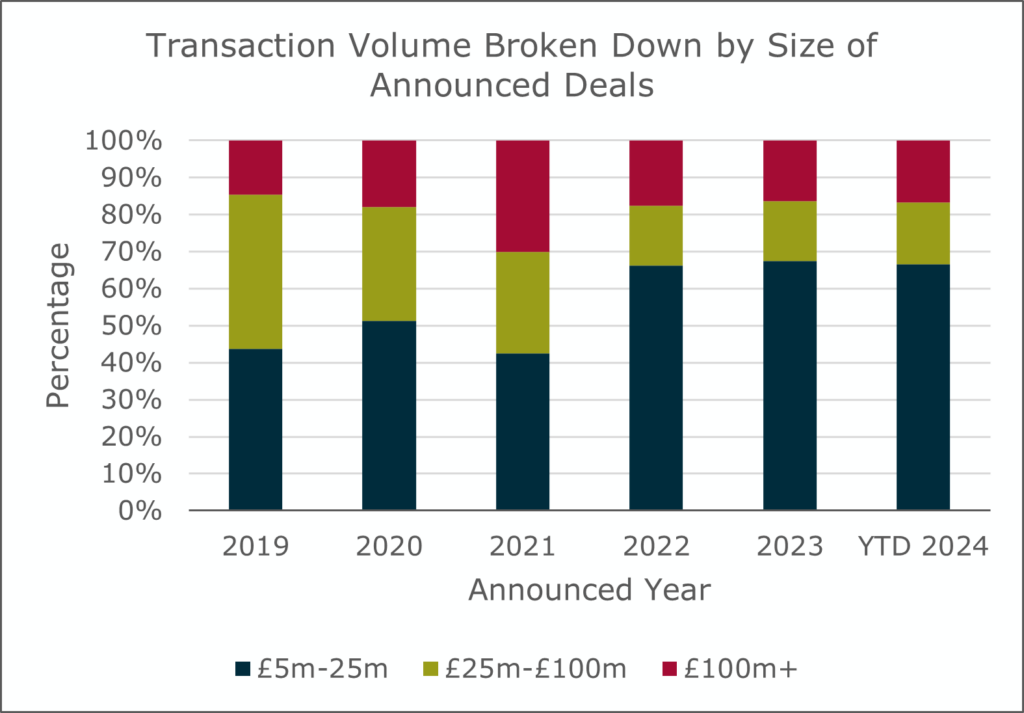

As seen in previous periods, most of the deal activity took place at the lower end of the scale in terms of transaction size, ranging from £5m to £25m, as acquirers benefitted from ample access to capital to support bolt-on and strategic acquisitions. But there was also a fair number of mid-sized and large deals, resulting in a distribution of transaction values YTD being very similar to 2022 and 2023.

Source: MarshBerry Proprietary Database and Companies House. Data as of 10/1/24.

