The landscape of insurance brokerage compensation has undergone significant transformations, from traditional salary and commission models to innovative rewards and more flexible working options. But producer compensation remains a significant amount of a firm’s expenses and is not always designed to deliver the best return on investment. Commission structures in particular are trending in the wrong direction, specifically – there is not enough spread between commissions for new and renewed business.

Broader commission splits drive new business

Paying producers too high a renewal commission will only lead to challenges. Firms that offer 40% commissions on new business and 40% commissions on renewal business (40/40 split) are paying a hefty commission on renewals that should require less effort from the producer. Consequently, those firms aren’t growing at the same rate as top performing firms.

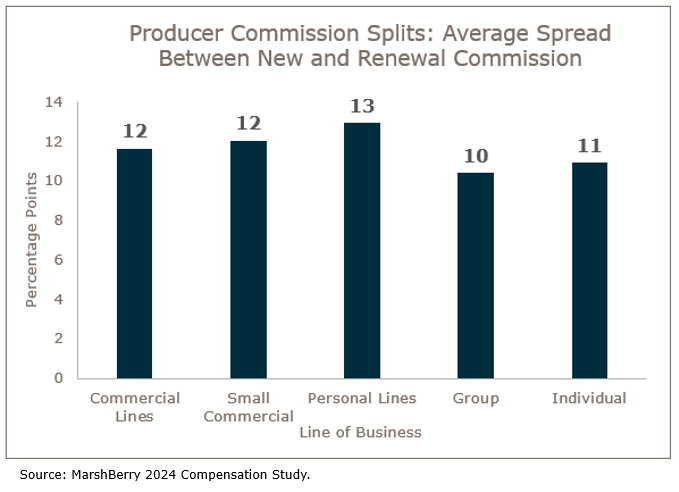

Establishing the right commission split incentivizes and motivates producers to “hunt” new business, leading to profitability for your firm as well as the producers. According to MarshBerry’s 2024 Insurance Agency & Brokerage Compensation Study – many firms are offering higher than necessary renewal commissions, with overall commission splits averaging an 11-12% difference across business lines.

If producers aren’t spending a lot of effort servicing accounts, they shouldn’t be receiving a higher commission on those renewals. Producers can become complacent, shepherding a book of renewals, and not focusing on generating new business. While there are cases when firms allow producers to do a lot of service work, justifying higher renewal commissions – the results may at the cost of new business development.

Reducing commission for renewal business will encourage producers to focus on writing new business, building relationships with prospects, achieving performance goals, mentoring new producers, and contributing to overall organic growth.

Higher performing firms choose to incentivize their producers by pushing the commission split between new and renewal business closer to 15-20%. Where do you want your producers to be spending most of their time?

Reinvest in the service team

By reducing producer renewal commissions, firms can reinvest into a team whose value and costs are on the rise: your service staff.

Servicing accounts is getting more and more expensive, particularly in compensation costs. Wages have increased for both current employees and new employee expectations. MarshBerry’s 2024 Insurance Agency & Brokerage Compensation Study found that service staff received the biggest compensation increase across all roles, going up 6% for both salaries and bonuses. There is an expectation that salaries will continue to increase as client services expand.

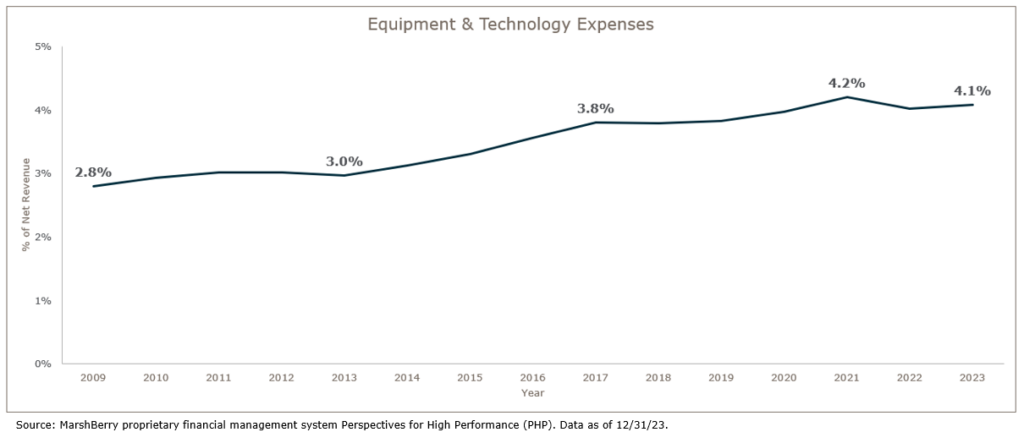

In addition to rising compensation costs, insurance brokerages are becoming overwhelmed with finding enhanced technology and outsourcing services. Both options can help drive efficiencies and improve your client service experience. IT resources are getting better, more efficient and focused on helping relieve some of the stress your service staff is experiencing. However, the costs are at an all-time high and not going away. The chart below shows how spending on technology is rising over time.

Empower producers beyond compensation

As you reflect where you want to spend your time, also ask where you want your producers to spend their time. Producer concerns about reduced renewal commissions and the impact on their W-2 is natural, so it is important to show them how they can earn more. By reducing their time servicing accounts and by giving them tools to make selling easier, your producers will have more time to uncover new business, helping the firm grow.

If a firm is committed to double digit organic growth, producers need proper motivation to focus on generating new business. Leaving the service to the service staff experts who are doing it every day will allow producers to concentrate on what they do best – sell.

Increasing the gap in commission splits for producers can also help your firm attract and retain top talent who understand the growth mindset. It will also help your firm adapt to new market dynamics and align employee performance with organizational goals. These changes will cultivate an environment of motivation, efficiency, and growth. Sales culture doesn’t begin and end with the producers, it’s a whole agency culture.

The value of a compensation study

Understanding how high performing firms in this industry handle compensation is a great starting point. MarshBerry’s 2024 Insurance Agency & Brokerage Compensation Study evaluates compensation trends in insurance brokerage and provides detailed insights into the results. It offers firms the opportunity to benchmark where they sit in the range of industry peers on compensation approaches. It can provide reinforcement for their current approach – or reveal areas of opportunity for change.

As insurance brokerages continue to look for ways to grow their business, whether it be through their product offerings, service capabilities, or technology upgrades – people will always be at the root of everything they do. Having a top-performing organization, with top-performing personnel starts with a top-performing compensation strategy.

Learn more about MarshBerry’s 2024 Insurance Agency & Brokerage Compensation Study.