Wealth Advisory M&A Transactions in April 2023

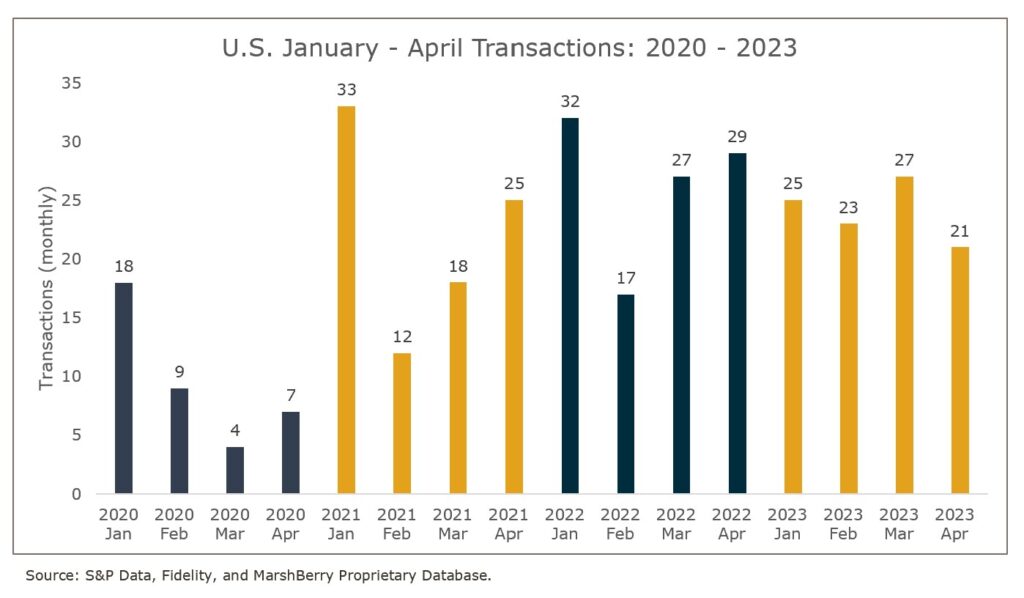

Wealth advisory merger & acquisition (M&A) transactions in April 2023 delivered 21 announced deals – the lowest total for April since 2020. However, when comparing year-to-date (YTD) numbers through April, it was the second highest total on record with 96 announced deals – only trailing 2022 which delivered 105 announced deals through April.

Consistency continues to be the trend in this space. While April (and the start of Q2) has historically been a strong month for wealth advisory deals, 2023 is showing an ability to deliver 20+ deals each month. Despite all the surrounding macroeconomic noise, deals for retirement and wealth advisory firms continue at a steady pace.

Private equity-backed buyers still represent a majority of the transactions accounting for 59 of the 96 wealth advisory transactions (61%) in YTD April 2023, as they continued expanding their presence in the marketplace. The private equity-backed space is still sending bullish signals with nine private equity investments closed in YTD April 2023, compared to six investments YTD April 2022.

Independent firms accounted for 22 of the total deals (23%) with public firms accounting for 15 deals (16%) YTD April 2023.

