In the late 1990’s, the Barnett Bank case1 (1996) and Gramm-Leach-Bliley Act2 (1999) opened the flood gates of bank attempts to drive fee-based income by cross-selling insurance to their banking customers. However, even banks with the best cross-selling activity, often disappointed bank leadership. Here’s why:

- The sales culture of insurance brokers differed from the institutional culture of banks.

- Insurance carrier appetites often did not align with the insurance referrals from bank relationship managers.

- Referrals between business lines are dependent on trusting relationships, which many banks did not foster due to turnover or differing goals.

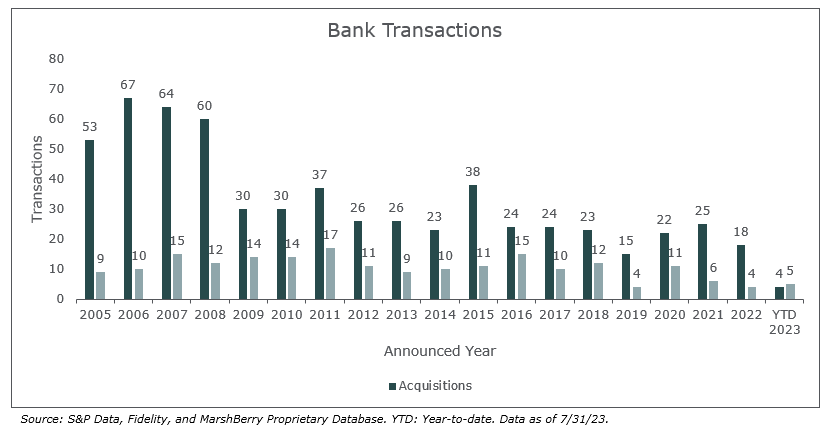

Since 2005, there have been 609 announced acquisitions of insurance brokerages by financial institutions, while there have been 199 announced divestitures. Many of the earlier divestures arose when the parent bank was acquired by another bank that did not share the acquired’s appetite for the insurance brokerage space.

However, the overall number of insurance brokerage acquisitions by banks has been on a steady decline for the past 15 years. In 2007, these transactions represented approximately 21.7% of total announced insurance brokerage merger and acquisition (M&A) transactions. By 2012, that percentage dropped to 6.4%, and in 2022 was only 2% of total deals. This year, through July 2023, there have been more divestitures (five) of insurance brokerages by banks than acquisitions (four).

Why are banks divesting their insurance brokerage?

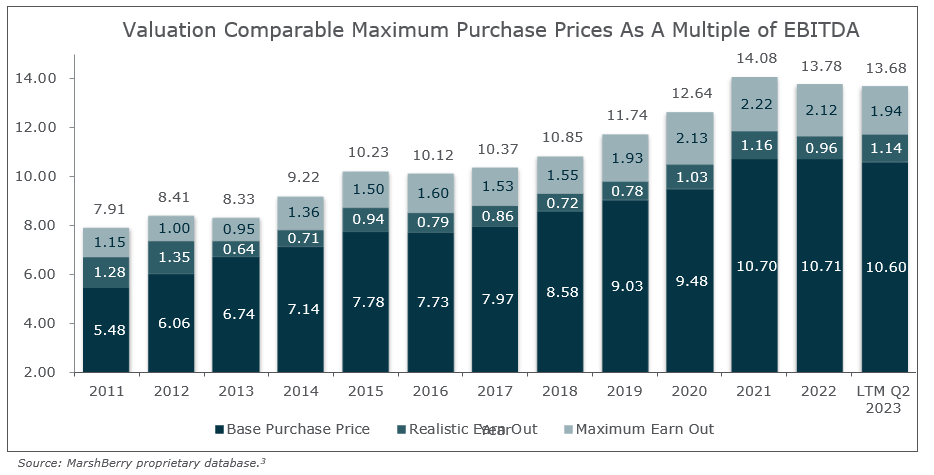

Since 2010, the number of private equity (PE) backed buyers have increased from three buyers to over 60 – helping to push insurance brokerage valuations to all-time highs. Current valuations are significant premiums to the original investments made by banks to acquire their brokerage. At the same time, PE buyers are making it difficult for bank buyers to acquire brokerages by bidding up valuations, forcing bank buyers to back off due to the difficulty justifying the premium valuations for their buy and hold strategy.

With the escalation of insurance brokerage values, coupled with the recent pressure on bank balance sheets due to the Federal Reserve (Fed) tightening of credit and increases in the discount rate – regional banks are starting to take a closer look at the role insurance plays in their business.

Additionally, with the Fed tightening credit and increasing the discount rate starting in March 2022, and the eleven rate increases to date, bank investments came under pressure, triggering a goal to increase balance sheet capital.

Also looming on the horizon are the challenges in commercial real estate, an area of concentration for many regional banks. With commercial occupancy lower since the pandemic and the related decreases in property valuations, at a time when commercial mortgage rates are increasing, financial institutions are preparing for tougher times ahead for their loan portfolios, due to delinquencies and foreclosures. Financial industry watchdogs have already downgraded some banks, with others being scrutinized.

Finally, there is a lack of equity incentives that are comparable to non-bank brokers, including private, PE backed, and public, which creates a challenge in attracting and retaining talent and further acquisitions.

The convergence of these factors creates a financial incentive for financial institutions to reconsider their strategic priorities and consider divesture of their insurance business.

What must bank directors consider as they debate the decision to double down or fold?

Bank-owned brokerages face the challenges shared by all insurance organizations. With capital constrained and the ongoing fight for talent, banks must consider the following initiatives to improve the organic growth of their insurance business:

- CEO-level commitment to the cross-selling initiatives across the organization. This is still the holy grail that many organizations have not made a priority. This initiative must include:

- Relationship building and education across lines of business.

- Incentive compensation plans that reward cross-selling behaviors.

- Cross-functional sales teams that build trust and client development activities.

- Ongoing investment in new producers. To backfill perpetuation needs and build the sales team, agencies must make producer recruiting an ongoing activity.

- Improve the sales velocity (new business) of all agency producers through better sales management and mentorship.

- Investment in resources that provide producers with compelling value propositions for new customers.

- Incentive programs, including equity, that attract, retain, and reward high-performing producers.

The challenge of implementing these initiatives, and the required investment, may be outside the budget of banks at a time when they are fighting off the effects of inflation and potential recession. However, if a bank is not willing to make these ongoing financial commitments to their insurance brokerage, they should consider other strategic options. Strategic options being discussed in bank board rooms include:

- Doubling down on their agency investment with organic growth initiatives.

- Positioning for a financial sponsor to take a minority stake. Divesting a portion of the insurance business allows banks to optimize their capital and leverage ratios and unlock additional value for reinvestment or to distribute to shareholders.

- Embarking on a search for a strategic buyer or investor to acquire the entire insurance brokerage business. This strategy will unlock the most value and provide the financial institution with the capital to shore up their balance sheet and invest in other initiatives.

MarshBerry brings decades of experience in the bank insurance space to lead financial institutions through this strategic planning process, and to consulting and investment banking teams to implement those strategies.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230