The act of transferring business ownership is referred to as perpetuation. Perpetuation comes in many shapes and forms, with the biggest decision being whether to perpetuate internally or externally. For the insurance distribution industry, internal perpetuation is becoming more and more of a rarity as the mergers & acquisitions (M&A) landscape has become a feeding frenzy of consolidation.

Based on MarshBerry’s experience in advising clients through organic growth strategies, perpetuation planning and M&A transactions, it’s estimated that 75% of insurance agencies and brokerages will most likely not perpetuate internally.

Still – many smaller firm owners continue to talk about the eventual perpetuation to family members or loyal employees. Agencies and brokers that are truly committed to an internal perpetuation plan will only find success if they understand the options available and start to execute on the plan, sooner rather than later.

Reasons to perpetuate internally

There are a number of reasons owners may consider internal perpetuation – including legacy preservation, the ability to remain independent, strategic control purposes, client or community loyalty, and tax implications.

The most common reason for owners to seek out internal perpetuation is usually to preserve their legacy and ensure continuity for clients, employees and their community. If family members are a part of the business, then there is even more incentive to keep the legacy going for future generations.

Perhaps there are also strategic reasons to keep ownership with internal stakeholders. If an owner believes that existing employees and/or family members possess the necessary skills and knowledge of the business to continue operating on the same path, an internal perpetuation plan could be a viable solution for succession. The challenge is creating a plan that can be executed successfully and doing so well in advance of a targeted departure from the business.

Advanced planning is key to successful internal perpetuation

Perpetuation should be viewed as a continuous process with neither a beginning nor an end. As the average age for owners of insurance brokerage firms increase, having a plan in place to transfer equity ownership has never been more important – nor can the planning begin early enough. Equity succession planning may seem daunting – however, it can be accomplished in a few different ways including identifying a good capital partner for debt or equity, or broadening ownership over time to key stakeholders.

But without question, the most important ingredient in the process of perpetuation planning is the people. To maintain the right people, a firm must be committed to continuously reinvesting in the staff. This includes identifying potential stakeholders, developing their skills and communicating the plan for succession.

Recruiting should also be done with strategic purpose, tailored to replace existing talent that may move up (or out), and for maintaining key relationships long before a transfer of ownership takes place.

How internal perpetuation planning can fuel growth and value

While internal perpetuation planning may be intended for creating the roadmap for an owner’s departure and the subsequent succession of the business to the next generation – a resulting byproduct may be exceptional growth and more value for the firm.

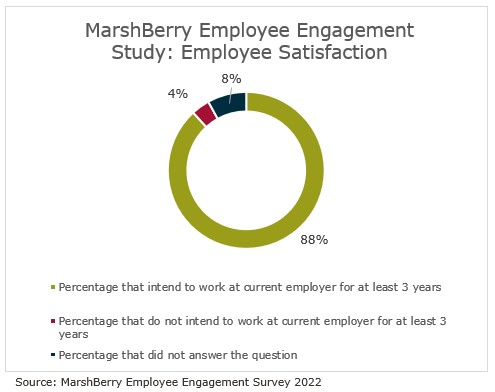

When existing employees are supported through professional development programs, given the opportunity to move up in an organization, or are given ownership opportunities, they are more motivated. Motivated employees are more productive, more innovative and stay with a company longer. According to MarshBerry’s Employee Engagement Survey, 88% of respondents who agreed their employer offers strong employee orientation and professional development programs also intended to work at their company for at least three more years.

From a recruiting perspective, an internal perpetuation plan can also be highly attractive to potential candidates and reduce the level of turnover in key leadership positions. This can help ensure the firm continues to run smoothly and can lead to more growth and value.

Options for internal perpetuation

When it is finally time to decide how to transfer equity, internal perpetuation has some options. One option is through an Employee Stock Ownership Program – or ESOP. An ESOP is a way to allow employees to own company shares, thus motivating them to consider a long-term commitment. There are various ways an ESOP can be offered, including purchasing shares from the owner, or having the company issue new shares.

One structure that is proprietary to MarshBerry is an Integrated Continuity Alignment Plan (iCAP). With an iCAP there is an opportunity to combine warrants (a financial instrument that allows the holders to have preferred rights to the company) with the ESOP, to allow key employees to benefit from the overall performance of the company while all shareholders benefit via retirement planning.

ESOPs can be complex to set-up and maintain and often require expert planning and execution. But the benefits outweigh the challenges and can put a firm onto a path for growth, improved valuation and successful internal perpetuation.

When considering options for transferring equity as part of an internal perpetuation plan, variables such as key talent, family members interest in the business, and tax efficient structures are all factors.

MarshBerry is aligned with insurance owners’ ultimate goals, whether it involves internal perpetuation, creating an ESOP or an iCAP model, or external perpetuation options.

If you have questions about Today’s ViewPoint, or would like to learn more about how MarshBerry can help your firm plan for its future, please email or call Brian Refici, Vice President, at 440.769.0321.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230