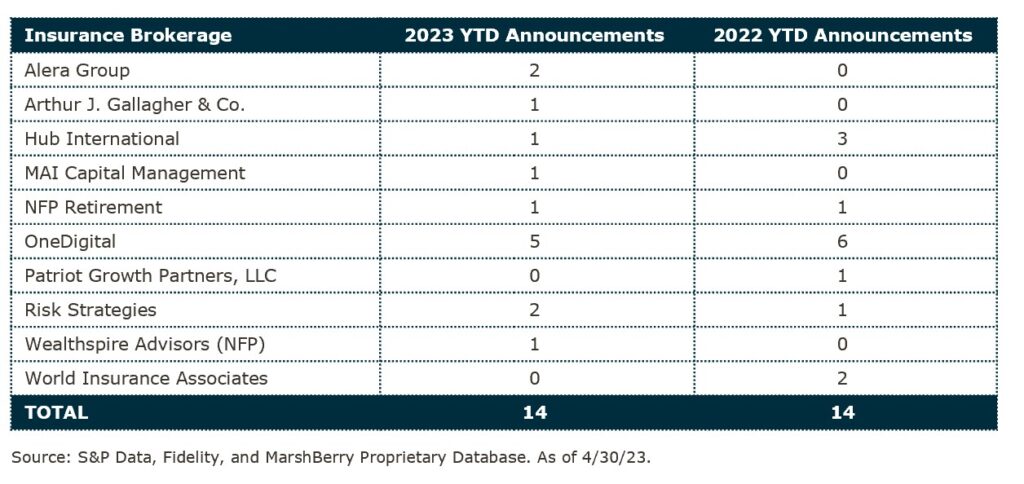

Insurance Brokerages Continue to Target Wealth Advisory Firms

There has been a consistent upward trend in acquisition activity on the part of insurance brokerage firms over the past three years. The number of wealth advisory businesses acquired by insurance brokerage firms increased from 10 deals in 2020 and 33 deals in 2021 – to 41 total closed transactions in 2022.

So far in 2023 there have been 14 announced transactions through YTD April 2023, half of which were announced in the month of April. This matches the total number of deals announced at this time last year.

Deal Spotlight: Parsec Financial Acquired by Modera Wealth Management

May 1, 2023: Modera Wealth Management, LLC (Modera), based out of Westwood, New Jersey, and backed by private equity firm TRIA Capital Partners, announced its acquisition of Asheville, North Carolina, based Parsec Financial (Parsec).

Parsec is a fiduciary fee-only advisory firm that can date its roots back to the 1980s. Tom Orecchio, Chief Executive Officer of Modera, stated that part of the rationale for the acquisition was Parsec was based on alignment in their fiduciary fee-only advisor model, as well as the synergies that come from two firms joining forces to increase scale, resources, and talent. All of Parsec’s employees joined Modera. In addition, 24 of those employees from Parsec have become Modera owners. Modera now has 61 employee owners in total.

Since its founding in 1983, Modera has stayed true to their client-first philosophy, most notably through their fee only approach. Modera provides a comprehensive suite of wealth management services for any situation and also provides clients with financial planning services. Modera has been active in growing its geographical footprint while also diversifying and adding to their bench of talent and service lines. Modera has offices all along the East Coast, from Florida all the way to New England. Modera is not limited to their geographic footholds as they have clients across the country.

The Road Ahead in 2023

Looking towards the next few months, it would be remiss to ignore ongoing economic conditions which could turn at any moment. The influences of inflation, interest rates, labor shortages and recessionary fears could all lead to factors that directly influences M&A activity.

While dry powder is still available, those with the need to access debt capital in order to acquire targets, are starting to become more selective in their search criteria. They are looking for firms that display predictable consistency of higher-than-average organic growth, operate in highly desired geographies, or have capabilities that align or fill gaps that buyers are searching to fill. Even now, the deals that are getting done are with the higher quality firms that check the boxes from a strategic standpoint.

The momentum for investment in the wealth advisory space has been building over the past few years. And despite the higher cost of debt capital and recent market volatility, demand continues to outpace supply with over 40 private equity buyers actively pursuing acquisition strategies.

The market remains cautiously optimistic and is encouraged by a strong first quarter of activity, but MarshBerry will continue to watch and listen to the market and provide insights as the year progresses.

Disclosure: All deal count metrics are inclusive of completed deals with U.S. targets only. Scorecard year-to-date totals may change from month to month should an acquirer notify MarshBerry or the public of a prior acquisition. 2022 statistics are preliminary and may change in future publications. Please feel free to send any announcements to M&A@MarshBerry.com.

Source: S&P Global Market Intelligence, http://www.insurancejournal.com, http://www.businessinsurance.com/ and other publicly available sources.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230