As an agency owner, you probably focus on organic growth as a core metric, but that’s only part of the picture. A stronger indicator of growth and performance is sales velocity, which measures the amount of the current year’s new business as a percentage of prior year commissions and fees. For example, if an insurance brokerage firm has $1 million in commissions, and they wrote $100,000 in new commissions, their sales velocity would be 10%.

There is a direct relationship between sales velocity and other core metrics. Sales velocity can help firms determine their leakage rate – the difference between organic growth rate and new business rate. Firms should strive to minimize causes of leakage, such as lost accounts. Because sales velocity offers reliable performance insights, no matter the cycle of the market, it’s one of the best assessments of sales success.

What is Sales Velocity?

Well-run agencies use data to influence their business decisions, including personnel-based strategies. Sales velocity is one of the strongest indicators of how well an organization’s producers are performing, therefore, regular review of sales velocity can uncover trouble spots and figure out if you’re creating “real” organic growth. That is, growth generated through strategic decisions and new business-generating hard work, not from insurance rate increases or existing books of business. If sales velocity is low, it may mean you’ve got non-producing producers since this metric does not include revenue from existing policies. Sales velocity data can be shared with your staff to illustrate the need for brokers to proactively sell and remain profitable.

During a hard market where premium rates are elevated, other growth metrics may be inflated by increased commissions; therefore, you need sales velocity to truly measure the strength of your organization, no matter the environment.

The benefits of strong sales velocity

When market conditions start to soften, and carriers start to open, there will be more opportunities to get new appointments and competition will be fierce. Carriers will seek firms who focus on growing new business and can demonstrate profitability.

New customers bring greater value to an agency and enhance the health of your organization. If your producers are driven to uncover new markets, implement aggressive marketing efforts, and proactively reach out to prospects, your sales velocity will be part of an attractive value proposition for top carriers.

A commitment to growth, even in a hard market, will enhance how potential buyers view your organization. As part of the sale process, they will dig into organic growth to identify if it’s coming from new business, or as a byproduct of a hard market environment.

Sales velocity can also help agencies prepare for a change in rate trends. It’s likely that conditions will eventually shift to a less generous rate environment, so firms won’t be able to grow just due to high premiums. High growth firms double in revenue every five years and are not dependent on external factors.

How to Increase Sales Velocity & Maintain It

After calculating your sales velocity, select focus areas and create targeted action plans from your findings. MarshBerry recommends that brokers strive for 15–20% sales velocity to produce predictable, profitable organic growth. Consider the following initiatives for increasing sales velocity.

- Explore niche markets: Firms that specialize in a couple of industries, or geographies, report higher organic growth than generalist. You want to be perceived less as a vendor and more as a trusted advisor.

- Improve mix of business: If your firm is heavy in personal lines, consider investing specifically in commercial producers that will enhance your ability to write larger, more complex accounts.

- Gain new markets: Building out a niche sometimes requires access to new markets, which is difficult to accomplish during a hard market. Consider joining an agency network that could give you access to coveted appointments that are difficult to obtain on your own.

- Establish individual goals with accountability: Particularly for experienced producers, goals should include both new business and sales velocity components and should be tailored to each person and their capabilities.

- Improved sales training and mentorship: To ensure producers succeed, firms should have a comprehensive training plan in place, including working with mentors. Brokerages that have a mentor structure have a lower rate of failure among new producers.

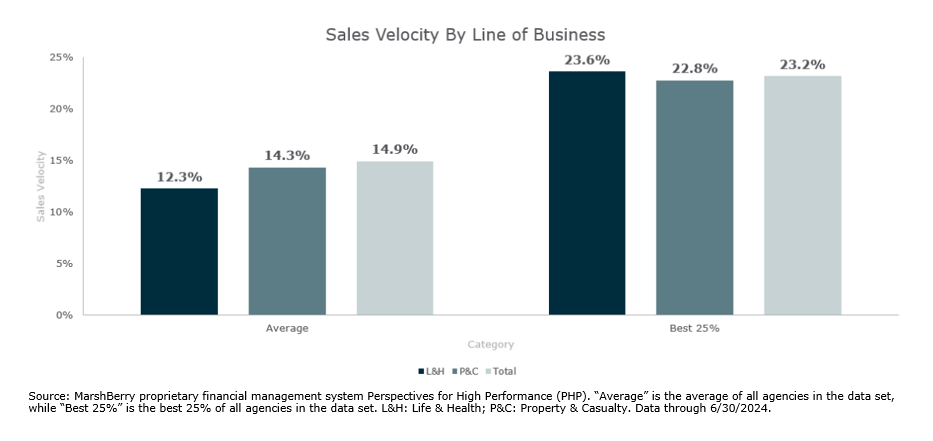

- Align to industry standards: Track sales velocity on a firm and individual level, making comparisons to benchmark averages. According to MarshBerry’s proprietary financial management system Perspectives for High Performance (PHP) the Best 25% of firms are outperforming the average of all firms for sales velocity – 22% to 14%.

Sustainable organic growth fueled by predictable sales velocity continues to be the most controllable method for taking a firm to the next level – for increasing revenue and for attracting possible partners. In time, carriers will be less exclusive and open to working with smaller agencies or uncovering new business again. Are you and your producers ready?

Thought Leadership Events

At a MarshBerry event, the outcomes are just as important as the experience. Attendees leave with the most advanced data, cutting-edge insights, new relationships, and key takeaways that will help them innovate their businesses. Join other insurance agencies and brokerage executives, along with MarshBerry advisors, at a MarshBerry event to explore strategies that will help you lead your firm to growth and profitability and learn how to maximize shareholder value.