Like many business sectors in Europe, insurance intermediaries typically have an ageing workforce. The average age of French intermediaries is currently 49 years old. In Italy only one in 10 people working at an intermediary is below 40. The rising average age of the insurance brokerage workforce – and even more importantly, owners – are a critical factor in the sustainability and future of many intermediaries. The insurance industry is fundamentally a relationship business, built on long-term trust and understanding of client needs. Hence, succession planning is an important factor in the consolidation drive.

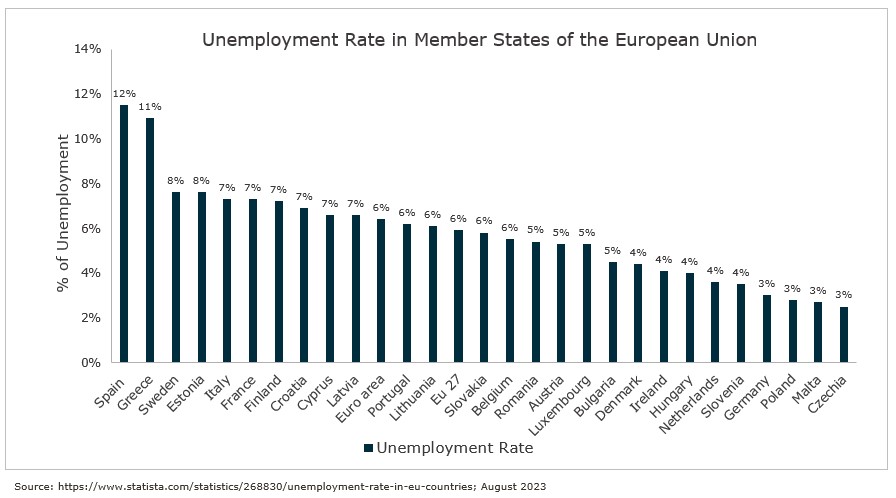

At the same time, intermediaries are having to compete in the “war-for-talent” to attract new employees, as well as retain top performers, lest they be recruited by competitors. Labour shortages have become a feature of economies across the world. These shortages are driven by sustained economic demand paired with pandemic-related shifts in employment between sectors and a limited availability of untapped labour capacity. Across the EU (excluding the UK) the unemployment rate as of August 2023 is 6.4%, ranging from 11.5% in Spain to 2.8% in Poland. Unemployment and youth unemployment rates are thus at record lows. Under these conditions employers have to fiercely compete for employees by offering attractive salaries and job prospects.

Insurance intermediaries are not spared from this trend. On the contrary: a 2022 survey among UK brokers by Aviva found that growth ambitions of brokers were hampered by recruitment issues. According to the survey, 98% of brokers had a vacancy with 53% of vacancies being open for four months or longer.

To have a fighting chance in this “war-for-talent”, intermediaries will need a business model that can sustain higher wages and attract talented employees by offering an enticing work environment and career advancement. Looking at your broker compensation structure is an important first step towards competing in this war. A well-designed compensation plan has tremendous impact on:

- Growth

- Talent acquisition

- Perpetuation planning

- Sales culture

- Employee performance

In times of highly competitive and challenging job markets, modifying broker compensation plans to peak effectiveness can give intermediaries an advantage in retaining and attracting top talent. As the industry and market change, and intermediaries add services, capabilities, and a higher level of technical employees, there are benefits for refining compensation plans.