For insurance brokerages, goal setting is a key part of building a successful producer roadmap. Setting, measuring, and fulfilling goals keeps producers motivated and accountable, inspiring them to perform at their best. Not only should producers know their value and set goals, but they should look to stretch their goals by pushing themselves out of their comfort zone and outperform even their own expectations.

An important aspect of goal setting is establishing minimum account thresholds. This threshold sets a standard for the type/size of account required to do business with the producer. These vary from producer to producer and can be based on book size, location, specialty, or other factors. It also requires potential clients to meet certain criteria such as premium volume.

Optimizing growth using minimum account thresholds

Establishing thresholds can help producers better understand where their time and resources are being used and how to make the most efficient use of those. If implemented properly, a minimum account threshold will drive producer book growth and leave them greater capacity to keep fishing “upstream” for new business. This is vital for producers to succeed and firms to grow.

Insurance brokerages that are committed to producer accountability and performance, transitioning non-producers out of sales roles, and reacting swiftly to productivity issues – are more likely to reach growth goals.

What is the right minimum account threshold for your brokerage?

Establishing a minimum account threshold must be based around your growth goals. High growth firms double every five years. Using the Rule of 72 (a formula to determine how long it takes to double an investment), this breaks down to 15% growth every year for five years.

Companies striving to grow by 15% each year should establish a minimum account threshold below which producers are not paid renewal commission. But finding the right minimum is a balancing act. Too high and you’ll discourage producers and lose volume of small accounts. Too low and producers are not pushed to their highest potential, leaving a performance gap.

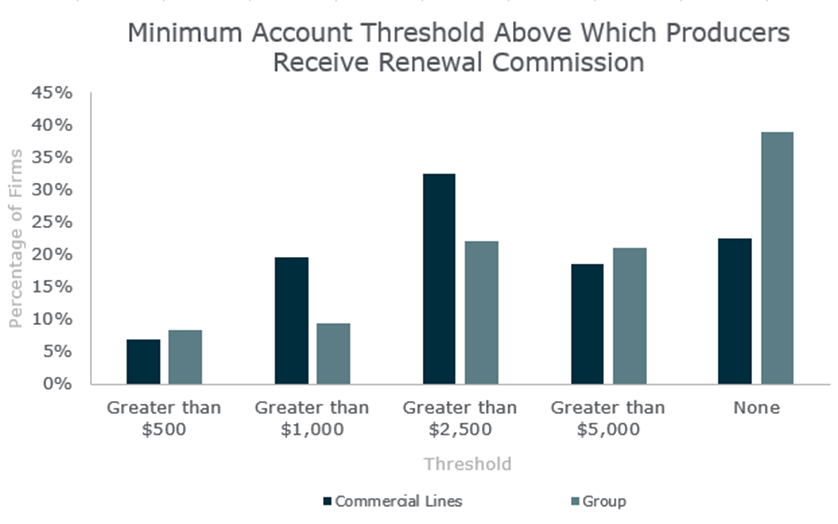

According to MarshBerry’s 2024 Insurance Agency & Brokerage Compensation Study over 20% of commercial lines firms and about 40% of employee benefit brokerages are not using minimum account thresholds (above which producers receive renewal commission) to incentivize their producers and to maximize organic growth. These firms could implement minimum account thresholds and potentially increase revenue growth.

Source: MarshBerry 2024 Compensation Study.

How can firms make minimum account thresholds a successful business strategy?

For minimum account thresholds to be successful they must be implemented properly. Here are five ways to start building your strategy:

- Run the books. Start by gaining a clear picture of the average account size in each producer’s book and compare it to your company’s average account today (excluding house accounts). Evaluate your average account size by producer and then adjust minimums to align with future growth goals. For example, a company aiming to double in size over the next five years (e.g., 15%+ growth each year) should establish a minimum account threshold for producers today that works towards their future growth goals.

- Trade down accounts below the minimum. Producers can create more bandwidth by trading down smaller accounts to dedicated service staff, and/or small business units for accounts below the threshold. However, a certain level of trust and proper communication is required amongst employees for this to work effectively. Start by outlining the impact on each producer’s W-2 (it should be minimal). Next, plan how to service the account. Lastly, communicate why the company is asking them to trade down accounts. (i.e., to support long-term individual book and company growth.)

- Develop a small business unit. A small business unit (SBU) typically refers to a specialized department or division within an insurance brokerage that focuses on serving the insurance needs of small businesses. (i.e., Clients that have a relatively low number of employees, minimal annual revenue, and limited assets compared to larger enterprises.) MarshBerry recommends developing an SBU if the block of business is large enough to warrant at least one full-time service employee. If executed correctly, it becomes a “win, win, win” for the customer, producer, and the company. In this service model, customers are made the priority, producers have more time to focus on larger accounts and generate new business, and the company benefits from increased profitability and value.

- Identify accounts for outsourced servicing. You can super charge growth and profitability by establishing clearly defined service standards for accounts that fall below the minimum threshold (segmented by revenue band). Track the number of calls/touch points per account, how often the account is re-marketed, and create an internal scorecard to evaluate each account’s current internal rate of return (IRR) and future growth potential. From here, determine which accounts should be handled in-house vs. outsourced to a virtual employee (VE) or carrier service center.

- Build scalability. Evaluating and potentially raising minimum account thresholds is an annual occurrence for high-growth companies. A few best practices from top growing firms are mandatory annual trade-down of the bottom 20-40% of accounts in each producer’s book. These firms utilize carriers’ service centers for accounts under $5,000 in revenue, limit remarketing of accounts who experience less than a 15% increase at renewal, and leverage technology and/or outsourcing all non-client facing service functions (e.g., raters, policy auditing, loss run/census data procurement, etc.).

It’s all about driving growth

Finding ways for producers to sell larger policies regularly can benefit the company’s growth goals and allow producers to grow their book – a win-win for everyone. Evaluating the effectiveness of current minimum account thresholds, and continually raising them as your company grows is also vital to long-term success.

MarshBerry’s industry comparative metrics and comprehensive, one-of-a kind industry reports can inform your brokerage on the impact of trading down smaller accounts, evaluating producers, increasing accountability, and optimizing thresholds – all things required to be a successful growth-oriented firm.

Find out what top performing firms are doing to remain competitive, including details about how brokerages structure salaries, commissions, and bonuses and their methodologies for driving maximum revenue and growth through MarshBerry’s 2024 Insurance Agency & Brokerage Compensation Study.