The robust market for private equity (PE) deals in the insurance brokerage space looks likely to continue into 2022 after a banner year in 2021.

Some reasons for promising private equity trends 2022 include an abundance of available dry powder, continued strong interest from private equity to consolidate the insurance brokerage sector, capital needed for agencies to invest in resources and technology, and all-time high valuations.

2022 Private Equity Deals & Demand for Insurance Brokerage Sector

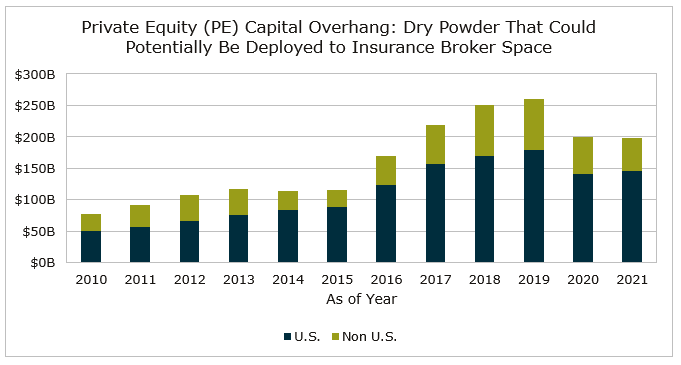

According to a recent survey of about 400 PE investors, 62% predict that 2022 PE deal activity in all sectors will be up slightly or remain flat year-over-year. In the insurance space, sixteen active acquirers took on new debt for a total of $21.6 billion in new debt issuances from 4Q2020 to 4Q2021. Total capital, or dry powder available to be deployed at the end of 2021 was $197.7 billion, relatively flat compared to 2020’s $199.2 billion. It was down compared to 2019 and 2018 when deployable capital was $259.9 billion and $251.1 billion, respectively, but it is still a significant amount of capital relative to historical levels.

MarshBerry provides insurance brokerage advisory services and financial advisory consulting services. Contact an expert to get help through all stages of ownership.

In 2021, there were 52 private equity backed brokers and these firms accounted for 703 of the 923 transactions (76.2%), continuing a multi-year trend of dominating the insurance distribution M&A market. Total deals by these buyers have increased at a CAGR (Compound Annual Growth Rate) of 26.9% since 2018. Private equity remains very attracted to insurance distribution for many reasons including the industry’s continued resiliency, fragmented market, residual income and low capital costs. After all, the insurance sector is one of the few industries that made it through the great recession and COVID-19 shutdowns with only a few bumps and bruises. And with a low-risk profile, the risk-adjusted return on investment for insurance distribution is high relative to other investment opportunities.

Valuation and Supply of Insurance Agency Sellers on Private Equity Trends in 2022

Numerous agency owners that were contemplating a sale in the near future decided to pull the trigger in 2021 because of the risk of an increase in capital gains under the Biden administration. Thus, buyer pipelines heading into 2022 were depleted and will need to be replenished. This is good news for agency owners as demand vastly outpaces supply and agency valuations continue to remain strong. The average base (or guaranteed) purchase price jumped 12.9% in 2021 over the upfront proceeds that sellers received in 2020. Valuations have almost doubled since 2010 and the first quarter of 2022 has started out with some of the highest pricing on record. Some are predicting a drop in pricing in the second half of 2022 assuming the Fed decides to increase interest rates to combat inflation. If this were to occur, it would be the first decrease in pricing since 2016.

The good news for private equity buyers is that their pipelines could soon be full. Independent agency owners continue to feel the pressure to find talent, grow organically, and invest in resources and technology to provide a full suite of services to meet client needs. Partnering with a buyer that has already invested in resources or that will provide capital to accelerate growth can be a very compelling option for many struggling agency owners. In addition, as external pricing continues to increase, internal perpetuation becomes more and more of a challenge. Pricing for internal stock trading has not come close to increasing at the same pace as the external market, and the result has been a significant valuation gap between an internal and external sale.

Overall, it is a favorable sellers’ market, and it will likely remain that way for at least the first half of 2022. Private equity backed deals will likely continue at an aggressive pace driven by high levels of dry powder, strong demand and high valuations.

If you have questions about Today’s ViewPoint, or would like to learn more about activity in the M&A marketplace, email or call Chris Darst, Managing Director, at 949.234.9648.

Subscribe to MarshBerry’s Today’s ViewPoint blog for the latest news and updates and follow us on social media.