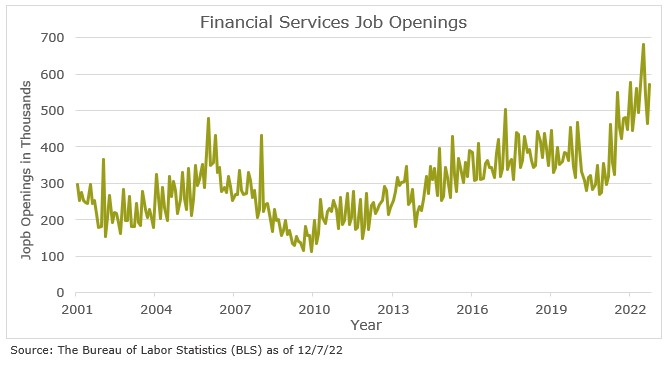

The post-COVID environment has created an evolving labor force with new and more dynamic motivations and career aspirations. In a highly competitive hiring environment, firms must be innovative to both attract new talent and retain high performing employees. As of October 2022, there were 570,000 job openings in the financial services industry.1 CNBC ranks financial services as the second highest industry for job openings, above technology and information industries. This number continues to trend upward as attrition remains high due to several factors, ultimately forcing pressure on talent acquisition and retention. To address hiring needs and create a high-performing workforce, firms must adapt their process to attract and retain previously under-leveraged demographics more effectively.

The Insurance Industry Faces Specific Hiring Challenges

COVID spurred workers to evaluate career choices leading to “The Great Resignation” which evolved into “The Great Reshuffle” with workers more aggressively switching jobs. In addition, inflation and soaring prices have increased employee demands for higher wages, enhanced benefits and flexibility. While this talent crisis is putting pressure on employers to find suitable candidates, the insurance industry faces two additional challenges: a potential loss of intellectual capital transferring to the next generation of talent and underperformance due to lack of diversity.

The current insurance workforce is aging out and young workers perceive a career in the insurance industry staid and uninteresting. The number of insurance professionals aged 55 and older has increased 74% in the last ten years. It is estimated that over the next 15 years, 50% of the current insurance workforce will retire, leaving more than 400,000 potential open positions.2 And yet, millennials and younger workers are uninterested in pursuing a career path in insurance with only 4% of millennials interested in working in insurance. Without a pipeline of younger workers being mentored and trained by senior executives, intellectual capital will be lost.

Additionally, in the insurance space, women are drastically underrepresented, even compared to other industries. According to MarshBerry’s proprietary financial database, Perspective for High Performance (PHP), in 2021, women in the insurance brokerage industry made up only 19% of executive positions and 23% of production roles.

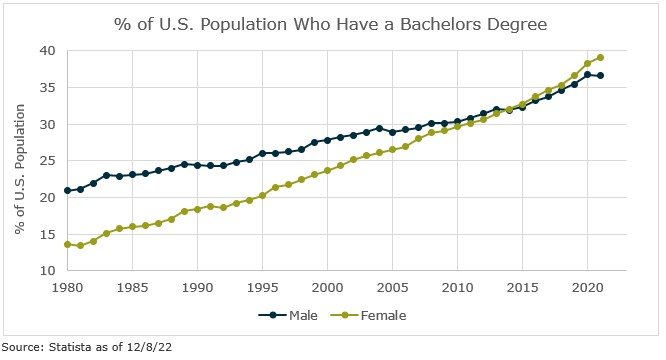

Across the board, women are an underutilized employment resource, making up 58% of the U.S. workforce, but only holding 34% of senior leadership roles.3 Currently, women earn 58% of bachelor’s degrees and 61% of associate’s and master’s degrees. This highly educated demographic has experienced higher levels of career movement, especially post-COVID. The power of diverse workforces has been proven repeatedly; companies with women executives are 30% more likely to outperform other companies.4

Women’s Career Tracks are Vastly Different Today

Just as COVID pushed an extraordinary number of workers into retirement, it also pushed women out of the workforce. Women’s labor force participation decreased severely during the pandemic and has not yet returned to pre-COVID levels. Nearly a third of women in finance temporarily or permanently left their jobs during the pandemic.5

Coming out of the pandemic, women experienced greater burnout due to simultaneously managing personal and career responsibilities. Additionally, during the pandemic, 58% of parents were unable to find childcare, causing increased pressure for women to leave work to fulfill childcare roles.6 Due to disparity in income, caregiving burdens were often carried by women. While the pandemic may have been the trigger to drive women from the workforce in disproportionate numbers, the legacy of roadblocks for women in the workforce compounds the problem.

Women continue to face the challenges of working in an inequitable system where promotion opportunities to management level positions are more difficult to attain. The initial hurdle for women comes from limited advancement opportunities from entry level positions to management, creating a pipeline challenge for more senior level promotions. The pandemic only further delayed women’s progress on their career paths and professional development. A study by McKinsey & Company illustrates in 2021 women leaders left the workplace at the highest rate since 2017, taking with them their knowledge and experience.7 Currently women, especially young women, rank flexibility, commitment to employee well-being, opportunities for advancement and manager support as the most important career qualities they value.7

5 Strategies for Attracting Women to the Insurance Industry

Recruiting a currently underrepresented demographic can be difficult. To attract high performing women in today’s market requires specific targets. The number of educated and experienced women switching jobs or reentering the workforce gives this group the power to be more selective. Here are a few strategies for attracting and retaining women in the workplace:

- Create clear opportunities for advancement. Clearly defined job roles, responsibilities and a transparent career path is critical to attracting the interest of women job seekers. Women are pushing for recognition and appreciation of their work, training, and mentorship to create a career over simply a job. Establishing a strong training and development program increases your firm’s ability to retain talent and have high performing employees on staff.

- Allow for flexibility. Now more than ever women are looking for a balanced work life. Allowing for hybrid or work from home options can appeal to many women looking to create a more inclusive lifestyle. Flexible work hours or shared schedules are other ways to allow for more balance.

- Embrace culture and lifestyle changes, including offering competitive benefits targeted to women. Offering paid time off and health insurance may have once enticed people into a job, but women currently value a broader variety of benefits. Healthy flex days, gym memberships, volunteer time off, sabbaticals, the list goes on. As firms consider additional duties placed on women, offers of extended parental leave and childcare are becoming a cultural norm.

- Promote your company values. Overwhelmingly, women want to work for a company that aligns with their values. Finding a company that is a good cultural fit is becoming top priority among women and younger job seekers. Effectively communicating your firm’s value proposition will attract individuals who identify with your firm and will be willing to go the extra mile.

- Normalize career breaks. Many highly skilled women have left the workplace to become caregivers. This trend was accelerated during COVID. Removing the stigma around a break in a resume timeline allows employers to access an untapped market of educated and skilled workers.

Why is This Important to the Insurance Industry?

The insurance industry is at a crossroads with its aging workforce and the lack of interest from younger demographics. With highly skilled and educated women looking for new careers with opportunities for advancement, firms in the insurance industry may want to look at this talent pool as an opportunity to grow their workforce and create perpetuation plans while enhancing their team’s diversity.

Now is the time to start implementing strategies that will help your company hire and retain the best talent to thrive.

If you have questions about Today’s ViewPoint, or would like to learn more about finding talent for your firm, please email or call Brandy Carbone – Vice President, at 212.972.4882.

Investment banking services offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230