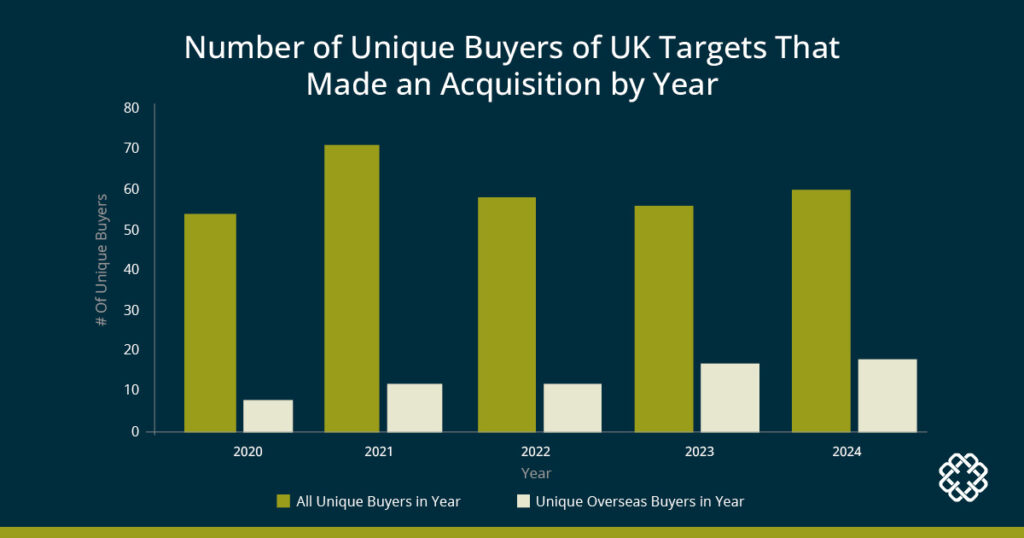

In terms of deal volume, 2024 was a record-setting year in insurance distribution, with 152 announced UK transactions. Overseas buyers were quite active with 32 transactions (or 21% of all UK deals) in 2024, spanning across 18 unique overseas buyers. An even greater number are still actively looking for merger and acquisition (M&A) opportunities here. This is not limited to buyers in the U.S. – there were also deals for UK targets involving buyers from five different countries in 2024; notable UK deals involved U.S., Australian, and French buyers. In a crowded market that still has too many consolidators, there’s no sign of a decrease in demand for UK businesses.

Why are U.S. companies seeking out opportunities in Europe?

In the same way that larger UK consolidators are looking to Europe to generate an acquisition pipeline, U.S. firms are realizing that acquiring in the UK and Europe will help sustain their own momentum. For U.S. buyers, the UK is a relatively easy market to enter because of a common language and similar business culture. It is also a global insurance centre which U.S. brokers may already be working in by placing business into Lloyd’s of London.

The chart below shows how overseas buyers are increasing their presence in UK acquisitions.

Trends that will impact the market in 2025

Five of the top 10 UK brokers are U.S. headquartered, including major players like Aon and Arthur J. Gallagher – who are amongst the most active acquirers, both directly and indirectly. (i.e., Acquisitions of targets that have a UK presence such as NFP and AssuredPartners.) As this domestic consolidator model evolves, it will lead to other notable developments, including:

- The evolution will cross borders. While the U.S. and UK are mature markets compared to the rest of Europe, there are still opportunities for consolidation outside these countries. Interest is also arising with buyers in Australia and Asia since it is far easier for consolidators to transact in the UK.

- Overcrowding in domestic consolidators introduces more challenges. As supply diminishes, a domestic-only M&A strategy will become increasingly unappealing for private equity (PE) investors. Growth minded firms will need to seek opportunities overseas, add or build out new adjacencies, develop deeper focus on finding organic growth, add more integration to drive margin improvements, or sell up.

- Valuations will not necessarily increase. Surprisingly, an increasing scarcity of targets will not necessarily drive higher UK valuations and 2025 is unlikely to see further increases. PE-owned firms will find it harder to refinance, therefore management teams wishing to remain independent with PE backing will need a compelling growth strategy.

- New entrants will drive up competition. There are a large number (10+) of sizeable U.S. firms (>$1 billion) with aspirations to grow internationally and the UK is a natural starting point for such a strategy. But it’s not only the U.S. with an eye on the UK. There are ongoing discussions with several larger European groups looking at cross–border M&A, even outside the UK.

- Unlikely pairings will become more commonplace. Brokers broadening their service offering and/or pursuing vertical integration to grow via M&A will continue through 2025, therefore, the industry will see more unexpected deal combinations. As a result, this blending leads to greater risks around cultural compatibility and achievability of synergies than in ‘more of the same’ type deals.

- Deals will get larger. Later stage consolidation will inevitably involve ‘consolidation of consolidators’. This was demonstrated in the U.S. with the recent acquisitions of NFP and AssuredPartners.

- The number of UK commercial broking brands will shrink. Multi-brand strategies will become increasingly rare, instead shifting to common identities due to the experience of the largest consolidators that clients care more about service and relationships than the brand.

- Retirement driven sales provide the ‘supply’ for consolidation. Owners retiring will remain a major driver of sales. Across 131 vendors in 2024 the average age of a seller was 58.

In an encouraging sign, the proportion of deals involving a privately held buyer actually increased in 2024 so there is still scope for smaller owner-managed brokers to engage in (typically) local M&A, where the ‘usual suspects’ have not yet achieved a monopoly on activity.

What lessons can the UK draw from the more advanced sector consolidation in the U.S.?

The most far-sighted and ambitious PE-backed consolidators recognize that as the availability of UK assets dry up, they need to source deals in Continental Europe. This will be tough for those who are late to the game and findings indicate that, in Europe, most have almost no relationships at all and have even less brand recognition. Building brand recognition is imperative to create relationships, and therefore opportunities, amongst natural broker targets.

Vertical integration was a 2024 trend as larger consolidators widened focus beyond core property and casualty (P&C) broking business; all now own and/or are building out MGA (Managing General Agent) capabilities. That trend will most likely continue in 2025, and other adjacencies will become increasingly important – notably health insurance and employee benefits which can widen offerings to clients. From an M&A perspective, targets in these segments are generally cheaper than just a core broking business.

Current market conditions are arguably unlikely to be a catalyst for a step-up in sector valuations in 2025. This increased differentiation in valuations is expected to result in owners and sellers taking an increasingly proactive approach to integration and a more thorough level of preparation before a sale, to ensure that every lever is being pulled to achieve the maximum possible price. Individual firms should take actions themselves to ensure that they uncover opportunities to drive value and create a strategic approach to enhance financial growth.

For the latest insights and analysis into the UK insurance distribution landscape and industry trends – download MarshBerry’s Insurance Distribution Market Report – UK.