Insurance and Environmental, Social and Governance (ESG) regulations are inextricably linked through their core principles – to mutualize and mitigate risk for the benefit of society. As risks evolve, so must brokers and policies. In a previous Today’s ViewPoint (ESG: Too Costly To Ignore), ESG tenets were defined and quantified against the cost of ignoring ESG requirements. Following the frameworks can help your firm decrease ESG risks while benefiting from the many advantages of incorporating ESG initiatives.

Staying ahead of these trends can separate you as a top-tier brokerage firm. Societal shifts allow insurance brokers to act early in certain ESG areas, outpacing competition and building rapport with clients and employees. Proactively addressing concerns can create ESG opportunities and enhance your bottom line.

Where are ESG opportunities?

In addition to the rules, regulations, and disclosure requirements, significant money is being invested in new technologies and infrastructure to move companies toward their ESG goals.

MSCI, Inc. found that companies with higher ESG scores experience lower capital costs, lower equity costs, and lower debt costs. Furthermore, another study found that ESG scores translate to an estimated 10% lower cost of capital. This cost decrease is due to companies with highly rated ESG policies associated with lower regulatory, environmental, and litigation risks. This means ESG is an imperative strategic necessity for firms to consider.

How will evolving ESG standards impact the insurance industry?

To promote transparency and standardize disclosures, global and domestic regulations have been enacted to govern and reinforce specific areas of ESG. Examples include the 2015 Paris Climate Agreement, Pay Transparency Laws, and Nasdaq’s board diversity requirement

One of the most recent regulations is the Security and Exchange Commission (SEC) climate control disclosures for investors – to be implemented in April and October 2023. While the SEC has not yet issued more specific guidance on some proposal topics, insurers still face a move from existing voluntary disclosures of climate-related risks to mandatory requirements — including the potential for increased legal liability.

Regulators are not the only concern for insurance brokerage firms. Investors and rating agencies increasingly use ESG-related metrics to assist in valuations. The three most prominent insurer rating agencies, Standard & Poor’s, Moody’s, and Fitch Ratings, have incorporated ESG themes into their credit rating methodologies.

Additionally, underwriters use ESG regulations to predict risk models better and write policies. Organizations like the Net-Zero Insurance Alliance (NZIA) have committed to setting and publicly disclosing their first underwriting portfolio decarbonization targets by mid-2023. This will give concrete form to members’ commitments to decarbonize their Property and Casualty (P&C) underwriting portfolios. Although creating a portfolio emissions strategy is a future goal, these aspirational initiatives are still only on the horizon due to current limits on tracking and evaluation.

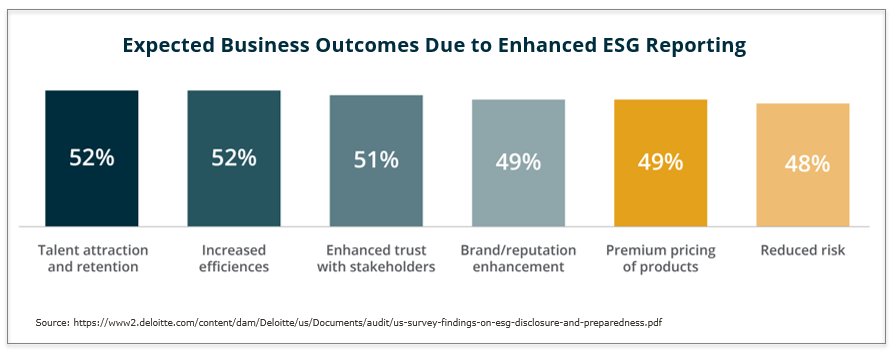

ESG implementation can have effects across a company. A recent study on sustainability found the following anticipated benefits from enhanced ESG reporting.

What should insurance agencies do today?

Insurance brokers should view this as an opportunistic moment for their business strategy. An offensive approach to ESG may allow firms to unlock growth and differentiate themselves in the market.

Recognizing a need to invest in a strategy aligned with ESG frameworks is an excellent start to your strategic plan. As many businesses face increased regulations and risks associated with ESG practices, brokerages should have a plan to support them. You can start with these questions that may uncover opportunities for ESG integration:

- How can you target companies or infrastructure projects with insurance products and services? As “green” technologies roll out, they will have insurance needs. This is the same for new companies who target environmental solutions. Being an ESG expert gives you a first-mover advantage and enables customer acquisition.

- Do you understand ESG and its impact on your clients? Proper ESG risk mitigation makes for less volatile companies and strengthens investor confidence. Companies are rewarded with access to credit and debt markets, positive brand equity, reinvestments, and sustainable, long-term growth. As a trusted risk advisor, you are uniquely positioned to assist your clients in their ESG pursuits.

- What ESG risk services can you create for clients to decrease their risk portfolio? By offering ESG-targeted risk reduction services, you add value to your services by helping clients reduce risks and build your reputation as a broker. A broker who can look at a business holistically to predict and mitigate risks is invaluable.

- Are you applying ESG practices to help clients mitigate costs? While medium and smaller businesses may not be subjected to the same stakeholder scrutiny or regulatory requirements as more giant corporations, they’re vulnerable to ESG incidents. Insurance providers are uniquely positioned to encourage clients to decrease risk and costs through proper management.

- Do you know the impact on underwriting portfolios? An ESG focus helps decrease volatility and workforce-related accidents that damage reputation and increase fines. The bottom line is that higher ESG ratings lead to better underwriting performance.

As a broker, your role goes beyond risk identification and clean-up after the fact. You must help businesses and individuals stay proactive in risk mitigation. New laws, regulatory changes, and social pressures rapidly change the ESG space. By continuously educating yourself and keeping up with industry standards, brokers can get ahead of the trends, offering top-tier service for their clients.

Insurance is all about predicting, reducing, and managing risks. The new evolution of risk includes topics related to ESG. Now is the time to start using ESG to your advantage. The success and profitability of your firm could depend on it.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230

Thought Leadership Events

At a MarshBerry event, the outcomes are just as important as the experience. Attendees leave with the most advanced data, cutting-edge insights, new relationships, and key takeaways that will help them innovate their businesses. Join other insurance agencies and brokerage executives, along with MarshBerry advisors, at a MarshBerry event to explore strategies that will help you lead your firm to growth and profitability and learn how to maximize value.