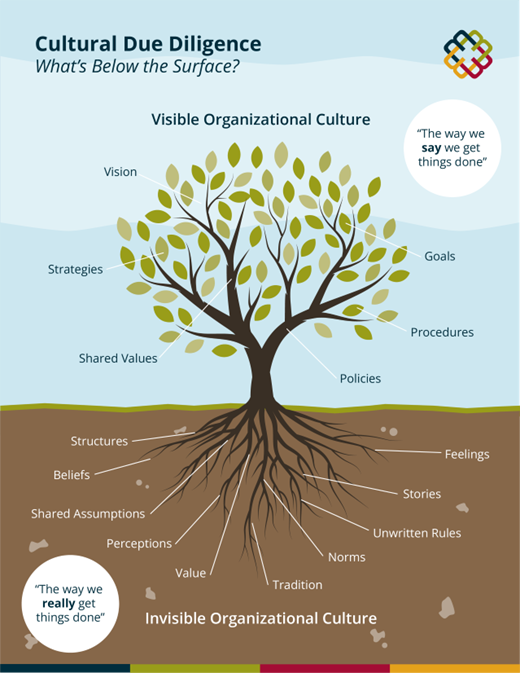

The insurance business is a relationship business and one of the main assets that buyers acquire in a transaction is the people. Most partnerships’ success depends on the alignment of people in their values, norms, and communication styles. Assessing and understanding the cultural aspects of a business or organization before engaging in a partnership should be a crucial part of the due diligence process.

Why cultural due diligence gets overlooked

It goes without saying that merger & acquisition (M&A) transactions are complex and time-consuming. Cultural due diligence may feel like an unnecessary expense that delays the deal. Some companies worry about confidentiality, particularly if they decide not to proceed with the transaction. Others overlook this process because of deal fatigue and skip M&A culture due diligence until post-transaction. Leverage is another cause of cultural fit neglect – some buyers or sellers attempt to withhold or limit requested business information until certain transaction terms are finalized.

The purpose of M&A cultural due diligence

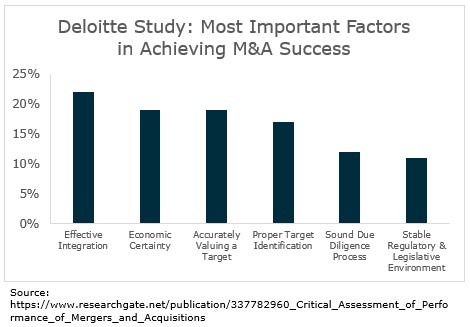

Culture due diligence evaluates the cultural compatibility between the two entities involved in the business deal, based on the goals of the transaction. If a party wants to increase profits, expand market share, or obtain new skills and knowledge, creating a strong cultural fit will help them enhance these objectives. Based on a Deloitte study of 1,000 executives, “effective integration” is the number one factor to consider when merging two companies.

McKinsey research indicates that 95% of executives describe cultural fit as critical to the success of integration. Still, research shows that 75% of people in key roles quit within three years post-merger. This demonstrates how often leadership is culturally misaligned – and the risks of neglecting this step. Cultural due diligence requires more than handshakes and water cooler conversations – it requires detailed strategic planning. It can’t be overlooked if you want your company to maintain operations as a well-oiled machine. Prioritizing M&A cultural due diligence helps both sides identify risks and opportunities, reduce post-transaction costs, streamline processes, and maximize M&A synergies, such as financial gains. It will also help maximize the value delivered to clients, stakeholders, and employees post-transaction.

How to perform cultural due diligence

A core component of successful cultural due diligence is determining the strengths of the buyer and seller. Then, you can determine whether you want to integrate or preserve each of these elements. For example, maybe the buyer is adept at internal communications; in that case, you’d want to preserve and adopt their approach. As you compare decision-making styles, be careful about concluding too early. Instead, assess compatibility and potential challenges in harmonizing the cultures. You don’t have to integrate every aspect of a company. If one company is doing something well, let them continue unabated.

At a high level, you’ll want to evaluate:

- Values and beliefs: Learn both companies’ core values and guiding principles.

- Communication and language: Analyze communication styles and language barriers, if any, to ensure effective collaboration and understanding among teams.

- Organizational structure: Understand the hierarchical structure, reporting lines, and decision-making mechanisms.

- Employee engagement: Evaluate the employee engagement and satisfaction level in both companies.

- Workplace culture: Examine the work environment, employee interactions, and company traditions.

- Customer and stakeholder relations: Understand how each company interacts with its customers and stakeholders to gauge the impact of cultural differences on these relationships.

Evaluations can be done by sharing data from internal engagement surveys, client satisfaction surveys, job descriptions, performance measurement tools, and other cultural documentation. To simplify, integrate cultural due diligence into other diligence workflows, such as financial, legal, and HR reviews.

Culture goes beyond mission statements and values. It’s about what’s practiced day to day. The key to a strong culture is that it’s shared – all levels should understand and implement the cultural norms in every practice. Do this effectively, and you’ll have engaged employees, strong performance, and an overall increase in productivity.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230