Most insurance brokerage firms focus on things like aggressive sales goals, new business prospecting, or pipeline management to drive profitability and growth. While those elements are critical to a firm’s success, there are other, often missed opportunities to retain clients, increase revenue, and drive efficiency. MarshBerry analysis found that brokers that maximize opportunities to round out accounts and cross-sell are growing significantly faster than their peers and uncovering surprising synergies.

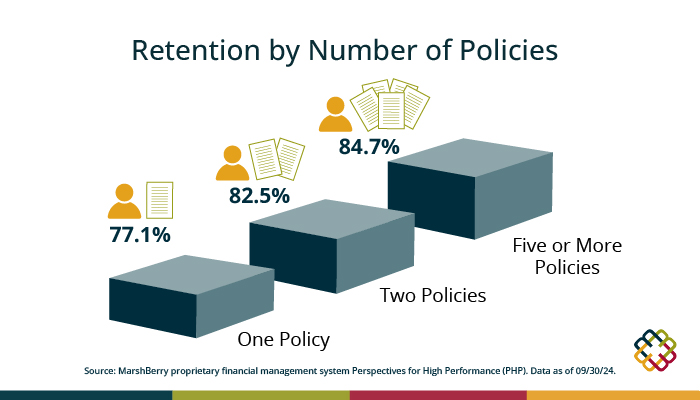

More policies equal better retention

As shown in the graphic below, retention improves greatly as customers hold more policies—rising from 77.1% for single-policyholders to 84.7% for those with five or more. While that 5.4 percentage point increase might appear small, the compounding effect over time is significant. Over a 5-year period, a multi-policy customer (with a retention rate of 84.7%) is nearly twice as likely to stay with their broker compared to a single-policy customer (with a retention rate of 77.1%). That’s a 60% improvement in long-term customer value, driven purely by stronger retention. When scaled across a book of business, these differences translate into exponential growth—more renewals, more opportunities to cross-sell, and far greater lifetime profitability.

An opportunity for higher revenue

Increasing retention not only boosts the number of policyholders, it also has a powerful effect on revenue. Even improving retention for a single policy has significant long-term gains. For example, take a $5M book of business. Over a 5-year period, improving retention from 77.1% to 82.5% results in an additional $548,705 in revenue on just the original policy (assuming all else remains equal). If each retained customer also picks up a second policy worth 50% of the original, that additional policy alone contributes another $955,454 in revenue over the same five years. Altogether, that’s over $1.5 million in added revenue—driven by better retention and deeper customer relationships.

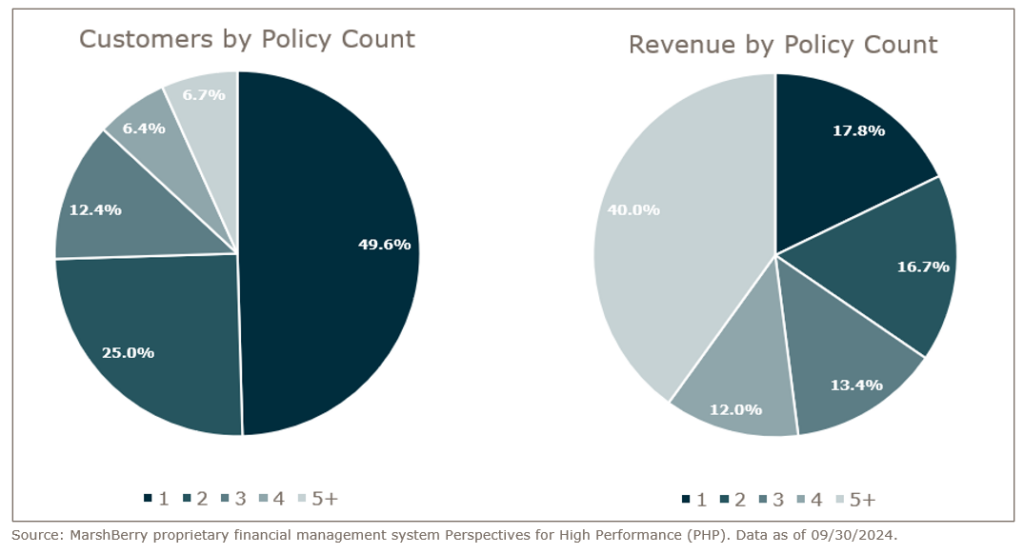

According to MarshBerry’s proprietary financial management system, Perspectives for High Performance (PHP), 50% of the average firm’s customers only have one policy associated with them. That means half a book of business may be sitting on untapped revenue potential. By focusing on cross-selling and improving retention, agencies have a clear, data-backed path to accelerated growth and profitability.

Surprising efficiencies and synergies

Uncovering opportunities for existing customers can be the most effective way to grow your business. In many ways, it’s easier than acquiring new customers — you don’t have to expand production staff, find new prospects, or increase marketing. High-performing firms have learned how to excel at this strategy by working with existing customers to add additional coverage.

Also, take into account all the synergies that come up on the account manager side by not having to deal with different relationships, contacts, industries, or businesses. They’re only working with one customer — and you’re receiving the same amount of revenue.

This practice isn’t just about short-term sales, it’s about expanding and deepening a relationship by offering new solutions and products to existing clients. This can drive trust in service staff and loyalty to an insurance firm, without increasing headcount or setting unreasonable goals. Ensuring customers have adequate coverage across all their insurance needs can have a large impact on your firm and significantly impact your ability to achieve short-term and long-term growth goals.

Co-Authored by Bonnie Weise. If you have questions about Today’s ViewPoint, or would like to learn more about how MarshBerry can help your firm determine its path forward, please contact Bonnie at 616-828-0149.