As the wealth advisory merger & acquisition (M&A) transactions of Q1 2023 were counted, it was hard not to reflect on the amount of macroeconomic uncertainty the first quarter saw. Continued inflation sparked another Federal Reserve rate hike. There was volatility in the financial markets, which saw positive returns in January, negative returns in February, then ending Q1 in positive territory – for all three major indices. And finally, a banking crisis in early March creating an increased talk of recession.

But despite all the macroeconomic noise, retirement and wealth advisory firms continued to draw the interest of acquirers looking to diversify their investments, bolster their roster, and expand into this adjacent space.

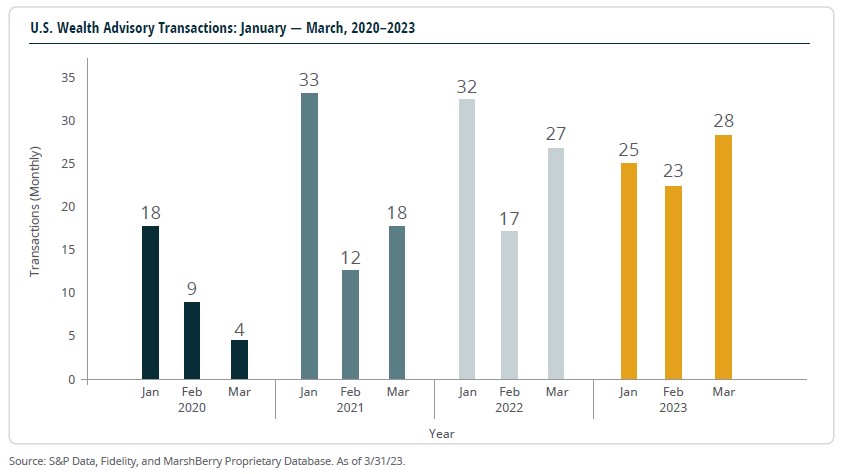

March 2023 delivered 28 announced deals, bringing Q1 2023’s total to 76 – the exact same number of announced transactions as Q1 2022. But if you look more closely – Q1 2023 appears to have a tighter distribution and overall better trend. This is impressive because Q1 2022 was propped up by a high January total that most likely had a lot of deals that spilled over from 2021.

There is a consistency with the activity in Q1, especially coming off a strong February, which historically slumps after January. But March stormed in, despite the concerns around the overall economy, and provided optimism for the rest of 2023. With an average of 24.5 deals per month over the past 15 months, there certainly is enough momentum to exceed 2022’s record-breaking total of 292. Only time will tell.

Private equity-backed buyers still represent a majority of the transactions accounting for 41 of the 76 wealth advisory transactions (54%) in Q1 2023, however, this trend is down as compared to 68.4% for full year 2022. The Private equity-backed space is still sending bullish signals with 8 private equity investments closed in the first quarter.

Independent firms accounted for 21 of the total deals (28%) up from 18.8% of transactions in 2022 with public firms accounting for 14 deals (18%) YTD also up from 12.7% of transactions in 2022.

Insurance brokerages continue to target wealth advisory firms

There has been a consistent upward trend in acquisition activity on the part of insurance brokerage firms over the past three years. The number of wealth advisory businesses acquired by insurance brokerage firms increased from 10 deals in 2020 and 33 deals in 2021 – to 41 total closed transactions in 2022. So far in 2023 – there have only been seven announced transactions in Q1 2023. This is down compared to 12 deals announced at this time last year in Q1 2022. Whether this is a shift in the trend or simply a slow first quarter for insurance brokerages will become clearer in the next several months.

Deal Spotlight: Monroe Vos Consulting

March 9, 2023: Captrust Financial Advisors (Captrust), based in Raleigh, NC, and backed by private equity firm GTCR, announced its acquisition of Houston, TX-based, registered investment advisory firm Monroe Vos Consulting (Monroe Vos).

Monroe Vos, who provides advisory and wealth management services to high-net-worth individuals and family offices, manages $5.8 billion in client assets. Founded in 1994, and with another location in Birmingham, AL – the 17 Monroe Vos employees will join Captrust, with an opportunity for equity ownership for employees with three or more years with the company.

Jim Vos, co-founder, stated their decision to sell was based on the best path for scaling back-office resources (tech, research, pricing power) and perpetuation options. Vos said that the ability for their whole team to have equity ownership was an important selling point.

Captrust has over 75 locations across the nation and has assets under management (AUM) of $125 billion with assets under advisement (AUA) of $775 billion. Continued growth through acquisitions is an important part of Captrust’s business model and strategy. Rick Shoff, Managing Director of Advisory for Captrust, stated that more deals are coming down the pike and will be larger in value than their 2022 counterparts. This seems to bode well for the space.

The road ahead

Looking towards the next quarter of 2023, it would be remiss to ignore ongoing economic conditions which could turn at any moment. The influences of inflation, interest rates, labor shortages and recessionary fears could all lead to factors that directly influences M&A activity.

While dry powder is still available, those with the need to access debt capital in order to acquire targets, are starting to become more selective in their search criteria. They are looking for firms that display predictable consistency of higher-than-average organic growth, operate in highly desired geographies, or have capabilities that align or fill gaps that buyers are searching to fill. Even now, the deals that are getting done are with the higher quality firms that check the boxes from a strategic standpoint.

The momentum for investment in the wealth advisory space has been building over the past few years. And despite the higher cost of debt capital and recent market volatility, demand continues to outpace supply with over 40 private equity buyers actively pursuing acquisition strategies.

The market remains cautiously optimistic and is encouraged by a strong first quarter of activity, but MarshBerry will continue to watch and listen to the market and provide insights as the year progresses.

If you have questions about Today’s ViewPoint, or would like to learn more about how MarshBerry can help in your wealth management strategies, please email or call John Orsini, Director, at 440.220.4116.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230

Disclosure: All deal count metrics are inclusive of completed deals with U.S. targets only. Scorecard year-to-date totals may change from month to month should an acquirer notify MarshBerry or the public of a prior acquisition. 2022 statistics are preliminary and may change in future publications. Please feel free to send any announcements to M&A@MarshBerry.com.

Source: S&P Global Market Intelligence, http://www.insurancejournal.com, http://www.businessinsurance.com/ and other publicly available sources.