Connect, MarshBerry’s executive peer-to-peer exchange, wrapped up its two-day Connect Summit in Palm Springs, California.

Representatives from more than 115 agencies and brokers attended the event featuring the State of the Industry, executive peer-to-peer collaboration, networking, and more. “If you’re worried about the cost of going for it, you should see the price of staying exactly where you are,” stated Brooke Liu, MarshBerry SVP, in her presentation, highlighting a notable theme from the summit. In today’s uncertain landscape, with the insurance brokerage supercycle under pressure, every firm must be proactive, drive new business and increase sales velocity, while improving performance – or risk falling behind.

John Wepler, MarshBerry Chairman and CEO, delivered a thought-provoking and actionable session on the state of the insurance brokerage industry, highlighting the key trends, challenges, and transformative forces in 2025. He addressed key issues around achieving predictable, sustainable growth and offered valuable strategies on improving quality of growth. The State of the Industry offered a clear roadmap for driving change and the strategies essential for thriving in today’s dynamic market.

Here are four key takeaways from the Connect Summit:

There’s a current landscape of uncertainty, but the insurance brokerage industry continues to be defensive and desirable.

Numerous concerns are creating uncertainty in the market, including “reciprocal” tariffs, elevated inflation, and declining growth. There’s also the risk of stagflation, as tariffs could boost prices on goods, leading to slower growth and higher inflation. Amidst the current volatility, the insurance brokerage industry continues to be a solvent, defensive, and desirable asset class.

U.S. stock markets have been extremely volatile since the initial tariff announcements in early April. However, the Property & Casualty (P&C) insurance industry has an extremely low beta (the volatility of an industry compared to all other industries), almost as low as groceries. Insurance brokers remain resilient – year-to-date through April 8, 2025, the S&P 500 lost 15% while the Insurance Broker Composite1 gained 4%.

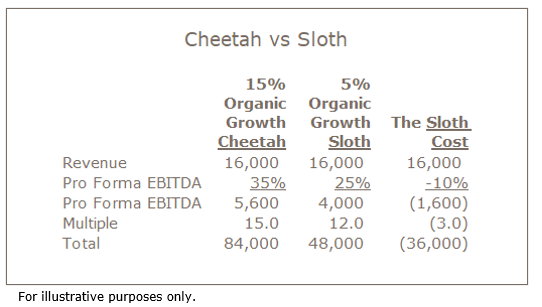

Would you rather be the cheetah or the sloth?

Some firms may become complacent because the insurance brokerage industry has such high recurring revenues and predictable, robust cash flow. The “cheetahs” are high-performing firms with strong leadership focused on sales velocity and execution, while the “sloths” are treading water and complacent.

For example, a theoretical “cheetah” firm might have an organic growth rate of about 15% and EBITDA (earnings before interest, taxes, depreciation, and amortization) margin of 35% while the “sloth” may be a complacent firm with an approximate 5% organic growth rate and EBITDA margin of 25%. But there’s a cost to being sloth firm: a “sloth” firm would likely command a valuation that’s $36 million less in a sale compared to a “cheetah” firm when both have the same annual revenue. And in 20 years, at the same growth rates, this sloth firm will potentially command a valuation that is $1.2 billion less than a cheetah firm.

The 15-year supercycle is under pressure

The insurance brokerage business has been the beneficiary of a great environment over the last 15 years. This industry has been blessed by a strong economy, a positive rate environment, strong organic growth and in turn – high profitability. This backdrop has yielded strong capital market support, high firm valuations, record public broker valuations and outstanding returns for private capital investing in this industry. It is such a great environment, many call it “utopia” or a supercycle.

However, this supercycle is currently under pressure. Slowing organic growth and the rise in interest rates has steadily decreased the rate of return for investors. Investors are concerned deflated returns could remain or worsen if interest rate reductions stall or the economy slows. Decreased return is putting immense pressure on consolidators to integrate, diversify and grow organically.

Maximize impact: collaboration, networking and optimizing resources

Amplifying expertise and optimizing resources were also in focus at Connect Summit. Attendees had time to engage with each other to build stronger relationships and navigate firm success and opportunities. Connect members utilized data insights to navigate topics like technology, talent, sales performance, and perpetuation planning through their Strategic Issue Group (SIG) participation – many encouraging the use of membership benefits like MarshBerry’s Employee Engagement, Sales Culture and Talent Culture assessments to enhance decision making. The Connect Summit provided an environment for members to engage each other, and MarshBerry advisors, to help build stronger relationships with their customers, employees, and other stakeholders leading to long-term firm success.

The Connect Summit is thoughtfully designed to amplify the attendee experience through engagement with members and forward-thinking SIG sessions, all aimed at optimizing firm growth. Stepping away from the day-to-day to focus on the business allows for a renewed perspective. United by shared insight and peer collaboration, insurance executives are empowered to amplify their vision, optimize performance, and engage in meaningful action for the future.