The past few weeks has seen the equity markets react (or overreact) to President Trump’s ongoing trade tariffs campaign, while the media headlines stir the pot with words like “inflation” and “recession.” Keep in mind, we are only several weeks removed from a strong economic year and fundamentally not much has changed to warrant such volatility in the stock market. Not all industries should be affected by proposed (or implemented) trade tariffs, yet across the board stock prices are getting hammered. Other factors like consumer confidence and social inflation can certainly impact the economy, and how the Federal Reserve reacts in their management of monetary policy may come into play.

For now, it’s important to keep perspective and understand that business outlooks are still strong and the cat and mouse game playing out in global politics is far from over. For insurance brokerage mergers and acquisitions (M&A), the theme remains consistent – optimism for continued strong deal activity amidst lower cost of capital and improved profitability in a hard rate environment.

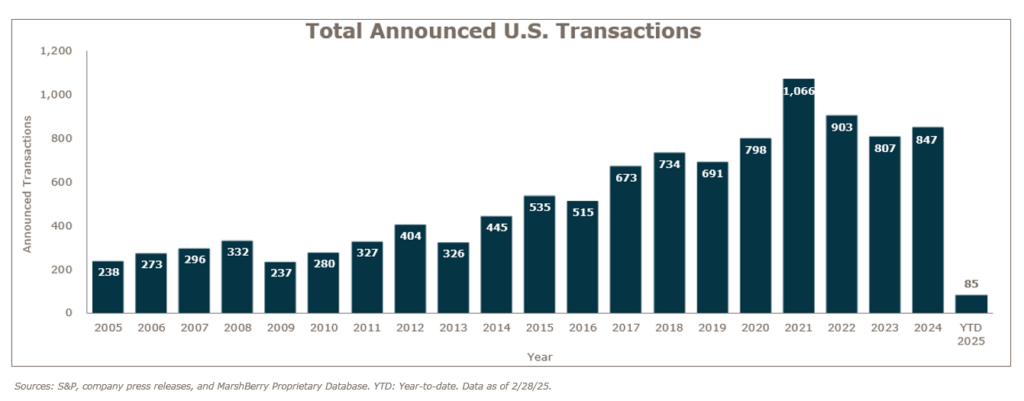

Through the first two months of the year (between headlines of market turmoil) M&A activity for insurance brokerages is up 25% over last year. Buyers remain focused on their goals for growth and for now, haven’t taken their foot off the gas pedal.

M&A Market Update

As of February 28, 2025, there were 85 announced M&A transactions in the U.S., putting the year-to-date pace at 25% higher than last year, which recorded 68 deals by the end of February.

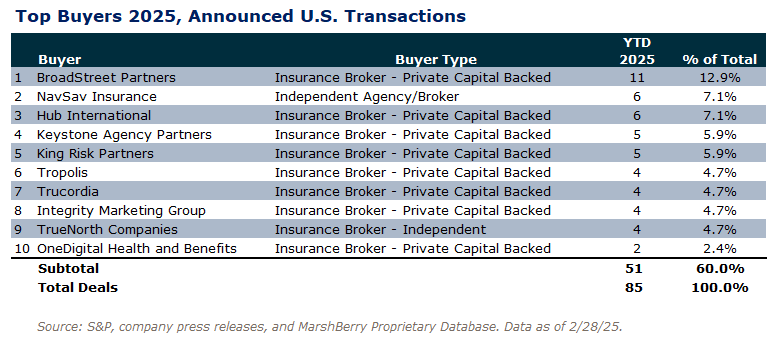

Private capital-backed buyers accounted for 57 of the 85 deals (67.1%) through February. Independent agencies were buyers in 20 deals so far in 2025, representing 23.5% of the market. There has been one announced transaction by bank buyers in 2025. Deals involving specialty distributors accounted for only 12% of the total deals (with ten transactions) so far this year, continuing the trend of a low supply of specialty firm sellers.

Deal activity from the top ten buyers accounted for 60% of all announced transactions, while the top three (BroadStreet Partners, NavSav, and Hub) account for 27.1% of the 85 total transactions.

Notable transactions:

- February 10: Hub International Limited acquired the assets of Mayfield Insurance, Inc., an independent insurance agency based in Mooresville, Indiana. The terms of the transaction were not disclosed. Mayfield Insurance, which offers a range of commercial and personal insurance products, will operate as Mayfield Insurance, a Hub International Company, with its president, Dean Mayfield, and team joining Hub Midwest East. Hub, headquartered in Chicago, continues to grow its footprint across North America, providing insurance, risk management, employee benefits, and wealth management services. MarshBerry served as advisor to Mayfield in the transaction.

- February 24: NSM Insurance Group signed a definitive agreement to sell its U.S. commercial insurance division to New Mountain Capital, a growth-focused investment firm managing over $55 billion in assets. The transaction, expected to close within 45 days pending regulatory approvals, includes NSM’s portfolio of 15 niche insurance programs across Property & Casualty, Accident & Health, and Reinsurance, along with its retail agency, NSM Insurance Brokers. The acquired business will operate independently under a new brand in the future. NSM, a portfolio company of Carlyle, has grown into a global specialty insurance provider with over $2 billion in premiums. Aaron Miller, NSM’s Chief Commercial Lines Officer, will take over as CEO of the newly formed entity, with Geof and Bill McKernan joining its board. The deal positions the business for accelerated growth, leveraging New Mountain’s investment in talent, technology, and strategic expansion.

- March 3: AmeriLife Group completed its acquisition of Crump Life Insurance Services and Hanleigh Management from TIH Insurance Holdings, LLC. While the financial terms were not disclosed, the deal strengthens AmeriLife’s position in life and health insurance, annuities, and retirement planning. Crump will continue operating as an independent brand under AmeriLife Wealth Group, with CEO Mike Martini remaining at the helm. The acquisition enhances AmeriLife’s distribution capabilities, reinforcing its long-term strategy to expand its wealth and insurance solutions.