Investment sector M&A market update

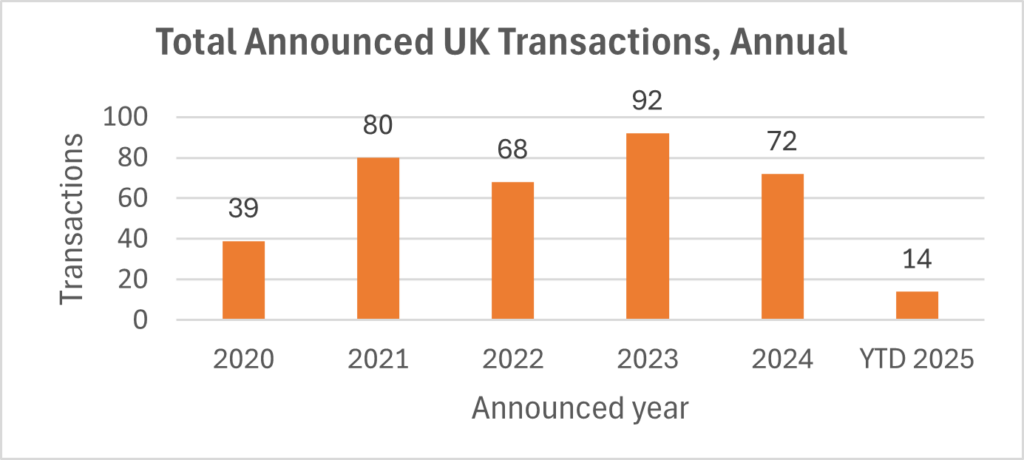

The volume of investment sector merger and acquisition (M&A) transactions above £5m of value increased in March to six, twice as many as in February, and higher than in January. March included another deal in actuarial and employee benefits consultancy, highlighting strong demand for the business model, as well as several deals involving wealth managers helped by the backing of private equity (PE) capital. But, perhaps most noteworthy was the PE-backed platform Wealthtime buying a sizeable financial planning group to add a new proposition to their organisation. There was also activity in the pensions administration space where FTSE 250-listed AJ Bell announced it had sold its non-platform SIPP and SSAS business to InvestAcc and Kingswood. Listed entity Kingswood was subject to an offer from HSQ seeking to acquire the remaining 10% of the group, another example of the shift from public to private ownership of companies in the investment sector, a trend which has been developing over the last few years.

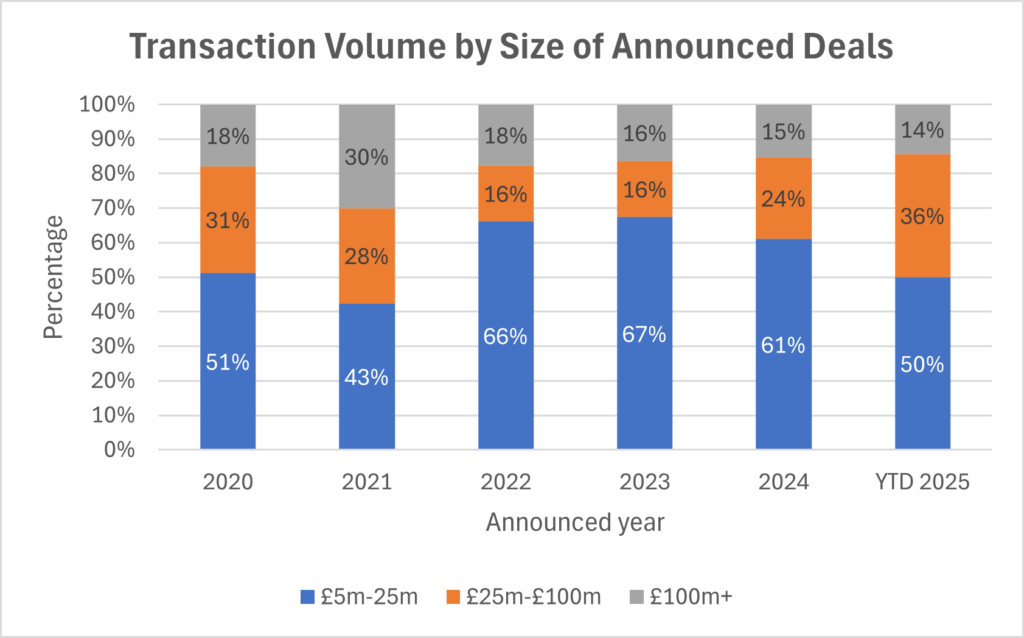

Most of the transactions in the first quarter were small, ranging from £5m to £25m in value, with only three deals larger than £25m of value. The largest deal was Howden’s acquisition of Barnett Waddingham, a provider of pensions, employee benefits and associated investment consultancy and risk services.