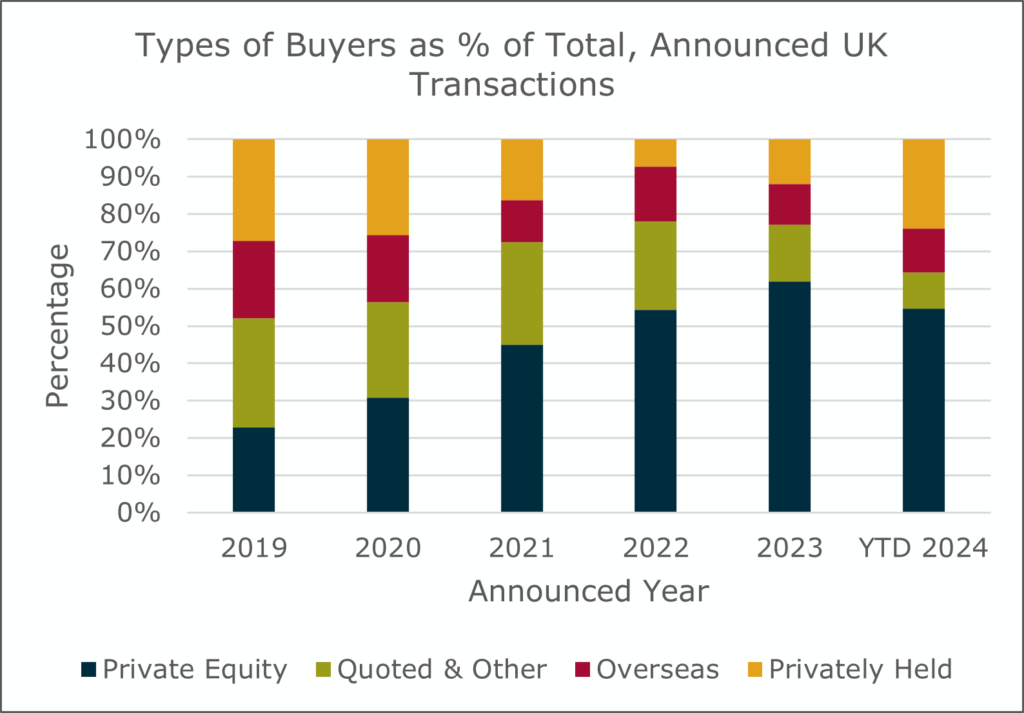

Privately held businesses as buyers continues to increase compared to previous years. However, private equity still remains the dominant force in funding acquisitions, either directly from their funds or indirectly via their portfolio companies. A notable example of the former this month was the announcement of Oaktree Capital Management’s acquisition of Close Brothers Asset Management, creating a new sizeable stand-alone wealth management group in the UK. An example of the latter was Saltus, being backed by Preservation Capital, announcing it had agreed to acquire Tavistock’s financial planning businesses which it intends to manage as a separate division. This shows how powerful a force private equity can be in helping to restructure the industry.

Source: MarshBerry Proprietary Database and Companies House. Data as of 10/1/24.

Notable transactions (September 2024):

- Close Brothers agreed to sell its wealth management arm, Close Brothers Asset Management (CBAM), to Oaktree Capital Management for up to £200m. The deal is set to close in early 2025 after gaining regulatory approval. Oaktree Capital Management, which has also invested in Atomos, another wealth manager, intends to manage CBAM as a separate investment in its portfolio.

- Brooks Macdonald agreed to sell its international arm, Brooks Macdonald Asset Management, to Canaccord Genuity Wealth Management (CGWM) for up to £50.85m as part of a strategic review to focus on UK operations. The deal, which is expected to close by March 2025, offers a strong strategic fit for CGWM’s international division and integrated wealth management proposition.

- Saltus agreed to acquire Tavistock Investments’ financial advice businesses, Tavistock Partners, and Tavistock Estate Planning Services, for up to £37.75m, pending regulatory approval. The deal adds £2.4bn in assets and over 140 advisers, bringing Saltus’s total assets under advice to over £7bn. Saltus will manage the acquired business as a separate unit under the continuing leadership of Mal Harper.

Other UK transactions (September 2024):

- Skerritts acquired Harrogate-based Ellis Bates Financial Advisers, adding over £1bn in assets under management and expanding its presence in the North of England.

- Ascot Lloyd acquired Bristol-based Whitechurch Securities, enhancing its £10bn asset portfolio amid financial challenges for the latter.

- Brooks Macdonald Group is set to acquire Norwich-based Lucas Fettes Financial Planning, adding £890m in assets under advice and enhancing its financial planning capabilities, pending regulatory approval.

- Foster Denovo acquired Glasgow-based Rosemount Asset Management, its fourth acquisition in a year, establishing a significant foothold in Scotland with over £200m in assets.

- Loyal North acquired Hertford-based IF Wealth and Essex-based Powell Financial Planning, adding a combined £56m in client funds.

- Quilter acquired fintech firm NuWealth to enhance digital capabilities and better support clients starting their investment journeys while bridging the advice gap.

- Goshawk Asset Management acquired Vermeer Investment Management and its £60.8m fund, now named the Goshawk Global Fund.

- Wealthtime is in talks to buy Craven Street Wealth, a financial advisory firm with £1.8bn in client assets.