CI Financial Corp (CI) (TSX: CIX, NYSE: CIXX) today released its Q1 2022 earnings. Key takeaways from the call included:

Response to Market Volatility: Business Unit Diversification Provides Ballast

CI has sought to diversify its business over the past several years with wealth management now accounting for over 60% of the company’s assets. The Company believes that the diversity in its business segments – Asset Management, Canada Wealth Management, and U.S. Wealth Management – provides a good balance during times of market volatility. While market movements directly impact the profitability of CI’s asset management business as investors may move funds depending on market conditions, these market movements do not generally compel individuals to switch advisors. So, while the firm’s asset management business often provides more upside when markets improve, its wealth management business provides more stability when markets take a downward turn. Read on to learn more about CI Financial’s Q1 2022 earnings and don’t hesitate to reach out if you have any questions.

Expanded Service Offering

Within its Wealth Management business, CI is seeking to expand its services which will provide further diversification of revenue. For instance, in the Q1 2022 call, management highlighted their newly launched tax planning and filing service, along with other enhanced concierge and family office services, and expects further adoption of these services in coming quarters. CI also announced on May 10 that its CI Private Wealth (CIPW) business intends to establish and operate a trust company, which will provide comprehensive and customized administrative trust solutions for CIPW’s high- and ultra-high-net-worth clients.

Merger & Acquisition (M&A) Activity: M&A Activity to slow in 2022

In 2021, CI acquired two Canadian and 14 U.S. wealth management firms. The Company views 2021 as an unusual year and does not plan to maintain that rate of M&A activity in 2022. CI did not close any acquisitions in 1Q22 and only announced a handful of M&A activity in the quarter. Announced transactions included the acquisition of a Canadian wealth management office that was completed on April 1, the acquisitions of two U.S. firms that were completed on April 29, and the purchase of a U.S. wealth management business that is expected to close in Q4 2022. The company intends to shift its focus to the integration of its new wealth management platform.

Registered Investment Advisor (RIA) Business: Integration and Unification of RIA Platform

CI first entered the U.S. RIA sector in January 2020 and made significant investments in expanding its wealth management business in the following couple of years. In the Q1 2022 call, management stated their focus is shifting in 2022 from M&A to integration and unification of their platform. For instance, under their new structure, they have centralized recruiting across the company’s wealth management business and unified branding across the business.

Wealth Management IPO to Pay Down Debt

While CI has been in the U.S. RIA business since 2020, management does not believe the company’s share price has accurately reflected the strength of CI’s wealth management business. As a result, on April 7, CI announced intentions to sell up to 20% of its U.S. wealth management business via a U.S. initial public offering (IPO), with IPO size, conditions, and timing subject to market conditions. In the initial press release, as well as in the Q12022 earnings call, the company stated that it believed the IPO was the best way to create shareholder value for the business. CI will remain the majority shareholder of the U.S. wealth management business and will use net proceeds from the IPO to pay down debt. The company also believes that the sale of the U.S. wealth management business will create more options for M&A strategy in the future.

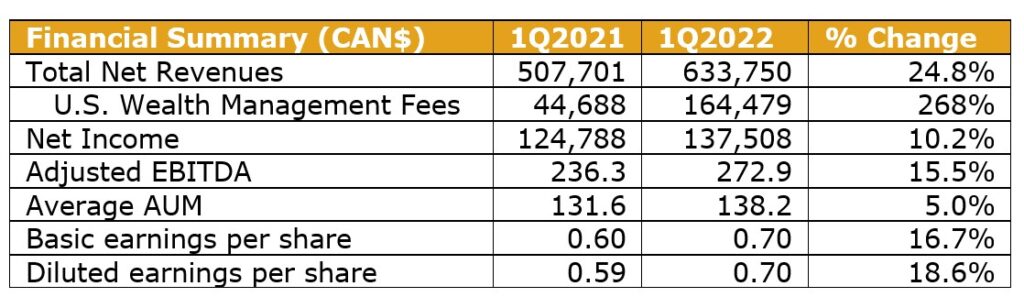

Q1 2022 Financial Highlights

- Total asset growth: 54% YoY

- AUM Annualized Organic growth: -4.6% YoY

- Adjusted EBITDA margin: 46.4%

- Total Debt: C$3,530 million

If you have questions about Today’s ViewPoint, or would like to learn more about how MarshBerry can help expand your wealth management portfolio, please email or call John Orsini, Director, at 440.220.4116. Browse our website to learn more about our investment banking and consulting services.