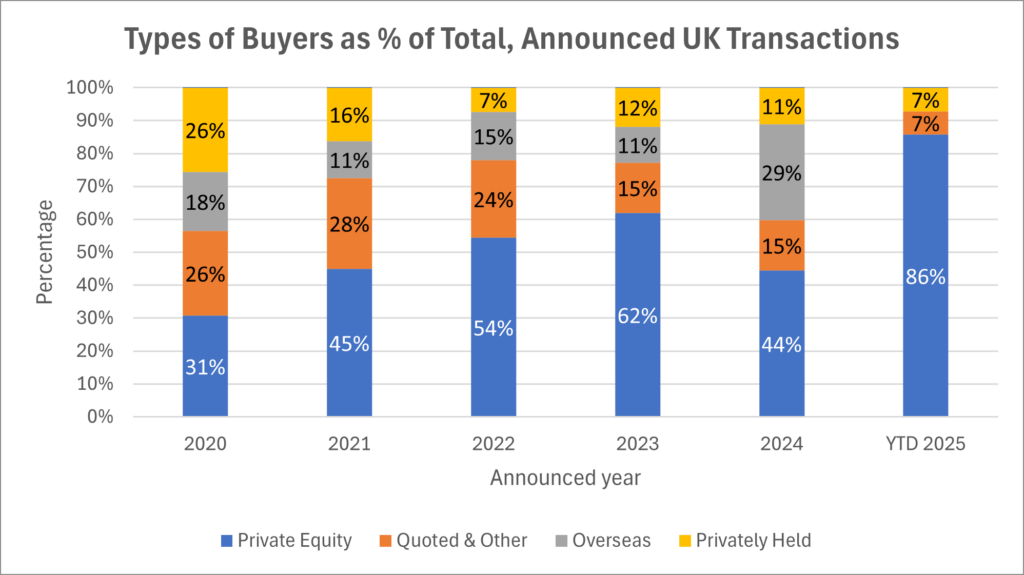

Among the buyers, PE was the most prolific acquirer group during Q1. 86% of the acquirers were linked to PE, either as direct investors or via their portfolio companies. The PE-backed consolidators accounted for a lot, and they continue to be very dominant in driving the shape of the industry. Their PE backers have gradually shifted from UK-based funds to more international, typically U.S.-based funds, albeit refinancings of consolidators have been less evident in 2025, with only one out of the four direct PE investments originating from a North American firm.

Notable transactions (March 2025):

- Barnett Waddingham, one of the UK’s leading independent pensions and employee benefits consultancies, was acquired by Howden, the global insurance and employee benefits group. The acquisition will create one of the largest pensions and employee benefits consultancies in the UK and will act as a platform for Howden to expand its provision of pensions and related investment and risk services. The transaction will result in Howden doubling its global employee benefits business in terms of employees, with c.4,000 professionals delivering combined revenue approaching £500m globally.

- Craven Street Wealth, the London-based financial planning business with £2bn of client assets and 90 staff (of which 30 are financial planners), was acquired by The Quanta Group, the recently rebranded parent company of PE-backed platform, Wealthtime. The acquisition will enable Wealthtime to offer clients the full spectrum of wealth management services, developing on its existing platform and discretionary fund management to now also include financial planning and advice. The transaction takes The Quanta Group’s total assets under advice to £16bn.

- AJ Bell Platinum, the SIPP and SSAS business of the FTSE 250 constituent AJ Bell, was sold to InvestAcc Group, a specialist pension administrator, in a deal worth up to £25m. The entity sold is part of AJ Bell’s non-platform business and has c.3,600 customers with £3.2bn of assets under administration. The transaction is expected to complete in the second half of 2025.

Other UK transactions (March 2025):

- Partners Wealth Management, part of 7IM, announced the acquisition of Aberdeen-based Johnston Carmichael Wealth, the wealth management arm of Scotland’s largest independent accountancy and advisory firm which has £855m in client assets.

- Private equity firm HSQ, a subsidiary of Pollen Street Capital, confirmed its unconditional offer to increase its investment in Kingswood and buy the remaining 10% of shares, with a view to de-list and merge the company with another wealth manager.

- Marlborough Fund Managers took a minority stake in London-based financial planning firm First Wealth, which has £480m in client assets.

- Shackleton Group, formerly Skerritts, announced the acquisition of Richmond-based PK Financial Planning, adding £200m of assets under management (AUM) and expanding its operations into the South East.

- Clifton Wealth Partnership announced the acquisition of seven advice businesses, collectively adding £500m of AUM. The deals were for Colchester-based Capel Court, Llanelli-based Financial Solutions Wales and Davies Craddock, Bristol-based Tailormade Financial Services, Nottingham-based Absolute Financial Services, London Private Wealth, and of its AR firms Clifton Wealth Partnership Portishead (previously named Pure Advanced Financial Planning).

- Wren Sterling announced the acquisitions of three advisory firms collectively adding a total of £300m of AUM. The deals were for Kent-based Investment Choices, Cotswolds-based Broadway Financial Planning, and Perth-based JLS Associates.

- Finli Group announced the acquisition of Somerset-based Schaefer Financial Management and Birmingham-based MMR Financial Planning.

- Radiant Financial Group announced the acquisition of Newcastle-based independent financial adviser Seven Bridges.

- Amber River announced the acquisition of Belfast-based Finance Matters through its Northern Irish business Johnston Campbell.

- Lumin Wealth announced the acquisition of the mortgage arm of RBS Associates.

If you have questions about Today’s ViewPoint, or would like to learn more about how MarshBerry can help your firm determine its path forward, please email or call Fred Hansson, Managing Director, at +44 (0)20 7444 4393.