U.S. E&S insurance sector continues its healthy pace of growth with the top 3 stamping offices reporting strong premium increases in 1Q21.

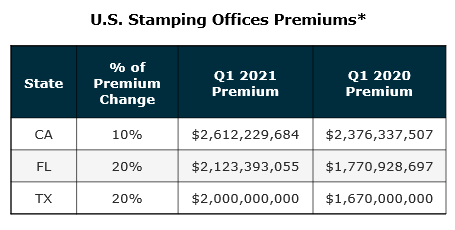

The U.S. excess & surplus lines insurance sector (E&S) continues its healthy pace of growth with the top three stamping offices reporting strong increases in premiums for the 1Q21. This follows robust premium figures reported by stamping offices for 2020. The healthy demand in the E&S space can be partly attributed to its ability to offer more flexible rate and form offers. Businesses are increasingly looking to E&S insurers as they have risks that are more challenging to place. This trend looks set to continue as factors like moderating industry reserves, capital conservatism driven by economic uncertainty, and tighter policy wording by large underwriters remain in place. The Texas stamping office reported record-breaking 1Q21 premiums of $2.0 billion, a 20.1% increase year-over-year (YoY), and an increase vs. the state’s 14% growth for the full year 2020. The strong pace of growth occurred across policy stratification (by premium). The Florida stamping office also saw a 20% increase YoY in 1Q21 with premiums of over $2.1 billion. Florida had 13% growth in premiums for the full year 2020. California, the largest stamping office by premium, saw a 10% increase YoY to $2.6 billion in premium in 1Q21. This compares to California’s 23% increase for 2020.

Here are three reasons why the E&S market is likely to remain strong through 2021.

- Tightening market conditions are expected to continue as economic uncertainty remains. Prompted by the upheavals related to COVID-19-related claims and a volatile economy, many insurance markets moved towards higher rates, reduced capacity, and more conservative risk selection. One year later, carriers are continuing to scale back capacity and focusing on underwriting discipline to improve profitability. There’s a move towards risk aversion as carriers cut down on the limits and terms they offer.

- Severe weather events and natural disasters, such as wildfires, flooding and storms, led to more business for E&S insurers over the last few years. Since 2015, there’s been 10 or more billion-dollar weather and climate events in the U.S each year. In February 2021, Winter Storm Uri contributed to massive power outages across Texas. Wildfires in other parts of the country are another concern. Some experts, including scientist Safeeq Khan of University of California, are predicting “another really bad fire year” for California in 2021. This follows a difficult wildfire season in 2020 for the state.

- Low interest rates combined with a volatile investment market and economic uncertainty could drive increases in premiums. Carriers may feel less confident about investment returns and look to raise premiums. At its April meeting, the Federal Open Market Committee (FOMC) reiterated that it would not change monetary policies until substantial progress occurs in employment figures and price stability. The Fed kept the target range of the benchmark federal funds rate at zero to 0.25%, unchanged since March 2020.

Overall, the U.S. E&S sector appears to be in good shape at mid-year 2021. A.M. Best upgraded its outlook on the sector from Negative to Stable in February 2021. The company noted in its market outlook for E&S that “despite the widespread impact of COVID-19 on the U.S. economy, and uncertainty as to how long the pandemic will last, the E&S segment’s ongoing profitability and premium growth signal opportunities for surplus lines carriers to successfully operate.”

If you have questions about Today’s ViewPoint or would like to learn more about activity in the E&S market, please email or call Gerard Vecchio, Managing Director, at 212.972.4886.Subscribe to MarshBerry’s Today’s ViewPoint blog for the latest news and updates and follow us on social media.

Sources: CA 1Q20, 1Q21; FL 1Q20, 1Q21; TX 1Q20, 1Q21

MarshBerry continues to be the #1 sell side advisor in the industry (as ranked by S&P Global). If you’re considering selling your firm, we are the best choice to help you through the complicated process. If you don’t hire MarshBerry, hire a reputable advisor that can help you navigate one of the most important business decisions you will ever make. You will be much better off having an advisor in your corner that knows the industry than trying to do this on your own.

Investment banking services offered through MarshBerry Capital, Inc., Member FINRA Member SIPC and an affiliate of Marsh, Berry & Company, Inc. 28601 Chagrin Boulevard, Suite 400, Woodmere, Ohio 44122 (440.354.3230)