California continues to be mother nature’s punching bag, as a combination of Tropical Storm Hilary and 5.1 magnitude earthquake both hit southern California on August 20, 2023. Meanwhile, not to be outdone, northern California continues to be on alert for possible wildfires due to lightning strikes and high winds.

These weather-related events are the backdrop for even larger issues California homeowners and independent insurance agencies face – the rising costs of homeowners insurance and the reduction in providers.

Due to rising construction costs and increasing weather-related risks, large insurance carriers continue to withdraw from California’s home insurance market. These factors substantially impact independent insurance agencies and owners, with some seeing commission rate cuts and canceled appointments.

In June 2023, State Farm said it would cease taking applications for all personal and business property lines and casualty insurance due to a challenging reinsurance market, inflation, and “rapidly growing catastrophe exposure.” Allstate, the largest property and casualty insurance company in the U.S., and Farmers Insurance are also limiting their California insurance businesses. “The cost to insure new home customers in California is far higher than the price they would pay for policies due to wildfires, higher costs for repairing homes, and higher reinsurance premiums,” Allstate said in a statement.

In August 2023, three other carriers announced they were exiting the California insurance market. Berkshire Hathaway’s AmGUARD announced it will stop writing personal line policies in the state. Smaller carrier Falls Lake will stop its homeowner’s program, citing challenges with obtaining reinsurance. Kemper announced that it is exiting the preferred home and auto insurance market and will actively reduce business immediately, with all policies being non-renewed or canceled per state regulations.

The History of California Proposition 103

California Proposition 103 was passed in November 1988, which required prior approval of the California Department of Insurance (DOI) for P&C insurance rate changes. Furthermore, a public hearing could be triggered if the proposed rate increases exceed 7%. Recently, these barriers to natural market movements have led to departures and restrictions on carriers’ willingness to write new business in the state. Some proponents of this policy argue it has saved consumers hundreds of billions of dollars in the past 25 years,1 as protecting consumers was the proposal’s original intention. However, there are unintended consequences to this singular view that we are seeing play out in the marketplace today.

Current Market Conditions

Beginning in March 2020, Insurance Commissioner Ricardo Lara issued a moratorium on insurance rate increases in response to the pandemic and lockdowns that reduced traffic volume. This lasted until October 2022, after his re-election was secured. In the early days of the pandemic, the insurance commissioner ordered the refund of premiums to drivers and businesses where the risk of loss was expected to decrease due to stay-at-home orders. Lara supported this decision, citing apparent increased underwriting profits reported by carriers.

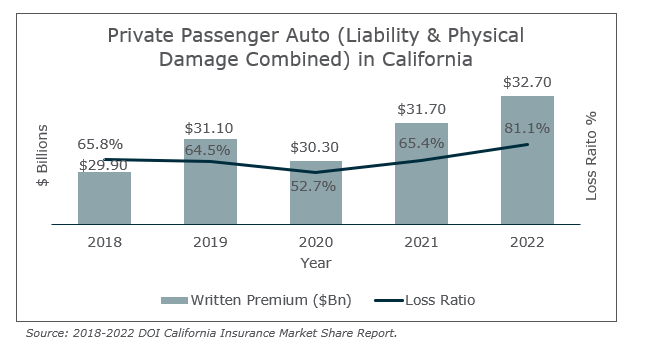

While California licensed insurers demonstrated loss ratios of 52.7% in 2020, an improvement over the 64.5% seen in 2019 – loss ratios have continued to tick up in 2021 and 2022, reaching 65.4% and 81.1%, respectively, as drivers returned on the road.

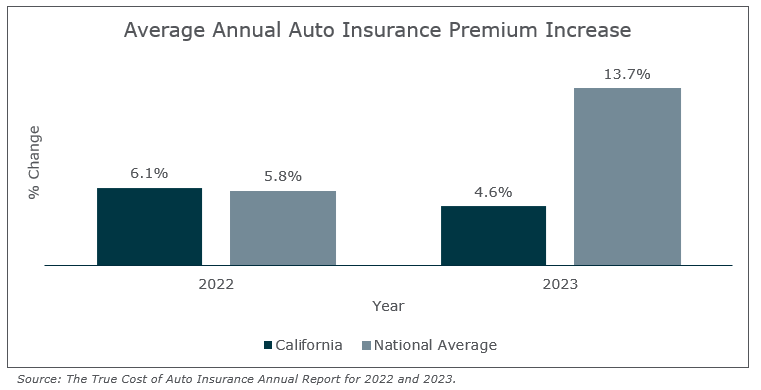

In Q4 2022, California finally began approving rate increases, with GEICO and Allstate each receiving approval for 6.9% increases. In Q1 2023, notable insurers State Farm, Auto Club Exchange, and Mercury Insurance also received approval for 6.9% increases – but it seems far too little, too late with the amount of pent-up demand for rate increases. Despite the national average of auto insurance premiums increasing 13.7% in 2023, California only saw a 4.6% increase based on figures published by Bankrate.

Effective May 27, 2023, State Farm General Insurance Company stopped accepting new applications for all business and personal lines P&C in California due to “historic increases in construction costs outpacing inflation, rapidly growing catastrophe exposure, and a challenging reinsurance market.”2 However, this decision does not impact the direct writer’s personal auto business. The American Property Casualty Insurance Association (APCIA) reacted to State Farm’s announcement citing inflation concerns and inadequate rates to cover increased loss costs and inflexibility under the outdated 1988 Prop 103 statute.3

Impact on the Independent Broker

These market factors substantially impact independent insurance brokerages and owners. Carriers are disincentivizing growth wherever possible to limit the downstream impact of unprofitable underwriting. In some cases, agents are losing their appointments or having commission rates cut due to poor underwriting performance outside their control. If the carriers aren’t allowed policy rate adjustments, the agents will naturally sell less profitable business.

While your business might not be for sale today, it is always important to understand the relative value of your different lines of business. The market value of your personal lines business is likely less than it would have been a short while ago. Valuation combines several factors, but perceived risk increases the discount rate, which is inverse to value.

The buyer community has had mixed reactions. A few buyers have opted to sit on the sidelines to wait for these market headwinds to die down, while others see it as an opportunity to expand market share. Firms that can adapt to market conditions will be better positioned as these short-term market factors work their way through the system. The best-performing firms invest in technology and focus on efficiencies for transactional personal lines business. Others are focused on writing profitable businesses and protecting their books, so they maintain carrier appointments and commission rates with trading partners.

Navigating this complex and dynamic marketplace can prove challenging for any independent business owner, producer, or service member. Whether in California facing this directly or somewhere else facing a different set of challenges, having the resources, knowing where to turn, and staying updated are important to position your business for success.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230